- Gusto is affordable payroll software ($49-180/month + $6-22 per employee) with strong automation and integrations. Best for small businesses under 20 employees who want straightforward payroll and basic HR without breaking the bank.

- Justworks is a PEO charging $79-109 per employee monthly (no base fee) that gets you enterprise-level health insurance and 24/7 HR support.

- Justworks includes workers' comp and offers significantly better health insurance plans, while Gusto gives you more flexibility and costs less but charges extra for workers' comp.

- Choose Gusto if budget matters and you just need reliable payroll processing. Choose Justworks if you need competitive benefits to attract top talent and want comprehensive HR support across multiple states.

Need support for hiring or payroll? Contact Us Now!

Discover how Wisemonk creates impactful and reliable content.

Running payroll shouldn't feel like solving a puzzle every two weeks, but here you are - stuck between Gusto and Justworks, wondering which one actually fits your business.

Here's what it comes down to: Gusto costs less and gives you solid payroll automation with flexibility. Justworks costs more but gets you enterprise-level health insurance and dedicated HR support. Both handle automated payroll, tax filing, and employee benefits - the difference is in approach and price.

We've compared real pricing, dug through user reviews, and broken down which platform makes sense for different business situations. No sales pitch - just the honest breakdown you need.

Let's get into it.

Overview of Gusto and Justworks[toc=Introduction]

If you're weighing your options for payroll and HR software, Gusto and Justworks are two names that probably keep popping up in your research. Both platforms help small businesses manage payroll, employee benefits, and HR tasks, but they take different approaches to get you there.

Gusto works as a full service payroll provider with strong automation and user-friendly tools, while Justworks operates as a professional employer organization (PEO) that partners with you through a co-employment relationship to handle your payroll and benefits administration.

What is Gusto?

Gusto started back in 2011 with a simple mission: make payroll and HR management less painful for small businesses. What began as a straightforward online payroll solution has grown into a comprehensive platform that handles everything from automated payroll to benefits management, time tracking, and compliance support.

Today, over 300,000 businesses trust Gusto to manage their HR and payroll tasks, and it's become a go-to choice for companies that want powerful features without the complexity.

The platform shines because it genuinely simplifies HR tasks that usually consume your time. Instead of juggling multiple systems or drowning in tax forms, you get one central hub where you can run payroll, manage employee benefits, handle contractor payments, and stay on top of labor law compliance.

Gusto takes care of automatic tax calculations and tax filing, so you're not scrambling every quarter wondering if you missed something important.

Features of Gusto

Gusto packs in features that cover the full spectrum of payroll and HR processes. Here's what you're getting from Gusto:

- Payroll Processing: Run unlimited payroll runs for both hourly and salaried employees with next-day direct deposit. The system handles multi-state payroll automatically and generates pay stubs that employees can access anytime through employee self-service portals.

- Benefits Administration: Choose from multiple health insurance plans, set up retirement plans (401k options included), and offer flexible spending accounts and commuter benefits. Gusto partners with major insurance carriers to give your team solid options.

- Tax Compliance: Automatic tax calculations, payroll tax filing at federal and state levels, and year-end tax forms are all handled for you. No more staying up late during tax season.

- HR Tools: Onboarding tools that get new hires up to speed fast, document storage, PTO tracking, and basic performance management tools. You also get access to an HR resource center with templates and guides.

- Time Tracking: Built-in time tracking for hourly workers that feeds directly into payroll, making it seamless to pay employees accurately.

- Employee Self Service: Your team gets lifetime employee access to view pay stubs, update personal information, and manage their benefits without bothering you.

Gusto's Integrations

Gusto plays well with the tools you're probably already using. It integrates smoothly with popular accounting software like QuickBooks, Xero, and FreshBooks.

You'll also find connections to expense management software, project management tools like Asana and Monday.com, and time tracking apps if you prefer something beyond Gusto's built-in option. The API allows for custom integrations if you need something specific for your business.

Gusto Price Structure

Gusto offers three main pricing tiers, and they're refreshingly straightforward:

- Simple Plan: Starting at $49/month + $6 per person. This covers basic payroll processing, employee self-service, and basic HR features. Good for businesses that just need reliable payroll without all the bells and whistles.

- Plus Plan: $80/month + $12 per person. This is where you get the comprehensive HR tools, benefits administration with more health insurance options, PTO management, and access to HR support specialists. Most growing businesses land here.

- Premium Plan: Custom pricing that starts around $180/month + $22 per person. You get everything in Plus, along with a dedicated support team, compliance alerts for labor laws across multiple states, advanced performance management tools, and custom reporting. This tier makes sense when you have complex HR needs or operate in several states.

All Gusto plans include automatic tax filing and unlimited payroll runs, so you won't get nickel-and-dimed for running off-cycle payments.

What is Justworks?

Justworks launched in 2012 with a different approach than traditional payroll providers. Instead of just selling you software, Justworks operates as a professional employment organization (PEO), which means they become your co-employer.

This co-employment relationship might sound strange at first, but it actually gives you access to enterprise-level benefits and HR support that small businesses typically can't get on their own.

By pooling together thousands of small companies, Justworks negotiates better health insurance plans and handles the heavy lifting of compliance support across all 50 states.

The platform targets businesses that want to offer competitive employee benefits without building an entire HR department.

When you partner with Justworks, your employees technically become their employees too (on paper), which unlocks access to better health insurance options, simpler compliance management, and a dedicated support team that actually picks up the phone. It's basically like having an experienced HR team on speed dial, which is why many startups and growing companies find the PEO model attractive.

Features of Justworks

Justworks bundles comprehensive payroll and HR services into their PEO package. Here's what they bring to the table:

- Full Service Payroll: Handle payroll processing for hourly and salaried employees with automatic tax calculations and tax filing. Direct deposit goes out smoothly, and employees can access pay stubs through their self-service portal. You also get unlimited payroll runs without extra fees.

- Benefits Administration: This is where Justworks really stands out. You get access to premium health insurance plans from national carriers at competitive group rates. They also offer dental, vision, 401k retirement plans, flexible spending accounts, commuter benefits, and even supplemental insurance options. The benefits management platform makes enrollment straightforward for your team.

- Compliance and HR Support: Labor law compliance across multiple states, automatic updates when laws change, and expert HR support from real people. They handle workers' comp and unemployment claims, and make sure you're following labor laws wherever you operate.

- Onboarding Tools: Digital onboarding that gets new hires through paperwork fast, including I-9 verification and e-signatures. Employee data gets organized automatically.

- Time Tracking: Basic time tracking features for hourly workers that sync with payroll. Not as robust as dedicated time tracking apps, but it gets the job done.

- Employee Self Service: Team members can view pay stubs, manage their benefits selections, update personal info, and track PTO balances through the employee portal.

Justworks's Integrations

Justworks integrations are more limited compared to some competitors, which is common with PEO platforms. You'll find direct connections to QuickBooks and Xero for accounting, which covers most small business needs.

They also integrate with popular time tracking tools and some expense management software and offer an API for custom builds. The trade-off is that because Justworks handles so much internally through the PEO model, you don't need as many third-party integrations as you would with a basic payroll provider.

Justworks Price Structure

Justworks keeps pricing simple with three main tiers, though costs run higher than traditional payroll software because you're paying for the full PEO service:

- Payroll Plan: Starting at $8 per employee per month, plus a $50 base fee. This plan provides payroll services and access to HR tools with time tracking. This is the most basic option for businesses that only need payroll support.

- PEO Basic Plan: Starting at $79 per employee per month. This includes payroll services, HR essentials, support, compliance assistance, and access to time tracking. No base fee. Most small businesses opt for this plan to get solid benefits without complex HR infrastructure.

- PEO Plus Plan: Starting at $109 per employee per month. This plan includes everything in PEO Basic, plus health insurance administration, HSA/FSA accounts, mental health benefits, and more robust HR support. No base fee. Companies with complex HR needs or those scaling quickly typically choose this level.

All plans include payroll processing, tax filing, benefits administration, and workers' compensation insurance. These are per-employee costs, so a company with 10 employees would pay $590 - $990 monthly on the Basic plan. The value proposition is getting enterprise-grade benefits and comprehensive HR support without hiring full-time HR staff.

Curious about payroll service pricing? Check out our in-depth article on "Payroll Services Pricing Comparison" for detailed breakdowns of plans, features, and costs.

Detailed Comparison Table[toc=Gusto vs Justworks]

To decide between Gusto and Justworks for HR and payroll, you should compare their main features side by side. Here's a full comparison table of Gusto vs Justworks, this will help you quickly identify which platform offers the features most important to your business:

The big difference here?

Justworks operates as a PEO, which means they become your co-employer and give you access to better health insurance rates and built-in workers' comp.

Gusto gives you more flexibility and integrations but charges extra for workers' compensation coverage. Your choice really depends on whether you value the PEO benefits or prefer standalone software with more customization options.

What are the Pros and Cons of Gusto?[toc=Pros & Cons of Gusto]

Here's an honest look at what works and what doesn't with Gusto. We've laid it out clearly so you can quickly tell if this platform is a good fit for your business:

Gusto nails the fundamentals of payroll and hr tasks for small to mid-sized businesses. Just budget for the Plus plan if you want more than basic payroll processing, and remember that per-employee costs scale with your team.

What are the Pros and Cons of Justworks?[toc=Pros & Cons of Justworks]

The PEO model is different, and that creates some unique advantages and trade-offs. We’ve conducted in-depth research about Justwork and here's what you need to know:

Justworks shines when you're competing for talent and need to offer benefits that punch above your weight. The comprehensive HR support and compliance assistance justify the cost for growing teams in multiple states. Just make sure you're ready for that monthly investment and comfortable with the PEO partnership model.

User Reviews and Ratings: Gusto vs Justworks[toc=Reviews & Ratings]

When you're spending money on payroll software, you want to know what real users think. Here's what business owners and HR managers are saying about both platforms.

Gusto Reviews and Ratings

Overall Ratings:

- Capterra: 4.6/5 stars (4,100+ reviews) - View Gusto on Capterra

- G2: 4.5/5 stars (1,900+ reviews) - View Gusto on G2

- TrustRadius: 8.9/10 (1409 reviews) - View Gusto on TrustRadius

- Trustpilot: 2.7/5 (2,342 reviews) - View Gusto on Trustpilot

What users love:

- Easy to use interface that makes payroll processing simple

- Automated tax filing that actually works

- Next day direct deposit reliability

- Helpful customer support (especially on Plus and Premium plans)

- Great onboarding tools for new employees

Common complaints:

- Per-employee fees add up quickly as teams grow

- Workers' comp costs extra instead of being included

- Reporting features lack customization

- Customer support slower during tax season

- Basic plan too limited for most growing businesses

Real user insight: "Gusto made payroll as easy as a few clicks. Handles all the taxes, next day direct deposits work perfectly. Much cheaper and more responsive than our previous provider."

Justworks Reviews and Ratings

Overall Ratings:

- G2: 4.6/5 stars (1,100+ reviews) - View Justworks on G2

- Capterra: 4.6/5 stars (730+ reviews) - View Justworks on Capterra

- TrustRadius: 6.9/10 (90+ reviews) - View Justworks on TrustRadius

- Trustpilot: 2.1/5 stars (27 reviews) - View Justworks on Trustpilot

What users love:

- Enterprise-level health insurance plans at affordable rates

- 24/7 hr support with knowledgeable staff

- Strong multi-state compliance support

- Transparent pricing with no hidden fees

- Fast employee onboarding process

- Workers' comp included in pricing

Common complaints:

- Expensive for small teams ($59-99 per employee monthly)

- Switching away is complicated due to co employment relationship

- Limited customization options

- Fewer integrations than standalone payroll software

- Reporting capabilities could be better

- Some users report inconsistent customer support quality

Real user insight: "Justworks has been one of the best decisions I made. We finally offer affordable, quality health benefits to our team. It's more expensive than competitors, but you get what you pay for."

Quick Comparison

Both platforms score an average 4.6 on major review sites, showing strong user satisfaction. The key difference? Gusto users prioritize ease of use and affordable automated payroll, while Justworks users value better benefits and comprehensive hr support despite higher costs.

Both get criticized for pricing as companies scale, so factor in growth when budgeting.

What Should You Consider When Choosing a Global Payroll Platform?[toc=Key Considerations]

Picking between Gusto, Justworks, or any payroll platform isn't just about features and pricing. It's about finding what actually works for your business right now and where you're headed. Let us walk you through what really matters:

Your Business Size and Growth Plans

- If you have 1-10 employees: Gusto's Simple or Plus plan usually makes more sense. You get full service payroll, automated payroll, and basic hr features without the PEO premium. Justworks starts feeling expensive when you're paying $590-990 monthly for a small team.

- If you have 10-50 employees: This is where it gets interesting. Justworks' better health insurance plans start justifying the cost, especially if you're competing for talent. Gusto works if payroll processing and compliance support are your main needs.

- If you're planning aggressive growth: Think about whether you'll stay US-only or expand internationally. Neither Gusto nor Justworks handles true global payroll well. For multi-country teams, you'd need a different solution entirely.

Benefits Are Make-or-Break

Here's a reality check: if offering competitive employee benefits is critical to attracting talent, Justworks wins. Their PEO model gets you access to enterprise-level health insurance plans, better retirement plans, and benefits administration that small businesses can't typically access alone.

But if your team is young, healthy, and less benefits-focused, or you already have good insurance relationships, paying Justworks' premium doesn't make sense. Gusto's benefits tools handle the basics fine.

Compliance Complexity in Your Situation

- Single state operation: Either platform works. Both handle payroll tax, tax filing, and labor law compliance well.

- Multi state payroll: Both can manage this, but Justworks' dedicated compliance support gives you more peace of mind. They proactively alert you to labor laws changes and handle state-specific requirements without you asking.

- Complex labor situations: Union employees, tipped workers, or unusual pay structures? Do your homework. Some users report Gusto's time tracking and pay management gets clunky with complex scenarios.

Real Cost Analysis (Not Just Sticker Price)

Don't just look at monthly fees. Calculate your true cost:

For Gusto:

- Monthly base + (per employee × team size)

- Add workers' comp if needed

- Factor in which tier you actually need (most need Plus, not Simple)

- Example: 15 employees on Plus = $80 + ($12 × 15) = $260/month

For Justworks:

- Per employee only, no base fee

- Workers' comp included

- Example: 15 employees on Basic = $59 × 15 = $885/month

That $625 monthly difference buys you better health insurance access, dedicated hr support, and PEO benefits. Is that worth it for your business? Only you can decide.

Integration Needs

If you live in QuickBooks, Xero, or other accounting software: Both integrate fine.

If you use specialized tools: Gusto has more third-party integrations. Justworks keeps things simpler but more limited. Check if your essential tools (time tracking, expense management software, project management) connect with your chosen platform.

Level of HR Support You Need

- DIY-friendly teams: Gusto's hr resource center and documentation work well. You can figure things out yourself.

- Need hand-holding: Justworks' 24/7 hr support with real experts justifies the cost. Their team handles complex hr tasks, compliance questions, and sticky employee situations.

- Growing pains ahead: If you're going from 5 to 50 employees in the next year, having Justworks' hr teams available prevents costly mistakes.

Common Mistakes to Avoid

- Choosing based only on price: The cheapest option costs more if it can't handle your benefits administration needs or compliance requirements.

- Ignoring your actual feature usage: Don't pay for Premium plans with performance management tools if you're not actually going to use them.

- Forgetting about employee experience: Your team uses employee self service portals daily. If they hate accessing pay stubs or managing PTO, that's friction you don't need.

- Underestimating switching costs: Moving from one payroll provider to another mid-year is painful. Choose carefully upfront, especially with PEOs like Justworks where the co employment relationship makes switching harder.

- Not testing customer support: Before committing, actually contact their support team with questions. Response time and knowledge level matter when you're stuck.

Making Your Decision

Choose Gusto if:

- You're a small business under 20 employees

- You want affordable, straightforward payroll and hr management

- You're comfortable with basic benefits options

- You value flexibility and integrations

- Budget is a primary concern

Choose Justworks if:

- You need competitive health insurance to attract talent

- You operate across multiple states and want compliance peace of mind

- You want 24/7 access to hr experts

- You're willing to pay more for comprehensive support

- Workers' comp and benefits management are priorities

The right payroll platform simplifies hr and payroll tasks so you can focus on running your business. Take time to assess your actual needs, not just what sounds good in a demo. And remember, both platforms offer trials or demos, so test them with your real workflows before committing.

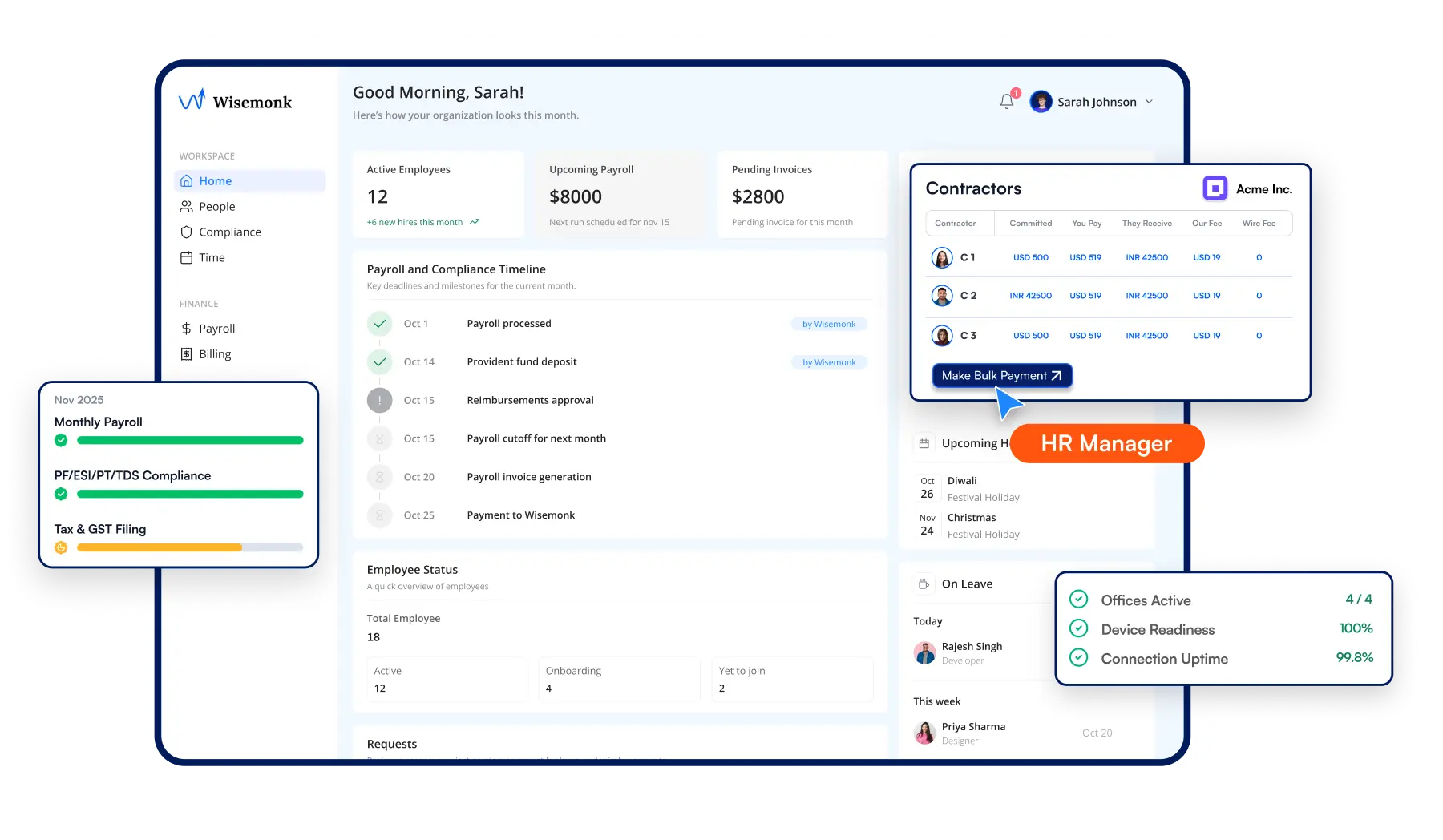

Why Choose Wisemonk for Payroll and Hiring?[toc=Choose Wisemonk Payroll]

Wisemonk is a trusted Employer of Record (EOR) platform, helping global businesses hire, pay, and manage talent without the need to set up a local entity. While platforms like Gusto and Justworks focus primarily on US payroll and PEO services, Wisemonk specializes in providing end-to-end support to 300+ global clients for India operations, from compliant payroll processing to workforce management.

Here’s why companies expanding into India choose Wisemonk:

- Official Employer of Record: We become the legal employer for your team in India, managing compliant contracts, payroll management, and statutory benefits.

- Effortless Hiring & Onboarding: Employees and contractors can be onboarded within 2–4 days with digital documentation and HR support.

- Full Payroll & Compliance: We handle payroll processing, tax filings, labor law compliance, and contributions to PF, ESI, and gratuity.

- Flexible Benefits Administration: Provide employees with statutory and custom benefits, including health insurance, vision insurance, commuter benefits, and employee perks.

- Contractor Management: Pay contractors accurately and on time, with compliance support for local tax regulations.

- Workforce Management Tools: Employee self-service portal for pay stubs, leave, and tax forms; onboarding tools; HR resource center; and ongoing compliance assistance.

- Beyond Payroll: Support for Global Capability Centers (GCCs) setup, company registration in India, equipment procurement, and background verification to ensure compliant, productive teams.

Wisemonk is more than a payroll platform, we’re a strategic partner for scaling into India. From simplifying HR tasks to ensuring labor law compliance, our solutions are built for global founders who want speed, transparency, and peace of mind.

Looking to streamline your India expansion? Connect with Wisemonk to explore your options or get personalized guidance for your business needs.

Frequently asked questions

Is Gusto the best payroll software?

Gusto is among the most popular payroll platforms for small to mid sized businesses, thanks to its easy interface, automated payroll tax filings, and integrated benefits administration. That said, the “best” option depends on your needs. Companies focused mainly on US payroll often choose Gusto, while those expanding globally pair it with providers like Wisemonk for compliant hiring, payroll management, and HR support in India.

What are the alternatives to Gusto and Justworks?

Here are some alternatives to consider:

- Wisemonk (India specialist)

- ADP (its alternative)

- Rippling (its alternative)

- Multiplier (its alternative)

- Oyster HR (its alternative)

Which is better: Gusto or Justworks?

The answer depends on your business size and HR needs. Gusto is better for small businesses (5-50 employees) wanting affordable DIY payroll software with transparent pricing ($49+ per month base) and 200+ integrations. Justworks is better for growing companies (15-100 employees) needing full-service HR outsourcing through a PEO model, enterprise benefits, and multi-state compliance support at $59-99 per employee monthly. Gusto costs less but requires you to manage payroll yourself. Justworks costs 2-3x more but handles everything for you through co-employment.

What was Gusto called before?

Before rebranding as Gusto, the company operated under the name ZenPayroll. The new name marked its evolution from a payroll-only service to a full service payroll platform offering payroll, HR, and employee benefits management.

Is Gusto a PEO?

No, Gusto isn't a professional employer organization (PEO). Gusto offers payroll, HR, and benefits tools, but it doesn’t provide PEO services like employee co-employment or access to enterprise-level benefits. Businesses needing PEO services would need to look at other platforms, like Rippling, as Gusto focuses on being an HRIS solution.

Is Gusto better than ADP?

Gusto is typically a better fit for small to mid sized businesses that want straightforward payroll processing, automated tax filings, and easy-to-use HR tools. ADP is more expensive but offers scalable payroll and HR solutions, with advanced reporting, compliance features, and support for large or complex organizations. Many companies use Gusto or ADP for their US payroll, while turning to providers like Wisemonk to handle compliant hiring, payroll, and benefits administration for teams in India.

Read more : Top 10 Gusto Competitors & Alternatives & Top 10 ADP Competitors & Alternatives

What's the main difference between Gusto and Justworks?

The main difference is the service model. Gusto is payroll software that you use to manage payroll yourself with automated tools, you maintain full control and employer responsibilities. Justworks is a Professional Employer Organization (PEO) that becomes your legal co-employer and manages payroll, HR, compliance, and benefits for you. Think of it as: Gusto = DIY tool with automation, Justworks = full-service HR outsourcing.

%20(1).webp)

%20(1).webp)

%20(1).webp)