- Back office outsourcing hands non-customer-facing work like payroll, HR, accounting, and data entry to a third-party provider, cutting costs and freeing internal teams to focus on core growth.

- Top benefits include lower operating costs, faster scaling without new hires, specialized expertise on demand, fewer compliance gaps, and round-the-clock operations across global time zones.

- Key risks include inconsistent output quality, data security exposure on sensitive payroll and financial data, hidden costs from poor scoping, and lost day-to-day control without clear SOPs.

- Best practice is defining scope, KPIs, and SLAs upfront, then running a 30-day pilot with parallel processing to surface accuracy, security, and exception-handling gaps early.

Need help optimizing your back-office outsourcing setup? Contact us today!

Discover how Wisemonk delivers trusted international solutions.

Should you outsource your back office or keep it in-house?

We’ve seen this play out repeatedly with US and global teams scaling operations.

Things start small.

A few processes get handed off.

Invoicing, payroll support, admin work.

It feels efficient. It works. Until it doesn’t.

The problem isn’t that teams don’t understand back office outsourcing. It’s assuming the setup that works at five or ten people will still hold when volumes grow, compliance triggers kick in, and small errors start compounding quietly in the background.

This article breaks down where that assumption fails for US companies, covering what’s typically outsourced, the benefits teams expect, the risks they often miss, and how to think about back office outsourcing decisions in 2026.

What exactly counts as “back office” today?[toc=Back Office]

Back office is a set of processes that runs behind the scenes to keep a company operating. It’s non-customer-facing work across accounting, HR, IT, and operations, handling AP/AR, payroll, data and systems, compliance, and order fulfillment, so the client-facing “front office” can focus on sales and service.

What is back office outsourcing?[toc=Back Office Outsourcing]

Back office outsourcing means letting a third-party service provider handle your behind-the-scenes work, things like payroll, invoicing, HR admin, accounting support, and data tasks, so your internal team can stay focused on customers and growth.

This work is typically non-customer-facing, rules-based, and repeatable, which makes it well suited to being run on clear SOPs and measured through SLAs such as accuracy, turnaround time, and error rates.

Done right, outsourcing gives companies the ability to scale operational capacity quickly without adding permanent headcount, while tapping into specialized teams and ready-to-use tools instead of building everything from scratch.

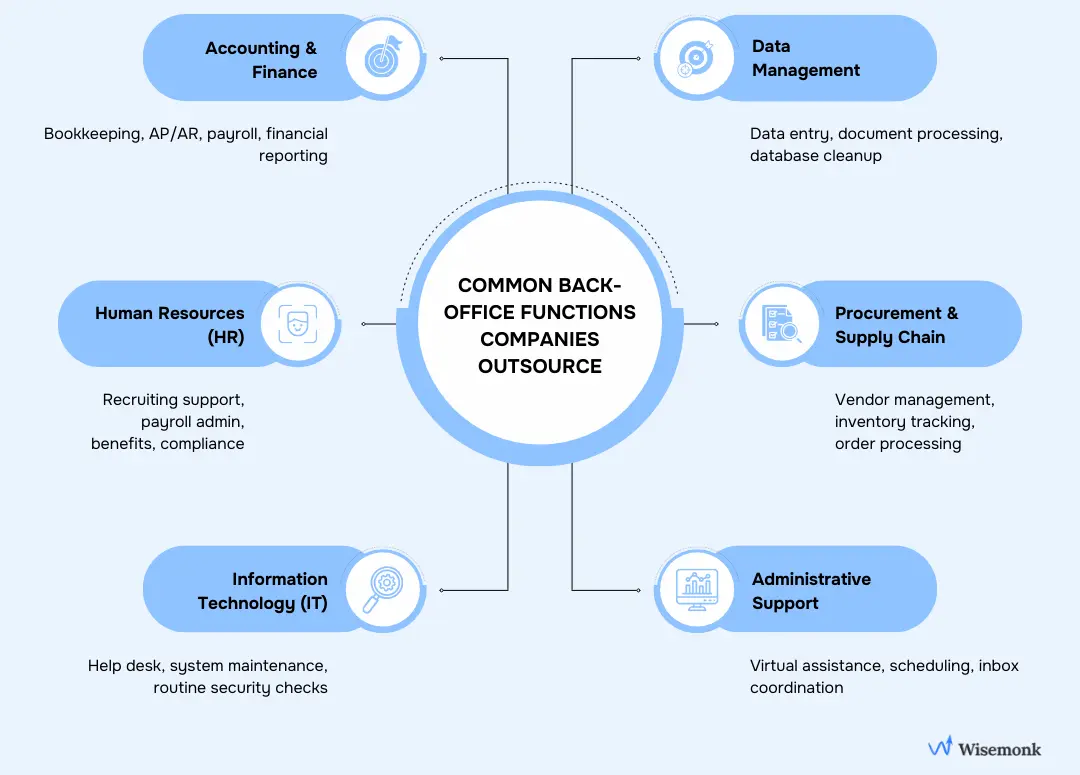

Which back-office functions are commonly outsourced?[toc=Common Functions]

From what we’ve seen working with US teams on payroll, hiring support, and compliance, these are the back-office functions that make the most sense to outsource.

- Accounting and Finance: Bookkeeping, AP/AR, payroll runs, and financial reporting that require accuracy, consistency, and audit-ready controls as transaction volumes grow.

- Human Resources (HR): Recruiting support, payroll administration, benefits coordination, employee records, and compliance tasks that scale with headcount but don’t need constant strategic oversight.

- Information Technology (IT): Internal help desk, system maintenance, updates, and routine security monitoring, excluding core product development or infrastructure architecture.

- Data Management: Data entry, document processing, transcription, and database cleanup that are repetitive, high-volume, and easier to manage with clear accuracy benchmarks.

- Procurement and Supply Chain: Vendor coordination, inventory tracking, order processing, and shipment follow-ups that keep operations moving without expanding internal ops teams.

- Administrative Support: Virtual assistance, scheduling, inbox management, and coordination tasks that remove daily operational friction from managers and individual contributors.

For a closer look at specific back-office workflows, check out our guides on data entry outsourcing, recruitment process outsourcing, and outsourcing accounting. Each one goes deeper into when outsourcing works and where teams usually get stuck.

Back-Office Process Outsourcing: Key Facts at a Glance

92% of Forbes Global 2000 companies outsource IT functions

Source: EI / ISG-One

Global BPO market reached $302.62B in 2024 and is projected to hit $525.23B by 2030

Source: Grand View Research

59% of companies outsource primarily to reduce operating costs

Source: Interrupt Media

Why do companies switch to back-office outsourcing services?[toc=Why to Outsource]

Historically, cost reduction has been the dominant driver for outsourcing.

In Deloitte’s global outsourcing research, nearly 9 out of 10 companies cited cost savings as the primary motivation.

But cost alone no longer explains why outsourcing continues to expand.

In Deloitte’s 2024 Global Outsourcing Survey, 83% of executives say they are already using AI within outsourced services, and 20% are actively building strategies to manage digital workers alongside human teams.

From practical experience across payroll operations, worker classification, and compliance filings, here’s why outsourcing back office operations continues to work for growing companies.

- Lower operating costs, fewer surprises: Back office outsourcing helps reduce hiring, training, and infrastructure overhead. Fixed headcount turns into predictable spend, which makes cost planning easier as business operations scale.

- More focus on the core business: By outsourcing back office tasks and administrative work, in-house teams get time back to focus on product, growth, and customer-facing work that actually moves the needle.

- Access to specialized expertise: A good back office outsourcing provider brings experienced teams, proven processes, and tools that are expensive and time-consuming to build internally.

- Easy to scale without disruption: Back office outsourcing services let companies ramp capacity up or down as demand changes, without constant hiring, layoffs, or resource management headaches.

- Better accuracy and operational efficiency: Specialized back office services providers run standardized workflows for payroll operations, data management, financial reporting, and other business processes, which usually means fewer errors and faster turnaround.

- Lower compliance and risk exposure: Strong outsourcing partners help manage data security, compliance requirements, and risk management, areas that tend to get messy as teams grow.

- Work keeps moving across time zones: With outsourced teams operating globally, back office operations continue even when your in-house team is offline, supporting smoother execution and better customer experience.

That’s why most growing companies turn to back-office outsourcing, not just to save money, but to buy back time, expertise, and peace of mind.

What are the risks of back-office outsourcing?[toc=Risks of Outsourcing]

We’ve curated these risks from real-world operator feedback and what we’ve seen firsthand while supporting payroll, accounting, and compliance workflows. These aren’t hypothetical downsides. They show up once work starts moving.

1. Quality issues: The biggest complaint is inconsistency. Some outputs are solid, others need rework, which quietly pushes work back to in-house teams.

“The quality of returns I get back are hit or miss. Some are really good, others have some really weird stuff in there.” [Read more on Reddit]

2. Lack of control: Outsourcing works best when expectations are crystal clear. Without that, losing day-to-day control can feel frustrating fast.

“Outsourcing is easier when you're focused because you know what you want done and have expectations.” [Read more on Reddit]

3. Data security exposure: Back-office work often touches payroll, banking, and employee data. Weak controls here create real risk.

“Accounting deals with highly sensitive information that would make it very easy to commit fraud with.”

4. Higher costs than expected: If scope, volume, or oversight isn’t tight, outsourcing can cost more than planned, sometimes more than hiring internally.

“An outside contractor tends to cost 2–3x more than an employee.” [Read more on Reddit]

5. Low provider margins: Back office outsourcing is a low-margin business. That can lead providers to stretch teams thin, which impacts quality over time.

“The actual margins in this kind of business are low. The amount of work involved is high.” [Read more on Reddit]

For a clearer look at when outsourcing actually saves money and when it doesn’t, check out our guide on "7 Backoffice Cost Saving Strategies That Work in 2026".

What are the best practices for successful back-office outsourcing?[toc=Best Practices]

Back-office outsourcing works best when it’s treated like an operating decision, not a quick handoff. Clear scope, strong communication, and ongoing oversight matter far more than who you pick on day one.

- Get clear on scope early: Before engaging an outsourcing partner, document the exact back office tasks you’re handing off, including behind-the-scenes tasks like data entry services, reporting, or inventory management, and define KPIs upfront.

- Choose providers beyond the pitch: Don’t rely on sales decks alone. Look at real delivery experience, security posture, and whether the outsourcing provider has handled similar business processes at scale.

- Lock in communication rhythms: Clear communication is what keeps outsourced teams aligned with client expectations. Set response times, escalation paths, and regular check-ins so nothing slips quietly.

- Treat data security as non-negotiable: Back office process outsourcing often touches sensitive payroll and financial data. Contracts should clearly spell out data security standards and compliance responsibilities from day one.

- Review, refine, repeat: Back office outsourcing solutions aren’t set-and-forget. Monitor performance, review SLAs, and fine-tune workflows as volumes grow and business operations change.

Expert Insight: Per Forbes, human-in-the-loop (HITL) collaboration is becoming the standard, where technology and automation handle repetitive, rules-based work, while experienced professionals retain judgment, approvals, and strategic control.

In back-office outsourcing, this means automation for processing, and humans for exceptions, reviews, and compliance decisions, not fully hands-off execution.

Some teams move beyond outsourcing and build dedicated overseas teams instead. The global employment platform article breaks down how that model works and when it makes sense.

How to choose the right back-office outsourcing provider?[toc=Find Right Provider]

With our experience helping global businesses stand up payroll, recruiting support, and compliance operations, we use this quick selection flow so teams don’t miss the critical checks.

- Be clear on what you’re handing off: Define the exact back office tasks you want outsourced, like payroll operations, data management, or administrative work, and set expectations for accuracy, turnaround time, and compliance.

- Validate real delivery experience: Look beyond sales claims. Choose an outsourcing provider that has actually run similar business processes at scale, especially in payroll, HR, or finance operations.

- Treat compliance and data security as table stakes: Your provider should clearly demonstrate how they handle regulatory filings, data security, access controls, and audits, not just promise compliance.

- Check how work is executed and reported: Make sure they use reliable tools, follow documented SOPs, and provide visibility through SLAs, KPIs, and regular reporting on performance.

- Plan for scale and exit upfront: Confirm how the provider handles volume changes, knowledge transfer, and contract exits, so you’re not locked into a setup that stops working as your business grows.

Pro tip: Before you sign, run a 30-day pilot with parallel processing, it’s the fastest way to see how a provider handles accuracy, security, and exceptions in real conditions.

What is the step-by-step process of back-office outsourcing?[toc=Outsourcing Process]

Back office outsourcing works best when it’s approached as an operating rollout, not a quick handoff. Here’s the step-by-step process most companies follow to outsource back office operations without losing control.

- Identify the right back office tasks: Start with routine, rules-based back office tasks like payroll operations, AP/AR, data entry, or administrative work. These are time-consuming but don’t require constant judgment from in-house teams.

- Select the right outsourcing provider: Choose a back office process outsourcing provider with experience in your business processes, especially payroll, human resources, and compliance. Review how they handle data security, SLAs, and ongoing support services.

- Define scope and expectations clearly: Document the exact back office functions being outsourced. Set clear SOPs, SLAs, and KPIs such as accuracy, turnaround time, backlog levels, and compliance timelines.

- Test the setup before full handover: Avoid a hard switch. Run a short parallel phase where your in-house team and the outsourcing partner handle the same back office work. This helps catch gaps early and align on quality.

- Hand over execution, keep control: Once performance stabilizes, move day-to-day execution to the outsourced team. Internal teams retain approvals, oversight, and control of key business operations.

- Monitor and optimize continuously: Back office outsourcing services are not set-and-forget. Track KPIs, review reports regularly, and adjust workflows as volumes grow or processes change.

Done right, outsourcing back office functions becomes an ongoing system, not a one-time project. The biggest gains come from steady optimization, not the initial handoff.

How does back-office BPO differ from front-office BPO and shared services?[toc=Back Office vs. Front Office]

Teams often group all outsourcing solutions together, but the differences matter. Each model solves a different problem depending on how much control, speed, and ownership a company needs across its business operations.

Back-office BPO (Business Process Outsourcing): This model focuses on internal, behind-the-scenes tasks like payroll operations, HR admin, accounting, compliance, data management, and other time consuming tasks. A third-party outsourcing partner runs these back office functions, while you manage outcomes through SLAs, reporting, and governance.

Best for: Teams that want operational efficiency and cost savings without expanding in-house teams or building a dedicated team too early.

Front-office BPO: This model covers front office services such as customer support, sales assistance, collections, and customer service outsourcing. Providers interact directly with customers, so performance is tied to client satisfaction, response times, and service quality, not just internal accuracy.

Best for: Teams that need scalable customer coverage while protecting customer relationships without growing large internal support teams.

Shared services (captive teams): With shared services, companies build their own centralized internal or offshore team to handle core office functions. You own the people, systems, project management, and outcomes, which delivers tighter control but requires higher upfront investment and long-term commitment.

Best for: Teams with stable volume and clear growth plans that want full ownership of back office operations instead of relying on an outsourcing company.

Now that we’ve covered back-office BPO, front-office BPO, and shared services, the next thing teams usually think about is location. Let’s look at how onshore, nearshore, and offshore setups actually play out in practice.

What are the types of outsourcing locations for back-office work?[toc=Types of Outsourcing]

Given our experience running payroll and HR operations across geographies under strict compliance, here’s how we match location models to workload sensitivity and collaboration needs.

If you want to go deeper into how location choices really compare, we’ve broken it down in onshore vs offshore, nearshore vs offshore, and outsourcing vs offshoring, each one digs into where teams usually get the trade-offs wrong.

When back office process outsourcing stops making sense?[toc=When to Stop]

Back-office outsourcing works. Until it doesn’t.

It usually starts breaking when volumes stop changing. The work looks the same every month. Payroll cycles repeat. Reports follow a pattern.

At that point, outsourcing fees often cost more than running a small, dedicated team.

It also struggles when work isn’t clean anymore. More exceptions. More approvals. More “this one is different.”

That back-and-forth eats the time outsourcing was meant to save.

Compliance is another trigger. As headcount grows and filings increase, teams need faster control and tighter coordination than most vendors can offer.

And finally, outsourcing stops working when context matters.

Knowing when to switch matters as much as knowing how to outsource.

How Wisemonk fits into back-office operations decisions?[toc=How Wisemonk Helps]

Wisemonk is an Employer of Record that helps companies hire, pay, and manage talent globally, with a strong focus on running compliant, scalable back-office operations in India.

As teams grow, back-office decisions move beyond simple outsourcing. We support those decisions with flexible models and operational depth, not one-size-fits-all solutions.

- Scalable & flexible outsourcing models: We support multiple operating setups, including EOR, staffing, and managed services, so companies can choose what fits their stage and risk profile.

- Simplified payroll management: We support automated payroll processing, statutory filings, and benefits administration, making it easier to run payroll as headcount scales.

- Dedicated HR support: We support day-to-day HR operations, from onboarding to employee management and benefits coordination, so internal teams can stay focused on growth.

- Comprehensive compliance management: We support compliance across Indian labor laws, tax regulations, and statutory requirements, reducing legal and regulatory risk as operations expand.

- Custom solutions for business needs: We support tailored back-office setups based on industry, team structure, and growth plans, rather than forcing fixed templates.

Beyond outsourcing, we also assist global businesses with background verification, equipment procurement, company registration, and setting up a GCC in India or building your offshore team in India. Our goal is to ensure your India operations are efficient, compliant, and growth-ready.

Ready to streamline your back-office operations? Book a free consultation and let us handle the complexity while you focus on growing the business.

Frequently asked questions

What is back office outsourcing?

Back office outsourcing is when a company works with a third-party outsourcing provider to manage internal, non-customer-facing business processes such as payroll operations, accounting, human resources, data management, and other behind-the-scenes tasks, allowing internal teams to focus on core business activities.

What are the 4 types of outsourcing?

The four main types of outsourcing are onshore, nearshore, offshore, and onsite. Onshore and nearshore use providers in the same or nearby countries, offshore relies on distant locations, and onsite places external teams within company offices to support specific business operations.

Which of the following is an example of back office process outsourcing?

An example of back office outsourcing is hiring a back office outsourcing company to run payroll, handle accounts payable, manage employee records, or support financial reporting. These back office tasks are essential for business operations but do not involve direct customer interaction.

What jobs are commonly outsourced in the back office?

Commonly outsourced back office jobs include payroll processing, bookkeeping, data entry services, HR administration, compliance reporting, IT help desk support, inventory management, and other administrative tasks. These roles are process-driven, repeatable, and easier to manage through standardized back office services.

Is outsourcing legal in the US?

Yes, outsourcing is legal in the United States. Companies can use domestic or international outsourcing services if they follow federal, state, and local laws, including worker classification rules, data security requirements, tax obligations, and industry-specific compliance standards that may vary by state.

What are considered back-office jobs?

Back-office jobs include roles that support internal office functions rather than customer interaction, such as payroll, accounting, human resources, compliance, data management, IT services, procurement, and operational support services. These back office functions keep business operations running behind the scenes.

What are the risks of outsourcing?

The main risks of outsourcing include inconsistent quality service, reduced operational control, data security exposure, compliance gaps, hidden costs, and over-reliance on an outsourcing partner. These risks increase when scope, governance, and performance tracking are not clearly defined upfront.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

%20in%20India.webp)

.webp)

.webp)

%20(3).webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)