- Mandatory employee benefits in India include EPF (retirement savings), ESI (health insurance), gratuity, statutory bonus, maternity leave, and paid time off.

- Supplementary employee benefits in India include group health insurance, life insurance, wellness programs, flexible work arrangements, meal allowances, and professional development budgets.

- Employee benefits in India cost 20-30% extra on top of base salary, with statutory contributions taking 15-20% and optional perks adding 5-15%.

- The 2025 reforms in India requires basic salary to be 50% of total pay and reduced gratuity eligibility for fixed-term employees from 5 years to just 1 year.

Need help managing employee benefits, compliance, and payroll in India? Contact us today!

Discover how Wisemonk creates impactful and reliable content.

What are employee benefits in India? India's employee benefits landscape goes beyond just paying salaries. You're required to provide statutory benefits like EPF (retirement savings), ESI (health insurance), gratuity, and paid leave, plus competitive employers are adding flex funds and mental health support to attract top talent in 2026.

This guide covers what benefits you're legally required to provide, what optional perks make you stand out, how much they cost, and how to stay compliant with India's 2025 labor reforms.

What are the mandatory statutory employee benefits in India?[toc=Statutory Benefits]

Indian law requires employers to provide seven core statutory benefits.

Here's what you must offer.

1. Employees' Provident Fund (EPF)

EPF is a retirement savings scheme where both employer and employee contribute 12% of basic salary plus dearness allowance.

It's mandatory for companies with 20 or more employees. Out of your 12% contribution, 8.33% goes to the pension scheme (EPS) and the rest to EPF.

Employees can withdraw at retirement or for specific needs like buying a home.

2. Employees' State Insurance (ESI)

ESI provides medical and disability coverage for employees earning below a certain monthly threshold.

Companies with 10 or more employees must participate. You contribute 3.25% of gross wages and employees contribute 0.75%.

ESI covers medical care, sickness, maternity, disability, and funeral expenses. Once salary exceeds the threshold, coverage stops, this is why many employers offer private group health insurance plans.

3. Employees' Pension Scheme (EPS)

EPS provides monthly pension payments after employees turn 58.

It's funded through 8.33% of your EPF contribution (capped at a specific wage ceiling). Employees need 10 years of service to qualify.

Unlike EPF, pension benefits are taxable.

4. Employees' Deposit Linked Insurance (EDLI)

EDLI is automatic life insurance for all EPF members.

The death benefit is 35x average monthly salary. You contribute 0.5% of gross wages per employee.

5. Gratuity

Gratuity is a lump sum payment when employees leave after completing minimum service.

Under 2025 labor reforms, fixed-term employees qualify after 1 year. Permanent employees need 5 years. It applies to companies with 10 or more employees.

Formula: (Last drawn salary × 15 × years of service) ÷ 26.

Use our gratuity calculator to estimate payouts accurately.

Understanding how payroll in India handles gratuity accruals is crucial for accurate cost planning.

6. Statutory Bonus

Under the Payment of Bonus Act, companies with 20 or more employees must pay an annual bonus.

Eligible employees earning below the wage ceiling receive 8.33% to 20% of their annual salary. This applies to employees who've worked at least 30 days in the year.

The bonus is typically paid during festival seasons or financial year-end.

7. Paid Leave Entitlements

Employees get multiple types of paid leave throughout the year.

- Annual leave: 15 days typically, though it varies by state (12-18 days).

- Sick leave: 12 days per year with medical certificate.

- Maternity leave: 26 weeks for first two children, 12 weeks for subsequent children. Requires 80 days of employment. Companies with 50+ employees must provide childcare facilities.

- Casual leave: 6-7 days for urgent personal matters.

- Public holidays: Three mandatory national holidays plus 7-11 state and regional holidays.

Note: Some states also require Labour Welfare Fund (LWF) contributions and Professional Tax deductions, check your state's specific requirements.

Read more: Understanding Leave Policy Laws and Holidays in India

Need state-specific guidance? Our Holiday and Leave Policy Calculator provides ready-to-use policies aligned with local rules.

These statutory benefits are just the baseline. Competitive employers offer additional perks to attract top talent.

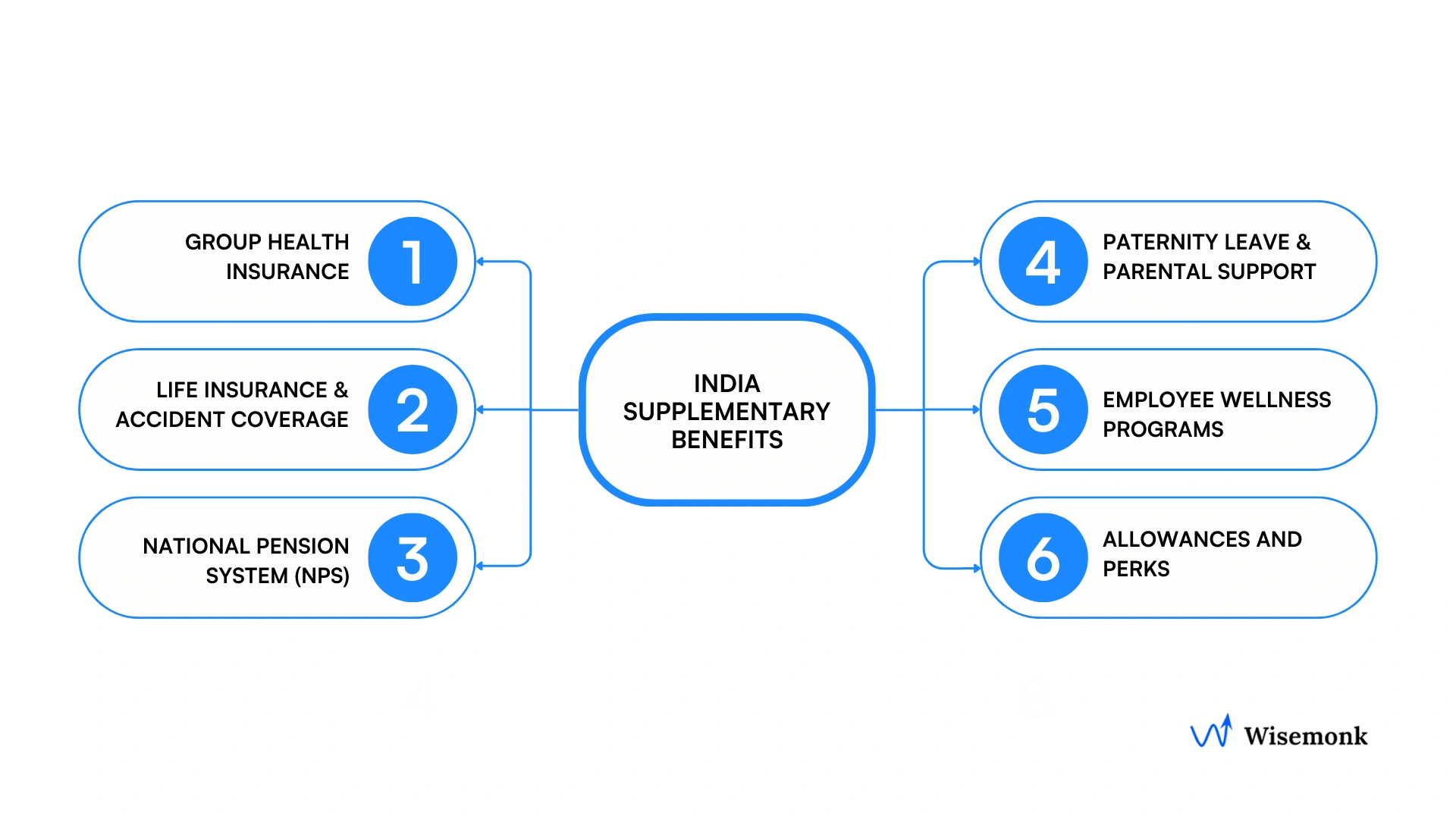

What supplementary benefits do employers offer in India?[toc=Supplementary Benefits]

Competitive employers offer benefits beyond statutory minimums to attract talent and fill coverage gaps.

These are optional but increasingly expected by skilled professionals.

1. Group Health Insurance

Private health insurance is the most common supplementary benefit and 99.9% of white-collar employers offer it.

Coverage includes hospitalization, vision, dental, and outpatient care for employees earning above the ESI threshold. Most plans extend to spouses, children, and even parents.

Employers provide this because ESI only covers lower-wage workers. Group health insurance plans fill the gap with comprehensive coverage.

2. Life Insurance and Accident Coverage

Enhanced life insurance supplements the basic EDLI coverage with 2-3x annual salary protection.

Group personal accident insurance covers accidental death and dismemberment beyond statutory benefits. These policies provide financial security to employees and their families.

3. National Pension System (NPS)

NPS is a voluntary retirement scheme that's gaining popularity as a tax-efficient alternative to EPF.

Employers can contribute up to 10% of an employee's basic salary. Both employer and employee contributions are tax deductible, making it attractive for long-term retirement planning.

This complements mandatory EPF and gives employees more control over their retirement investments.

4. Paternity Leave and Parental Support

Paternity leave isn't legally required but it's becoming standard in competitive companies.

The industry norm is 2-3 weeks of paid leave for new fathers. Some employers extend additional parental leave beyond the statutory maternity benefit to support work life balance.

5. Employee Wellness Programs

Wellness programs support both physical and mental health.

This includes gym memberships, mental health counselling services through employee assistance programs, periodic health check-ups, and stress management workshops. In 2026, mental health support has become a critical employee expectation.

Wellness initiatives improve employee well being and reduce long-term healthcare costs.

6. Allowances and Perks

Employers offer these fringe benefits to improve job satisfaction and retention:

- House Rent Allowance (HRA): A standard tax-efficient component that helps employees with housing costs. This is one of the most valued allowances.

- Conveyance and fuel allowances: Reimbursements for commuting expenses and transportation.

- Meal vouchers: Provided as digital cards (like Sodexo) for tax deductible meal benefits.

- Remote work stipends: Home office setup budgets and internet reimbursements.

- Education assistance: Professional development budgets and upskilling programs.

- Flexible work arrangements: Hybrid schedules and remote work options are now standard expectations in tech and professional services.

- Employee stock ownership plans (ESOPs): Popular in startups, these give employees equity and align their success with company growth.

These supplementary benefits help you compete for top talent. Now let's look at what all this actually costs.

How much do employee benefits in India cost?[toc=India Employee Benefits Cost]

Employee benefits in India typically add 20-30% on top of base salary when you include both statutory and supplementary benefits.

Statutory Benefit Costs

Mandatory contributions alone account for 15-20% of an employee's gross salary.

Here's the breakdown:

These percentages are based on "basic salary," which must now be at least 50% of total compensation under 2026 wage rules.

Need to calculate total employment costs? Our employee cost calculator gives you a complete breakdown including all statutory and supplementary benefits.

Supplementary Benefit Costs

Competitive employers budget an additional 5-15% for optional benefits.

- Group health insurance: The most significant cost, typically adding 1-2.5% of total payroll depending on coverage level.

- Life and accident insurance: Minimal cost, usually under 1% of payroll.

- Wellness programs and allowances: Variable based on company policy and size.

- National Pension System (NPS): Employers can contribute up to 10% of basic salary as a tax-efficient retirement benefit.

Total Employment Cost

Your total Cost to Company (CTC) typically runs 1.25 to 1.4 times the base salary.

For competitive packages in tech and professional services, expect to budget approximately 25-30% above gross salary to cover all statutory and supplementary benefits.

Industry and risk factors affect these costs. Manufacturing and construction companies often pay higher insurance premiums than IT and service companies.

Managing these costs while staying compliant requires careful planning and proper enrollment processes.

Your total Cost to Company (CTC) typically runs 1.25 to 1.4 times the base salary. Use our salary calculator to see exactly how CTC breaks down into take-home pay.

For competitive packages in tech and professional services, expect to budget approximately 25-30% above gross salary to cover all statutory and supplementary benefits. Learn more about EOR costs in India and how pricing structures work.

How to enroll employee benefits and stay compliant?[toc=Benefits Enrollment & Compliance]

India's 2026 labor codes streamlined 29 separate laws into four unified codes, simplifying enrollment but increasing penalties for non-compliance.

Registration and Enrollment

Register your business on the Shram Suvidha Portal if you have 10+ employees. This single registration replaces six previous separate registrations.

Collect employee Aadhaar numbers, bank details, and PAN cards. Generate Universal Account Numbers (UAN) for each employee and link them to Aadhaar, this is mandatory for EPF and ESI contributions.

Register for EPF (20+ employees) and ESI (10+ employees earning below the threshold). Issue appointment letters that clearly list all social security entitlements.

Key 2026 Compliance Rules

- 50% basic pay rule: Basic salary plus dearness allowance must be at least 50% of total compensation. This impacts PF and gratuity calculations.

- Fixed-term employee equality: Fixed-term workers now get gratuity after 1 year instead of 5 years.

- Monthly deadlines: PF and ESI contributions due by the 15th of following month. Late payments trigger penalties.

Ongoing Requirements

Submit monthly PF and ESI contributions. Process annual statutory bonus payments. Maintain digital records of attendance, wages, and all contributions.

Provide free annual health checkups for employees aged 40+.

Penalties

Financial penalties range from ₹10,000 to ₹1 lakh. Late gratuity payments attract ₹20,000 fines plus 10% interest. Serious violations can result in imprisonment up to 3 months.

Managing these requirements while running your business is complex.

That's where understanding what an EOR does and how it simplifies compliance becomes critical.

For companies concerned about tax presence, take our Permanent Establishment Risk Quiz to assess your exposure.

What are the 2026 trends in employee benefits in India?[toc=Key 2026 Trends]

Indian employees are demanding more personalized and holistic benefits beyond statutory minimums.

According to India EOR specialists, companies that adapt to these trends see significantly better hiring outcomes.

Here's what competitive employers are offering.

Flexible Benefit Plans (Flex Funds)

Employees want choice in how they use their benefits budget.

Cafeteria-style plans let them pick what matters most, extra insurance coverage, gym memberships, wellness programs, or learning budgets. 78% of Indian employees want this flexibility, but only 34% of companies offer it.

Tech companies and GCC (Global Capability Centres) are leading this trend with personalized benefit allowances.

Mental Health and Wellness Programs

Mental health support is now expected, not optional.

Employee assistance programs (EAPs), therapy apps, counseling services, and stress management resources are standard in competitive packages. Wellness stipends for gym memberships, yoga, and fitness programs are increasingly common.

Younger professionals especially won't join companies without mental health benefits.

Diversity and Inclusion Benefits

Progressive employers are extending benefits beyond traditional definitions.

Some companies now cover domestic partners (not just married spouses) in health insurance plans. Gender reassignment surgery coverage is emerging among modern firms committed to inclusion.

These benefits signal a workplace culture that values all employees.

Eldercare and Family Support

With 20% of employees managing both children and aging parents, eldercare leave and extended family health coverage are key retention drivers.

Professional Development

Learning budgets, certification reimbursements, and upskilling programs are essential for attracting skilled talent in tech, finance, and consulting roles.

Companies offering these personalized benefits see 20-35% higher offer acceptance rates and better retention.

Understanding the difference between contractors and employees also helps you structure benefits appropriately.

How Wisemonk Simplifies India Benefits Compliance[toc=Wisemonk EOR]

Wisemonk is a leading India-specialist Employer of Record (EOR) platform that helps global companies hire, pay, and manage employees in India without setting up a local entity. We provide end-to-end EOR services built on deep local expertise, strong compliance capability, and a track record of managing large, distributed teams across India.

Here's how Wisemonk helps global businesses manage employee benefits in India:

- Fast benefits enrollment and onboarding: Supporting 300+ global companies with seamless EPF, ESI, and health insurance setup backed by our India-first workflows.

- Dedicated HR support: Managing 2,000+ employees with responsive, on-ground HR specialists who handle benefits queries, enrollment issues, and employee assistance.

- Comprehensive compliance management: Overseeing $20M+ in payroll with accurate EPF, ESI, TDS, gratuity provisions, statutory filings, and state-specific labor law coverage.

- Transparent and predictable pricing: EOR pricing starting at $99 per employee per month with no hidden fees, no FX markups, and clean cost visibility that global teams can trust.

- Risk mitigation and full legal protection: Keeping global teams protected from misclassification, non-compliance penalties, labor disputes, and accidental Permanent Establishment (PE) exposure in India.

Beyond EOR in India, Wisemonk also supports global teams with background verification, equipment procurement, payroll processing, tax optimization, contractor management, company registration, and building offshore teams or Global Capability Centers (GCCs) in India for businesses planning long-term India operations.

Why wait? Book a call now and let our experts take the stress out of navigating India benefits compliance, so you can focus on what truly matters: growing your business!

Frequently asked questions

Is there a benefits system in India?

Yes, India has a comprehensive employee benefits system combining statutory benefits (EPF, ESI, gratuity, paid leave) mandated by law and voluntary perks. The four new labour codes became effective November 21, 2025, consolidating 29 laws and expanding coverage to gig workers and platform workers.

Which benefit is legally mandatory in India?

Employers must provide EPF (retirement savings), ESI (health coverage for lower-wage earners), gratuity (after 5 years of service), statutory bonus, maternity leave (26 weeks), and paid annual/sick leave. Requirements vary based on company size and employee salary thresholds.

Is it mandatory to provide insurance to employees in India?

ESI health insurance is mandatory for companies with 10+ employees if at least one earns ₹21,000/month or less. While ESI covers eligible lower-wage workers, most employers also offer private group health insurance for higher-earning employees since ESI doesn't apply above the threshold.

What are employee benefits in India?

Employee benefits include statutory requirements (EPF, ESI, gratuity, maternity leave, paid time off) and supplementary perks (group health insurance, wellness programs, flexible work, meal allowances, performance bonuses). Together, they typically add 20-30% to base salary costs.

Does gratuity is mandatory in India?

Yes, gratuity is mandatory for companies with 10+ employees. Permanent employees qualify after 5 years of continuous service, while fixed-term employees now qualify after just 1 year under the November 2025 labor reforms.

Can employees in India opt out of the Employees' State Insurance (ESI) scheme?

No, ESI coverage is mandatory for eligible employees earning ₹21,000/month or less. Once an employee qualifies and the company has 10+ employees, both employee and employer must participate, there's no opt-out option.

Who is entitled to benefits in India?

All employees full-time, part-time, fixed-term, and now gig/platform workers are entitled to statutory benefits based on eligibility (company size, salary thresholds, service duration). The November 2025 labour codes extended social security coverage to previously excluded unorganized sector workers.

%20(1).webp)

%20(1).webp)

%20(1).webp)