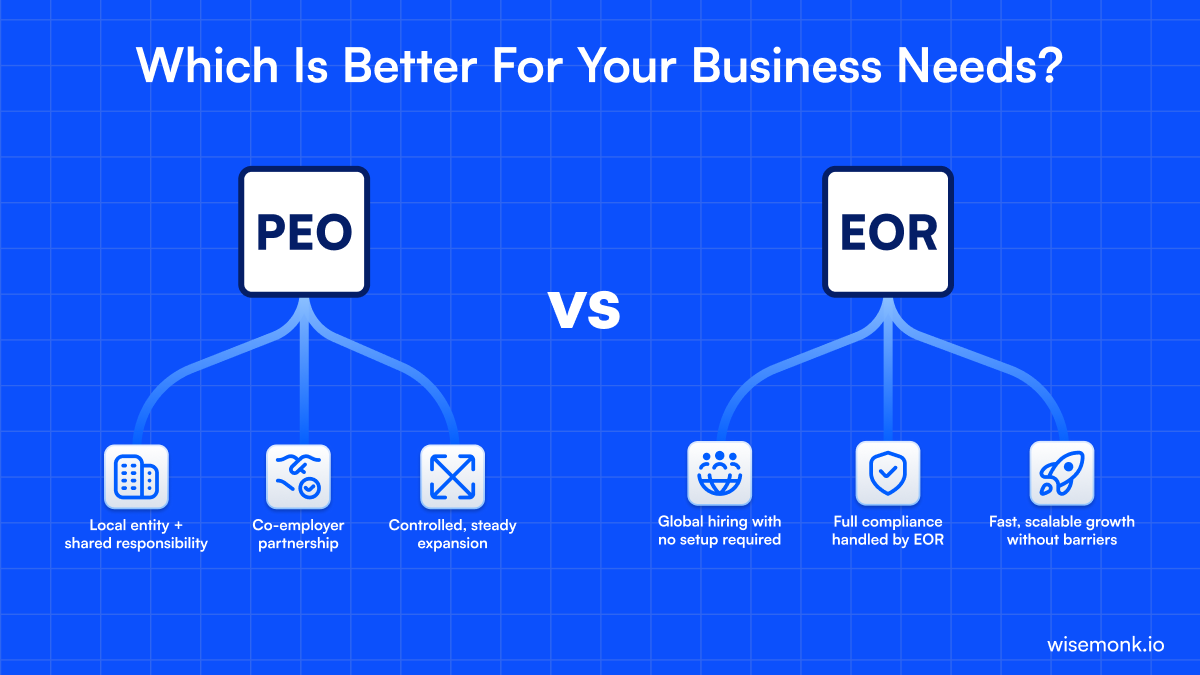

- A PEO establishes a co-employment relationship, where your company remains the legal employer, handling day-to-day operations while the PEO manages HR functions. In contrast, an EOR takes on full legal responsibility for your hires, enabling global expansion without the need to set up a local entity.

- The core difference is that a PEO shares employer responsibilities with you, while an EOR assumes full legal responsibility in each country. PEOs require your own legal entity, while EORs use their own entities worldwide to manage employment, taxes, and local labor laws.

- Choose a PEO when you need HR support and pooled benefits for your workforce, and you’re hiring within a single region. Choose an EOR when expanding globally, requiring faster onboarding, tax compliance, and the ability to hire without establishing a local entity.

- PEO pricing typically ranges from 2–6% of payroll, while EOR services use a flat fee, usually $200–$700 per employee per month.

Need help with your global expansion? Contact us today!

Discover how Wisemonk creates impactful and reliable content.

Looking to understand the real difference between a PEO and an EOR before you scale your team globally? You’re not alone, this is one of the most searched HR questions today, especially with cross-border hiring, new tax regulations, and compliance risks getting more complicated every year. In our experience helping US companies hire employees in India and other international markets, choosing the right model can be the difference between smooth global expansion and serious legal liabilities. This article is for founders, HR leaders, and finance teams who want clarity before choosing the right global hiring model.

With co-employment rules tightening, misclassification penalties rising, and global payroll becoming more complex, understanding EOR vs. PEO is no longer optional, it’s a compliance decision that affects your entire business entity. In this guide, we break down both models clearly so you can decide what fits your hiring plans in 2025 and beyond.

What is a Professional Employer Organization (PEO)?[toc=What is a PEO]

A Professional Employer Organization (PEO) is a third-party firm that enters into a co-employment relationship with your company, managing key HR functions such as payroll processing, tax compliance, employee benefits administration, and risk management. While your company retains control of day-to-day operations and workforce management, the PEO assumes responsibility for the administrative and compliance aspects. This allows businesses to scale more easily by outsourcing complex HR tasks while maintaining operational control.

Key Services Offered by a PEO:

- Payroll Processing & Tax Compliance: The PEO manages monthly payroll, payroll taxes, and ensures compliance with local tax regulations.

- Employee Benefits Administration: Access to competitive health benefits, retirement plans, and other employee perks negotiated by the PEO.

- Risk Management & Workers’ Compensation: The PEO handles workers’ compensation claims and other risk management services to protect your business.

- HR Support & Onboarding: Assistance with employee onboarding, training, and workplace safety programs.

- Compliance Support: Ensures your hiring practices and HR operations are in line with local labor laws and workplace safety standards.

- Access to Group Insurance Plans: The PEO can provide access to large-group insurance plans that may be difficult for small businesses to secure on their own.

To know more the best PEO companies, you can refer to this guide on "10 Best PEO Companies 2025: Complete US Business Guide"

What is an Employer of Record (EOR)?[toc=What is an EOR]

An Employer of Record (EOR) is a global hiring model where a third-party provider becomes the full legal employer of your international workers so you can hire in another country without creating a local entity. In simple terms, your team manages the work, while the EOR takes on all legal employment responsibilities: payroll and benefits administration, tax compliance, employment contracts, and adherence to local labor laws. Based on our extensive experience helping US companies hire globally, EOR services are the fastest and safest way to build teams in new international markets without dealing with business registration, legal liabilities, or compliance risks.

Unlike a PEO, an EOR assumes full legal responsibility for your international employees, which is why it’s the preferred choice for companies hiring across multiple countries or expanding into markets like India, LATAM, Europe, or Southeast Asia. This structure removes the need for your own legal entity and eliminates the complexities of managing global payroll, tax regulations, benefits packages, and country-specific HR compliance. Here’s what an EOR typically handles for you:

Services offered by an EOR include:

- Acting as the legal employer, issuing compliant employment contracts under local employment laws.

- Managing monthly payroll, payroll taxes, global payroll reporting, and ensuring compliance with country-specific tax regulations.

- Administering statutory and supplemental employee benefits such as health insurance, retirement plans, and other employee benefits required by local laws.

- Handling HR operations including onboarding, leave management, termination processes, and risk management services.

- Managing compliance responsibilities from workplace safety requirements to social security contributions, to reduce compliance liability for the client company.

- Supporting international hiring practices, including background checks, equipment provisioning, and onboarding support across multiple countries.

To know about the best Employer of Record companies, refer to this detailed guide on "10 Best Employer of Record (EOR) Companies 2025"

What are the key differences between a PEO and an EOR?[toc=Key Differences]

If you're comparing PEO vs EOR to understand which model actually fits your hiring strategy, the core difference is simple: a PEO shares HR responsibilities with you under a co-employment relationship, while an EOR becomes the full legal employer of your international workers so you can hire globally without setting up a local entity.

From our experience guiding US companies expanding into new international markets, this is where confusion usually clears up seeing both models side-by-side makes the decision far easier. Here’s a clean, comparison to help you evaluate them quickly.

If you’re hiring domestically, a PEO is the right fit. However, if you want to hire internationally, an EOR becomes the simpler, faster, and more compliant option. Now, let’s break down the cost comparison, as pricing often becomes the deciding factor for businesses looking to scale globally.

How much does a PEO cost compared to an EOR?[toc=Cost Comparison]

If you’re weighing PEO vs. EOR from a cost perspective, the difference comes down to how each model charges you: PEOs typically use a percentage-of-payroll pricing structure, while EOR services use a predictable flat monthly fee that covers full legal responsibility and global compliance. While PEO services may appear cheaper upfront, they still leave you with core liabilities and the ongoing cost of maintaining your own legal entity.

From our experience working with companies expanding internationally, a clear cost breakdown helps leaders understand the real financial impact, especially when global hiring is involved.

Here’s the side-by-side comparison that businesses typically use to evaluate costs:

PEO services often appear cheaper, but the cost of maintaining your own legal entity, managing compliance risks, and handling HR duties adds up quickly. EOR services offer a predictable flat fee that covers global hiring, legal employer responsibilities, and compliance support especially valuable when expanding into new international markets.

To get a much clearer view of pricing structure of a Professional Employer Organization, you can refer to this detailed article on "How much does a PEO Cost? A Complete Guide for 2025"

Next, let’s look at when a company should choose PEO vs when an EOR makes more sense, so you can align the model with your actual hiring plans.

When should you choose a PEO or an EOR?[toc=When to Choose PEO/EOR]

If you’re weighing both models, the simplest way to think about it is this: a PEO works best when you’re hiring within a single country and need shared HR support, while an EOR is the right fit when you need to hire internationally and want a legal employer to handle compliance end-to-end. Over the years, we’ve seen companies reach clarity quickly once they map each model to their real hiring scenarios.

Choose a PEO if:

- You are hiring exclusively within a single country and don’t need support for international employees.

- You already operate through a local legal entity and need help with HR services, payroll taxes, workers’ compensation, and risk management.

- You want access to large-group health insurance plans, retirement benefits, and other employee benefits negotiated by a professional employer organization.

- You prefer to maintain full control of day-to-day management while sharing limited HR duties under a co-employment relationship.

- You’re comfortable carrying the legal employer responsibilities, including compliance with local labor laws.

- You meet the minimum number of full-time employees many PEO providers require for enrollment.

Choose an EOR if:

- You want to hire employees or contractors in countries where you don’t have a local entity, whether that’s in India, LATAM, Europe, or Southeast Asia.

- You need to enter a new international market quickly without setting up a legal entity or navigating foreign business registration.

- You prefer an EOR provider that becomes the full legal employer, issuing employment contracts, managing payroll taxes, and ensuring compliance with local labor laws.

- You want to reduce misclassification risk and avoid compliance issues tied to international employment and tax regulations.

- You need faster hiring (typically 2–7 days) with global payroll, benefits administration, and HR operations handled for you.

- You want predictable flat-fee pricing and clearer ownership of compliance responsibilities when scaling into multiple countries.

Next, let’s break the decision down even further with a simple framework that helps businesses choose between PEO and EOR based on their hiring goals.

How to choose between PEO and EOR services?[toc=How to Choose]

The simplest way to decide is to line up four key factors: where you’re hiring, who you want as the legal employer, how fast you need to move, and whether you’re ready to set up legal entities outside your home country. In our experience working with founders, HR leaders, and finance teams globally, once you answer those questions honestly, the PEO vs EOR decision usually becomes clear.

.png)

1. Where are you hiring?

- If you're hiring locally, a Professional Employer Organization (PEO) is a good fit for HR services, payroll, benefits administration, and compliance within a specific region.

- If you're hiring globally, an Employer of Record (EOR) is built for international employment, global payroll, and managing local labor laws in multiple countries.

2. Do you want to keep legal employer responsibility?

- With a PEO, you remain the legal employer and enter a co-employment relationship where the PEO handles HR functions, but your company retains full legal responsibility and compliance liabilities.

- With an EOR, the provider becomes the legal employer of record, taking on full legal responsibility for employment contracts, tax compliance, and adherence to local employment laws in each country.

3. How fast do you need to hire?

- PEO services work best when you're already set up and can manage a slower expansion, as your internal HR team will still handle parts of HR operations and ongoing compliance.

- EOR services are designed for speed, enabling you to hire in new international markets in days, not months, with the EOR handling business registration, tax IDs, and local entity setup.

4. Do you want to avoid setting up entities outside your home country?

- A PEO requires you to have your own legal entity wherever you're hiring, as it does not replace the need for business registration or corporate presence in other regions.

- An EOR allows you to hire employees without creating a local entity, as the EOR uses its own legal entities and assumes compliance risks on your behalf in each country.

PEO vs EOR vs Own Entity Setup: How do they really compare?[toc=PEO vs. EOR vs. Entity Setup]

If you’re trying to understand all three models side by side, this breakdown shows exactly how each option works in practice so you can see which one aligns with your hiring plans.

Refer to this article to know more about the difference between a PEO and setting up a own entity "Employer of Record vs Own Entity: What to Choose in 2025".

Once you’ve answered where you’re hiring, who should be the legal employer, how fast you need to move, and whether you want your own entities, the choice turns from abstract theory into a very practical next step which is exactly what we’ll lock in with the Final Recommendation Framework in the next section.

What’s the simplest way to decide between a PEO and an EOR?[toc=Quick Decision Framework]

Here’s the quick, confident way most businesses land on the right model no complexity, just the clearest path forward.

Choose a PEO if:

- You’re hiring only in one country.

- You already have a local legal entity.

- You want pooled benefits and shared HR support.

- You’re comfortable being the legal employer and managing compliance responsibilities.

Choose an EOR if:

- You want to hire internationally without a local entity.

- You prefer the provider to become the full legal employer.

- You need fast, compliant onboarding in new markets.

- You want to reduce global compliance and tax risk.

Stick with a PEO for domestic HR support, and choose an EOR when global hiring and compliance simplicity matter most. Once you know where your next hires will be, the decision becomes obvious.

“Wisemonk helped us hire specialized B2B SaaS marketing talent from top-tier companies in under four months. It’s been a seamless experience and I’d recommend them to any SaaS vendor scaling globally.”

- Saurabh Sharma, CMO at Onereach (US)

How does Wisemonk help companies hire globally?[toc=How Wisemonk Helps]

Wisemonk is a leading Employer of Record (EOR) that helps companies hire, pay, and manage employees across international markets without setting up a local entity or navigating unfamiliar labor laws. Our focus is simple, remove the complexity from global hiring so you can build teams confidently, compliantly, and at speed.

Here’s how we support your global expansion:

- Fast onboarding: Hire top talent in days, not months, with fully compliant contracts and seamless setup.

- Effortless payroll management: We handle salaries, taxes, and statutory filings accurately and on time across geographies.

- Comprehensive employee benefits: From health coverage to paid leave, we offer locally compliant and competitive packages that attract top talent.

- Dedicated HR support: Our HR specialists handle day-to-day operations, employee engagement, and issue resolution, so your team stays happy and productive.

- End-to-end compliance: Stay protected from legal and regulatory risks with our always-updated local expertise.

“I’m very happy that I discovered Wisemonk. They helped us understand their pricing model, find top-qualified individuals, interview them, and then onboard them. The engineers they found have been some of the best I’ve ever worked with.”

- Dan Sampson, Head of Engineering at Cobu (US)

While India is our core strength, we’re expanding rapidly into key global markets such as the United States, the United Kingdom, and beyond. With Wisemonk, you get a reliable partner for your India operations and your broader global hiring journey.

Ready to scale your global team fast, compliant, and without the headaches? Talk to our team today!

Frequently asked questions

What is the difference between a PEO and EOR?

A PEO works through a co-employment relationship, meaning your company stays the legal employer while the PEO handles HR services, payroll, and benefits. An EOR becomes the full legal employer in another country, handling compliance, tax regulations, and employment contracts so you can hire internationally without a local entity.

What is the difference between global PEO and EOR?

A global PEO still requires you to have a legal entity in each country, even when it provides international HR support. An EOR uses its own legal entities worldwide, becoming the legal employer for your international employees and taking on compliance responsibility.

Is PEO an employer of record?

No, under a PEO, your company remains the legal employer, and the PEO simply shares some HR functions through co-employment. An Employer of Record (EOR) is different because the EOR becomes the legal employer on paper in that country.

What is the difference between EEO and PEO?

EEO refers to Equal Employment Opportunity laws that prevent discrimination in hiring and employment practices. A PEO is a Professional Employer Organization that provides HR services, payroll, benefits administration, and risk management under a co-employment model.

Is PEO the same as EOR?

No, they serve different purposes. A PEO supports HR operations for companies with their own legal entity, while an EOR becomes the legal employer so you can hire workers internationally without setting up a business locally.

What is the downside of a PEO?

The biggest drawback is that you must already have your own legal entity, and you still retain legal liability as the employer. PEOs also require meeting minimum employee counts, offer limited international support, and operate only through co-employment, which may not fit every business model.

What are the three types of PEO?

The industry generally recognizes three types of PEO models. Full-service PEOs handle payroll, benefits, HR compliance, and risk management through a co-employment structure. ASO (Administrative Services Only) providers manage HR tasks without becoming a co-employer. HRO (Human Resource Outsourcing) firms offer customizable HR services without sharing liability or entering a co-employment relationship(10 Best HR Outsourcing Companies for 2025). To understand the difference between a PEO and an ASO, you can refer to this detailed guide on "PEO vs. ASO: Which HR Model is Right for Your Business?". And to learn the difference between a PEO and HRO, refer to this complete guide on "PEO vs HRO for Small Businesses: Complete 2025 Guide".

.png)

%20(1).webp)