- The best Gusto alternatives are Deel, Rippling, OnPay, ADP RUN, Wisemonk, BambooHR, Paychex Flex, Multiplier, QuickBooks Payroll, and Remote.

- When choosing, focus on total cost (not base price), whether you need domestic or international payroll, how well the platform integrates with your existing tools, and the quality of customer support included in your plan.

- Companies are leaving Gusto because costs escalate fast with add-ons, global payroll is limited to just 10 countries, customer support wait times have gotten worse, and the platform struggles to scale past 100 employees.

- Avoid picking a provider based on base price alone, signing long-term contracts without testing the platform first, choosing a global EOR that lacks real local expertise in your target country, and switching mid-year without confirming the provider handles full data migration.

Need help with payroll or HR for your business? Contact us today!

Discover how Wisemonk delivers trusted international solutions.

Gusto is a popular choice for small business payroll, but it's not the right fit for everyone. If you're looking for Gusto alternatives because of rising costs, limited global payroll, or frustrating customer support, you're in the right place.

This guide covers why companies search for Gusto competitors, the best alternatives available for managing your payroll, HR, and workforce, and what to look for when choosing a platform that actually fits your needs.

Whether you're scaling beyond Gusto's limits, hiring international employees, or simply want better value for your payroll and compliance management, we'll help you find the right solution.

What are the main reasons companies are moving away from Gusto?[toc=Why Gusto Alternatives]

Gusto is a well-built payroll and HR platform, no doubt. But from what we've seen helping global companies manage their workforce in India and beyond, there are clear reasons why more businesses are searching for Gusto alternatives in 2026:

- Costs escalate quickly: The Simple payroll plan starts at $49/month + $6 per employee, but add-ons like time tracking ($6/person), priority dedicated support ($30/month + $3/person), and performance management ($3/person) can push your bill past $100+/month fast. No hidden fees technically, but the add-on model catches many small business owners off guard.

- Global payroll is very limited: Gusto Global's EOR only covers 10 countries (powered by Remote). If you're building a global workforce or hiring international employees beyond those countries, you'll need a different solution entirely. Contractor payments work in 120+ countries, but full international payroll for salaried staff? Not Gusto's strength.

- Customer support is a sore spot: Recent Trustpilot reviews (late 2025/early 2026) flag 40-50 minute call waits, 2-15 business day response times on urgent tax notices, and difficulty getting issues escalated. For a tool handling your payroll processing and tax filings, that's a real problem.

- Multi-state payroll costs more: The Simple plan only supports single-state payroll. If you have remote salaried employees or hourly employees across states dealing with federal, state, and local taxes, you're forced into the Plus plan ($80/month + $12/person) or Premium ($180/month + $22/person).

- Doesn't scale past ~100 employees: Gusto was designed for small businesses. Companies that grow beyond 100 people consistently report hitting limitations with reporting, custom workflows, compliance tools, and advanced HR processes.

- Basic automation and customization: Compared to Gusto competitors like Rippling, the platform offers limited workflow automation, no dashboard customization, and struggles with complex compensation structures like commission-heavy teams.

- Benefits administration has extra costs: Features like retirement plans (401(k)), FSAs, and HSAs are paid add-ons, not included in base benefits administration. Health insurance is brokered through Gusto, but the costs sit on top of your plan pricing.

In short, Gusto works well for US-based small businesses with straightforward payroll services needs. But the moment you go global, grow your team, or need deeper HR tools, the limitations become hard to ignore.

What are the best alternatives to Gusto?[toc=Top 10 Gusto Alternatives]

The best Gusto alternatives include Deel, Rippling, OnPay, ADP RUN, Wisemonk, BambooHR, Paychex Flex, Multiplier, QuickBooks Payroll, and Remote. Each offers distinct strengths in payroll processing, HR tools, benefits administration, and global hiring.

Based on our experience working with companies transitioning from Gusto, here are the top 10 Gusto alternatives & competitors worth considering:

1. Deel

Deel is a leading global payroll and workforce management platform founded in 2019, supporting hiring, payroll services, benefits administration, and compliance across 150+ countries. Its intuitive interface and wide feature set make it suitable for startups and large enterprises alike. A key advantage is Deel's ability to manage both contractors and full-time international employees in one unified platform, giving companies flexibility in global workforce management.

The company invests heavily in localized expertise, ensuring accurate tax compliance and adherence to country-specific labor laws. Beyond core EOR services, Deel offers tools for expense management, equity compensation, multi-currency payroll processing, and visa and immigration support, along with frequent feature updates and integrations with major HR software.

Key Features:

- Global payroll in 150+ countries

- Contractor and full-time employee onboarding management

- Built-in compliance and tax management

- Expense reimbursement and company card options

- Equity compensation support

- Visa and immigration assistance

Pricing:

- EOR services: $599 per employee per month

- Contractor management: $49 per contractor per month

- Global Payroll (own entities): Starting at $29 per employee per month

- Custom enterprise pricing available for large-scale deployments

If you are planning to choose Deel, you must check out: Best Deel Competitors & Alternatives || Deel vs Gusto

2. Rippling

Rippling is a unified workforce management platform combining HR, payroll and benefits, IT, and finance into a single modular system. Unlike Gusto's HR-only focus, Rippling connects payroll processing with device management, app provisioning, and financial management, making it ideal for tech-forward companies managing distributed teams.

The platform's automation engine is where it truly shines. From employee onboarding workflows that automatically provision apps and devices to custom compliance rules that update across jurisdictions, Rippling reduces manual work significantly. With 650+ integrations and support for global payroll in 185+ countries, it's built for companies that want one system to rule everything.

Key Features:

- Modular HR, payroll, IT, and finance platform

- Global payroll and EOR in 185+ countries

- 650+ integrations (seamless integration with popular tools)

- Advanced workflow automation with custom triggers

- Employee self-service portal and mobile app

- Performance management tools and employee surveys

Pricing:

- Core platform starts at $8 per employee per month

- Payroll module: $8 per employee per month (additional)

- Full stack (HR + Payroll + Benefits + Time): Approximately $15-25 per employee per month

- Custom quotes required for global payroll and EOR

If you are planning to choose Rippling, you must check out: Gusto vs Rippling

3. OnPay

OnPay is a straightforward, all-inclusive payroll services platform built specifically for small businesses that want Gusto-level features without the add-on pricing headaches. With over 30 years of payroll processing experience, OnPay offers a single plan that includes everything: unlimited payroll runs, multi-state tax filings, benefits administration, and HR services, all at one flat price.

What makes OnPay stand out among Gusto alternatives is its industry-specific payroll support. Whether you run a restaurant, farm, nonprofit, or law firm, OnPay tailors its tax services and compliance features to your specific needs, something Gusto doesn't do.

Key Features:

- Unlimited payroll runs with automated tax filings (federal, state, and local)

- Multi-state payroll included at no extra cost

- Employee self-service portal with lifetime access to pay stubs and tax forms

- Health insurance, 401(k) retirement plans, and benefits management

- Industry-specific payroll (restaurants, farms, nonprofits)

- Custom report designer with 50+ data points

Pricing:

- $40/month base + $6 per employee per month (single plan, everything included)

- No hidden fees for multi-state payroll, off-cycle runs, or tax filings

- First month free trial available

4. ADP RUN

ADP RUN is a small business payroll solution from ADP, one of the largest payroll providers globally with 1 million+ customers across 140 countries. It's designed for businesses that need robust multi-jurisdiction tax filings, strong compliance support, and the reliability of a decades-old brand.

For companies outgrowing Gusto's compliance tools, ADP RUN offers a significant upgrade with access to legal assistance, employee background checks, and extensive new hire reporting capabilities. Its mobile app is one of the best in the industry for both employers and employees.

Key Features:

- Full service payroll with automated tax filings across all jurisdictions

- Direct deposit, pay cards, and flexible payment options

- Employee self-service portal and robust mobile app

- New hire reporting and employee onboarding tools

- Time tracking and attendance tracking integration

- Access to HR experts and legal assistance on higher plans

Pricing:

- Custom quotes required (no public transparent pricing)

- Four tiers: Essential, Enhanced, Complete, and HR Pro

- Reported starting range: ~$49/month + $4-$5 per employee per month

- Pricing scales based on features and employee count

If you are planning to choose ADP, you must check out: Top 10 ADP Competitors & Alternatives

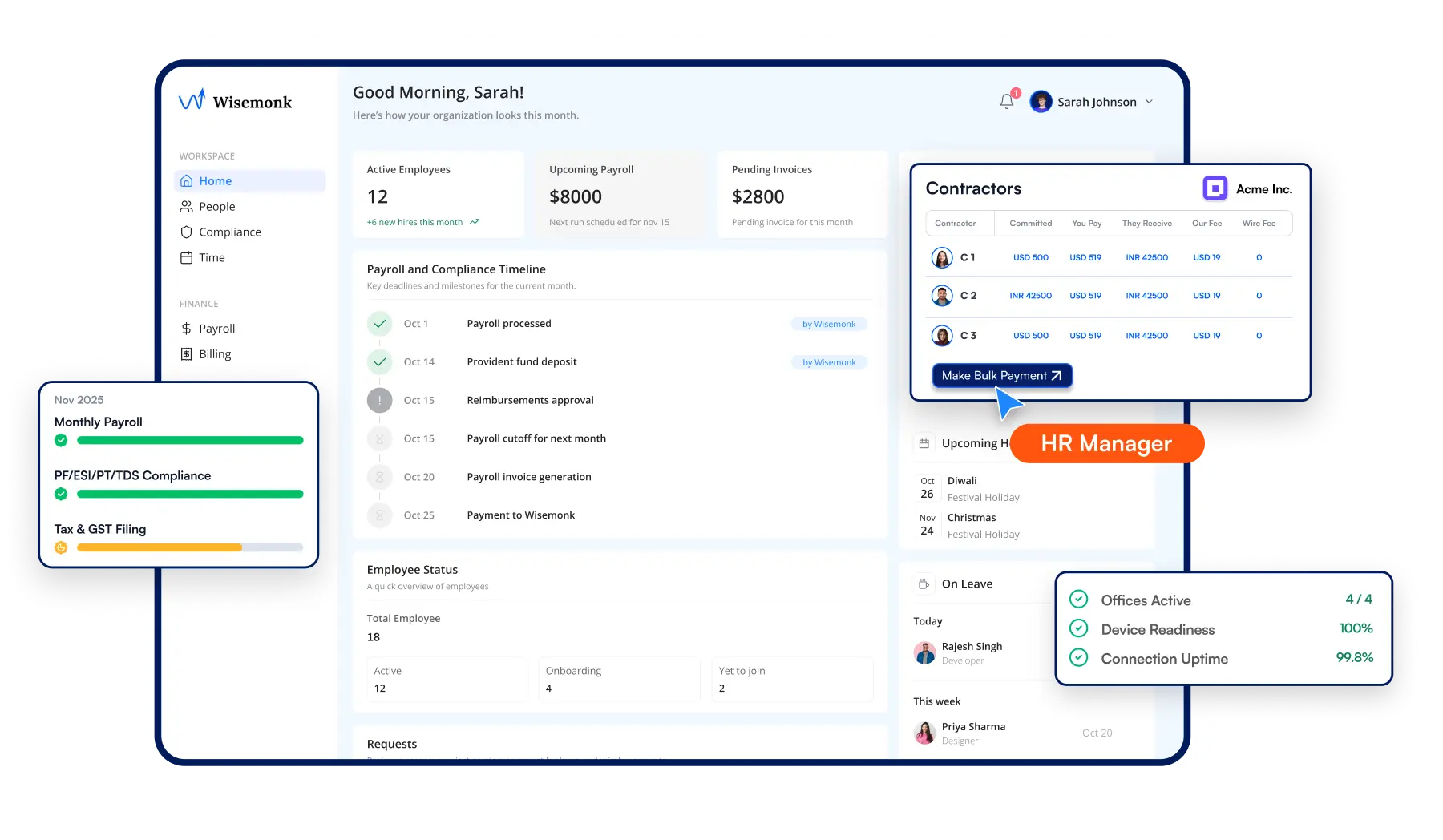

5. Wisemonk

Wisemonk is an India-specialist Employer of Record (EOR) and HR solution platform that helps global companies hire, pay, and manage employees and contractors in India without setting up a local entity. Supporting 300+ companies, managing 2,000+ employees, and overseeing $20M+ in payroll, Wisemonk has deep expertise in navigating India's complex labor laws, state-specific regulations, and statutory benefits like Provident Fund, ESI, and TDS.

If your company is expanding into India or already has Indian team members, Wisemonk is purpose-built for your needs. Unlike global EOR providers that cover India as one of 150+ countries, Wisemonk focuses exclusively on the Indian market, resulting in faster onboarding (24-48 hours), deeper compliance tools, and pricing that's a fraction of what Deel or Remote charge for India.

Key Features:

- Full service payroll and compliance management for India (EPF, ESI, TDS, professional tax)

- 24-48 hour employee onboarding with compliant contracts

- Tax optimization services for employers and employees

- Employee portal for leave management, reimbursements, and pay stubs

- Equipment procurement and management (laptops, phones)

- Dedicated support with assigned HR Business Partner

- Contractor payments and management in India

Pricing:

- EOR services: Starting at $99 per employee per month

- No hidden fees, no FX markups

- Custom pricing for large-scale deployments and GCC setup

- Transparent pricing structure with no onboarding or termination fees

6. BambooHR

BambooHR is an HR-first platform designed for small to mid-sized businesses that want a clean, intuitive system for managing the entire employee lifecycle. While Gusto leads with payroll, BambooHR leads with people management, offering strong employee onboarding, performance management tools, applicant tracking, and employee records management.

The platform is especially popular with companies that already have a payroll solution and want a dedicated HR software that handles everything else. With a culture-focused approach including employee satisfaction surveys and eNPS tracking, BambooHR goes beyond basic HR processes.

Key Features:

- Centralized employee data management and document storage

- Built-in applicant tracking system (ATS) and employee onboarding

- Performance management with reviews, goal tracking, and feedback

- Time tracking and PTO management

- Custom report builder with real-time dashboards

- Employee self-service portal

Pricing:

- Flat rate starting at $250/month for 25 or fewer employees

- Per-employee pricing: $12-22 per employee per month for larger teams

- Payroll, benefits administration, and time tracking are add-ons

- 15% discount when bundling payroll + benefits

- Free trial available

7. Paychex Flex

Paychex Flex is a cloud-based payroll and HR platform that scales from small businesses to enterprise. It delivers full service payroll, compliance management, benefits administration, and optional HR modules for recruiting, time tracking, and retirement plans. With 24/7 customer support and strong multi-state capabilities, Paychex is built for businesses that want long-term reliability.

For companies frustrated with Gusto's limited support hours, Paychex offers around-the-clock access to certified HR professionals, something Gusto reserves only for Premium plan users.

Key Features:

- Full-service payroll with automated tax filings across all 50 states

- 24/7 dedicated support with certified HR professionals

- Benefits administration including health insurance and retirement plans

- AI-assisted recruiting and employee onboarding

- Time tracking, scheduling, and attendance tracking

- Employee self-service and robust mobile app

Pricing:

- Essentials plan: Starting at ~$39/month + $5 per employee per month

- Custom quotes for higher tiers

- Benefits, time tracking, and advanced HR are paid add-ons

- Pricing varies by company size and modules selected

8. Multiplier

Multiplier is a global payroll and EOR platform that helps businesses hire, onboard, and pay employees in 150+ countries without establishing local entities. With 100+ owned entities worldwide, Multiplier relies heavily on its own infrastructure rather than third-party partners, creating a more consistent experience. The platform is particularly strong in Asia-Pacific markets.

For companies looking at Gusto alternatives with global hiring needs, Multiplier offers competitive flat-rate pricing, multi-currency payroll processing, and ESOP support that Gusto simply can't match.

Key Features:

- EOR services in 150+ countries with owned entities

- Global payroll automation with multi-currency support

- Employee onboarding typically completed in 24-72 hours

- Benefits administration with localized benefit packages

- ESOP and equity compensation support

- Compliance tools covering local labor laws and tax regulations

Pricing:

- EOR services: Starting at $400 per employee per month

- Contractor management: ~$40 per contractor per month

- Global payroll (own entities): ~$20-40 per employee per month

- No onboarding or contract termination fees

9. QuickBooks Payroll

QuickBooks Payroll is the natural Gusto alternative for businesses already using QuickBooks Online for accounting. Its direct integration ensures payroll data and accounting stay perfectly in sync without manual entry. The platform offers same-day direct deposit, automated tax filings, and HR support add-ons.

While it lacks the depth of HR tools offered by Gusto or Rippling, QuickBooks Payroll is extremely convenient for teams that want one ecosystem for financial management and payroll.

Key Features:

- One-click sync with QuickBooks Online accounting

- Same-day or next-day direct deposit (plan dependent)

- Automated tax filings for federal, state, and local payroll taxes

- Time tracking via QuickBooks Time (included on Premium+ plans)

- Employee self-service for pay stubs and tax documents

- Mobile app for running payroll on the go

Pricing:

- Core plan: $50/month + $6.50 per employee per month

- Premium plan: $88/month + $10 per employee per month

- Elite plan: $134/month + $12 per employee per month

- Frequent promotional discounts available

10. Remote

Remote is a global payroll and EOR platform built for companies hiring internationally. It offers EOR services in 100+ countries through its own legal entities, contractor payments in 180+ countries, and localized compliance tools. Remote stands out for its IP protection feature ("Remote IP Guard") and a free trial of its HRIS tools.

For companies moving beyond Gusto's limited global hiring capabilities, Remote provides a straightforward path to international payroll with flat-rate pricing and strong compliance coverage.

Key Features:

- EOR services in 100+ countries with own legal entities

- Contractor payments in 180+ countries

- IP protection with "Remote IP Guard"

- Free HRIS tools (time-off tracking, document storage, expense management)

- Localized benefits administration and compliance

- Employee self-service portal with onboarding workflows

Pricing:

- EOR services: $599 per employee per month ($699 monthly, $599 annually)

- Contractor management: $29 per contractor per month

- Global payroll (own entities): $29 per employee per month

- Free HRIS plan available for basic HR processes

If you are planning to choose Remote, you must check out: Top 10 Remote Competitors & Alternatives

What should you look for when choosing Gusto alternatives?[toc=How to Choose]

Switching payroll providers affects your employees' paychecks, your tax filings, and your compliance posture. After helping foreign companies navigate this decision, here's what actually matters when evaluating Gusto competitors:

1. Total Cost, Not Just the Base Price

Don't fall for the "$8 per employee per month" headline.

Ask: what does it cost once you add payroll processing, benefits administration, time tracking, and dedicated support?

Platforms like OnPay and Wisemonk offer transparent pricing with no hidden fees. Others like Rippling and ADP require custom quotes. Always get a fully loaded quote based on your team size and required features.

2. Domestic vs. Global Payroll Needs

If your team is US-only, OnPay, QuickBooks Payroll, or Paychex Flex will serve you well. But if you're hiring international employees, you need platforms that handle international payroll, local compliance, and statutory benefits.

For global hiring, look at Deel, Multiplier, Remote, or Wisemonk (specifically for India). Gusto's global reach covers just 10 countries at $599 per employee per month.

3. Scalability

Your solution should grow with you. Gusto and OnPay work best for smaller teams but show cracks past 100 employees. BambooHR, Rippling, and Paychex Flex scale smoothly from 10 to 1,000+.

Think ahead: does the platform support multi-state payroll processing, custom workflows, and advanced compliance tools?

4. Integration with Your Existing Tools

Seamless integration saves hours monthly. QuickBooks Payroll wins if you're already in the QuickBooks ecosystem. Rippling leads with 650+ integrations. BambooHR offers 150+ marketplace apps. Before committing, confirm the platform connects with your accounting, time tracking, and communication tools.

5. Compliance and Tax Support

Your provider must handle federal, state, and local tax calculations, automated tax filings, and year-end tax forms without errors. For US teams, look for multi-state payroll included at no extra cost (OnPay does this, Gusto charges extra). For international employees, verify the provider has actual local expertise in your target countries, not just a checkbox on a features page.

6. Customer Support Quality

When payroll goes wrong, you need someone fast. Gusto locks dedicated support behind its Premium plan ($180/month + $22/person). OnPay and Wisemonk include personalized support from day one. Ask about average response times, whether you get a dedicated account manager, and support hours relative to your time zone.

7. Employee Experience

A good employee self-service portal lets your team access pay stubs, manage direct deposit, handle tax documents, and request time off without emailing HR. Rippling, BambooHR, and Deel offer strong employee portals with mobile app access. OnPay gives employees lifetime document access even after they leave.

8. Data Migration Support

Switching mid-year is tricky. You need year-to-date payroll data migrated accurately for correct tax filings. Ask whether the provider handles migration for you, what the onboarding timeline looks like, and if there's a dedicated implementation manager. Rippling and OnPay offer white-glove migration support.

9. Reporting and Analytics

Basic payroll reports are table stakes. If your finance team needs custom breakdowns by department, location, or cost center, confirm the platform supports it. Rippling's unified analytics is industry-leading. BambooHR's custom report builder is also strong. Gusto's reporting is limited by comparison.

10. Contract Flexibility

Avoid platforms that lock you into long-term contracts with steep cancellation fees. Multiplier and Wisemonk have no onboarding or termination fees. ADP and Paychex may require annual commitments. Read the fine print.

Get Started With Wisemonk EOR[toc=Choose Wisemonk EOR]

Look, if your team is entirely US-based, any of the Gusto alternatives above will get the job done. But if you're hiring in India or planning to, that's where things get complicated fast. India's labor laws vary by state, tax filings like EPF, ESI, and TDS have strict deadlines, and one compliance slip-up can cost you more than a year's worth of software fees.

That's exactly why we built Wisemonk. We don't try to be everything for everyone across 150 countries. We focus exclusively on India, and we do it really well.

Here's what that means for you:

- EOR starting at $99/month per employee (global providers charge $599+ for the same market)

- 24-48 hour onboarding so you don't lose top Indian talent to slow processes

- A dedicated HR Business Partner assigned to your team, not a rotating support queue

- Full compliance management including EPF, ESI, TDS, professional tax, and state-specific labor laws

- Equipment procurement, tax optimization, and contractor payments handled end-to-end

- Zero hidden fees, zero FX markups, zero onboarding charges

We currently support 300+ global companies, manage 2,000+ employees, and process $20M+ in payroll across India. Whether you're hiring your first developer in Bangalore or scaling a 50-person team across multiple Indian states, we've done it before and we'll make it seamless for you.

Ready to hire in India without the compliance headaches? Talk to our team today and get your first employee onboarded in 48 hours.

Frequently asked questions

What is the best HR payroll software?

The best HR payroll software depends on your business needs. If you’re a US-based small business, Gusto is a solid choice for basic payroll. However, if you’re looking to expand globally or manage remote teams, consider platforms that offer global payroll, compliance, and HR operations. Alternatives like ADP or Rippling provide more scalability, and for global operations, you’ll need a solution that supports international payroll and compliance, like Wisemonk.

Who is Gusto competition?

Gusto’s competition includes ADP, Paychex, Rippling, OnPay, and Justworks. These platforms offer similar payroll and HR solutions, with Rippling and ADP being strong alternatives for larger companies or those with more complex needs. For companies hiring internationally, platforms like Wisemonk can be the better choice, offering full Employer of Record (EOR) services and handling compliance across multiple countries.

Why is ADP better than Gusto?

ADP is better than Gusto for large companies or those with more complex payroll and compliance needs. ADP offers advanced automation, full compliance support, and the ability to scale across multiple locations. However, Gusto is a simpler option for small businesses in the US. If you need global payroll and remote team management, alternatives like Rippling or Wisemonk may be more fitting.

What are the alternatives to Gusto and Justworks?

Here are some alternatives to consider:

- Wisemonk (India specialist)

- ADP (its alternative)

- Rippling (its alternative)

- Multiplier (its alternative)

- Oyster HR (its alternative)

What is the best payroll for a small business?

QuickBooks Payroll is excellent if you The best payroll software for small businesses depends on priorities. Gusto, OnPay, and QuickBooks Payroll are popular for ease and affordability, while Paychex or ADP work better for scaling or compliance-heavy needs. OnPay often stands out as a budget-friendly, transparent option with strong customer support.

Read more: Affordable Payroll Services Cost Comparison Guide 2025

What are the cons of Gusto?

Gusto is a great choice for small businesses in the US, but it has limitations when it comes to scaling. Gusto lacks support for multi-state payroll and doesn’t offer global payroll management. It also doesn’t handle international compliance or remote team setups, which can be crucial for businesses expanding globally. Alternatives like ADP or Wisemonk are better equipped for these needs.

Does Gusto have hidden fees?

Gusto’s pricing is transparent, but there are additional costs for multi-state payroll, certain HR features, and employee benefits management. These fees can add up as your business grows. For a more predictable pricing model, alternatives like Paychex or Wisemonk might be more suitable for businesses with evolving needs.ms no hidden fees. Their pricing is transparent, a base monthly fee plus a per-employee rate, and they state that additional fees for optional add-ons are disclosed upfront.

.png)

%20(1).webp)