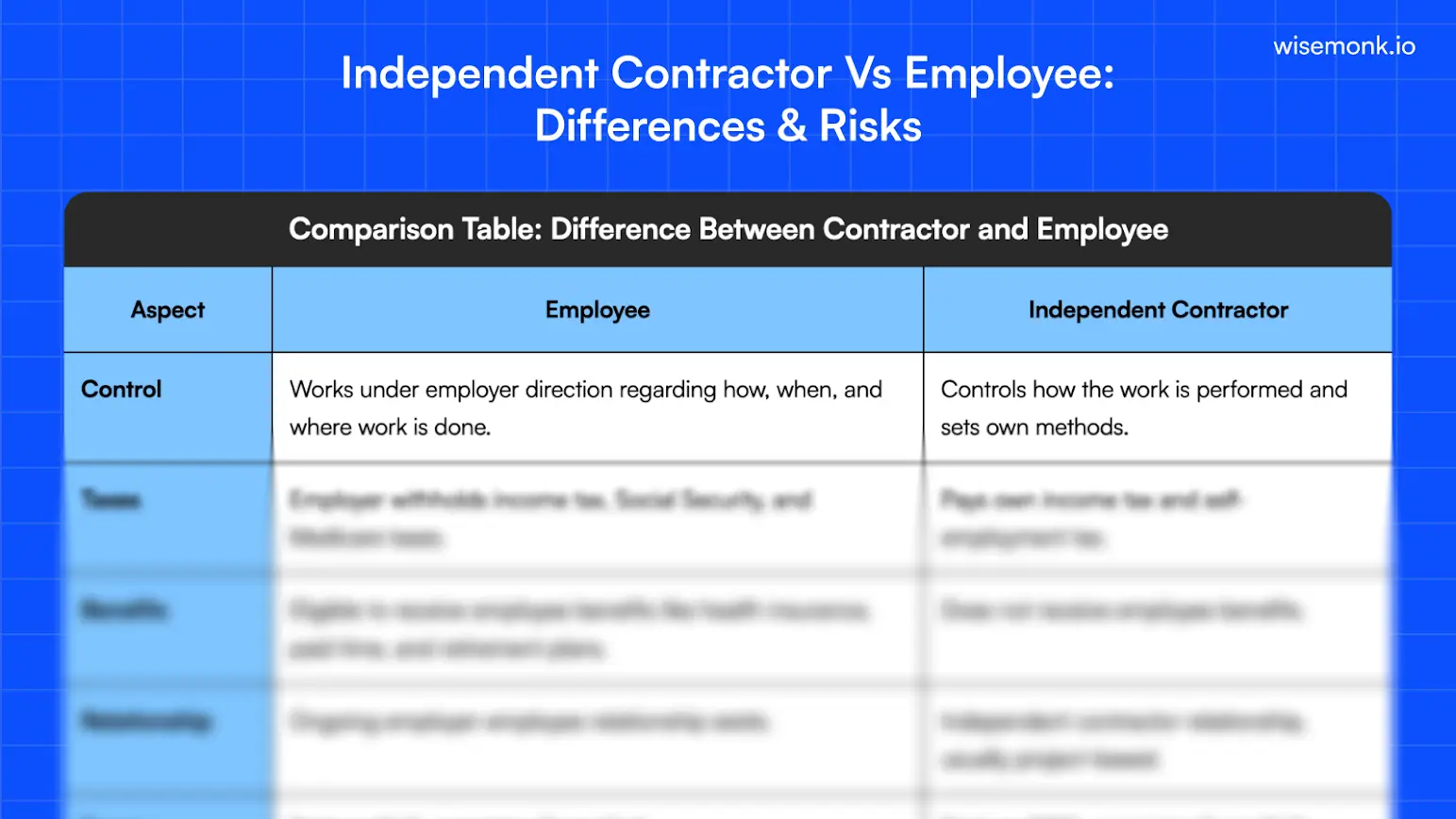

- The difference between the contractor and employee is that contractors operate their own business, control how work is done, and are paid for results, while employees work under employer direction and receive statutory benefits.

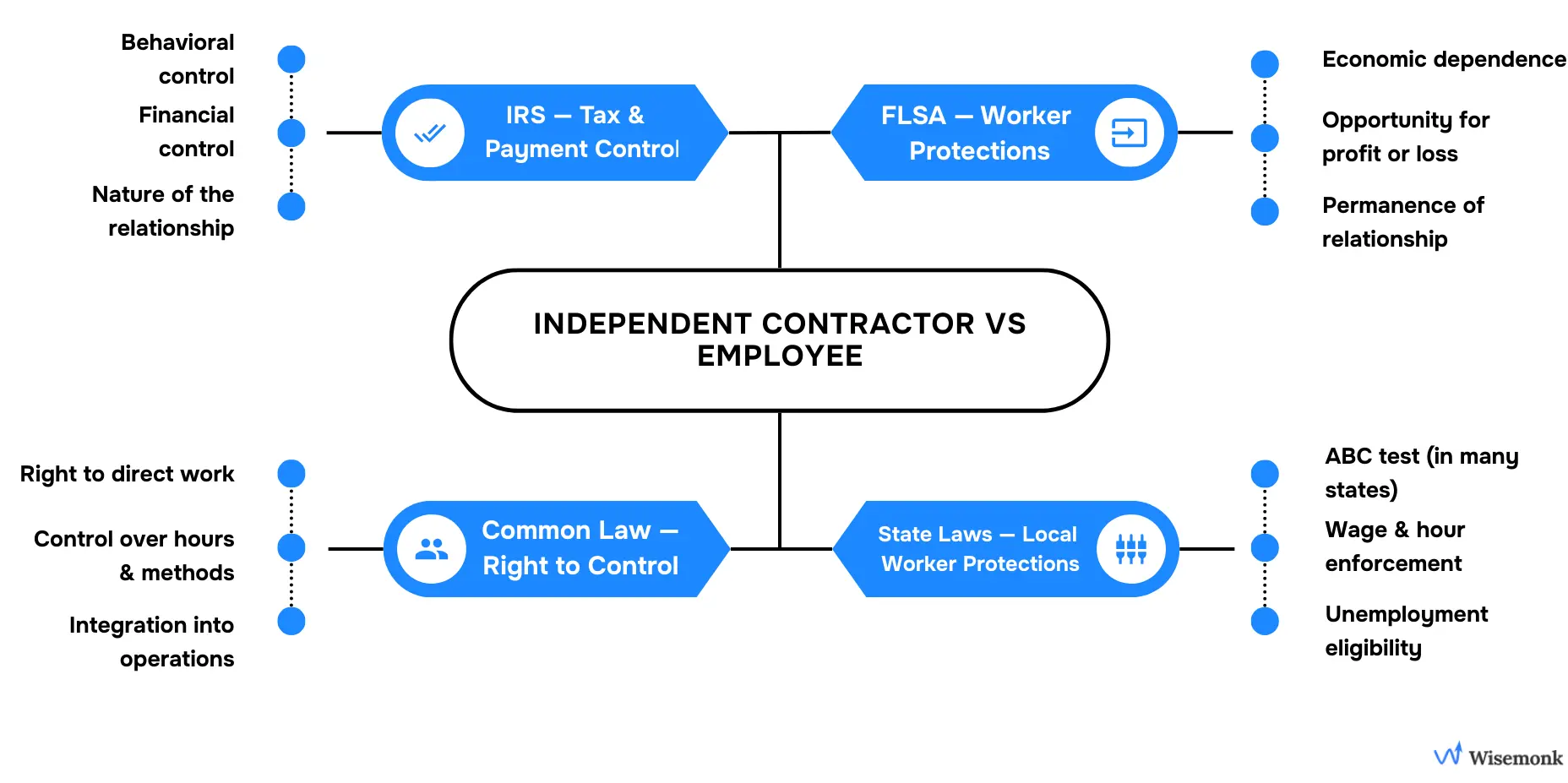

- Worker classification is judged under multiple tests. The IRS focuses on tax control, the FLSA evaluates economic dependence and worker protections, and common law examines day-to-day control. Passing one test does not override the others.

- Misclassification risk arises when an employee is treated as an independent contractor. Full-time work, long-term dependency, and close supervision can trigger reclassification, leading to penalties, back taxes, and labor law violations.

- Tax responsibilities differ by worker type. Independent contractors are paid via 1099 and handle their own income tax and self-employment tax, while employees receive W-2 wages with payroll taxes withheld by the employer.

Need help hiring contractors or employees compliantly across borders? Talk to us today.

Discover how Wisemonk creates impactful and reliable content.

Should this person be an independent contractor or an employee?

We’ve seen this play out repeatedly with US and global founders building remote teams.

Hiring starts fast.

Paying contractors feels easy.

Everything works. Until it doesn’t.

By definition, an independent contractor, sometimes called a freelancer, self-employed worker, or gig worker, is meant to operate independently, control how the work is done, and take care of their own taxes and benefits.

An employee, on the other hand, works under the company’s control, follows set expectations, and is covered by employment laws.

The problem isn’t misunderstanding the definitions. It’s assuming the label you choose today will hold up when the business grows.

This article breaks down where that assumption fails for US and global founders, covering the difference between contractor and employee classification, misclassification risks, tax obligations, and the decisions that hold up as companies scale.

What is the difference between an independent contractor and an employee?[toc=Independent Contractor vs Employee]

Based on our experience working closely with companies on payroll and employment compliance, this breakdown explains the difference between contractor and employee beyond just titles or contracts.

To fully understand the independent contractor vs employee decision, it’s important to look at how workers are formally classified under different federal and state laws.

How are independent contractors and employees classified?[toc=Worker Classification]

Worker classification is not decided by job titles, offer letters, or what a contract calls someone. Calling a worker an “independent contractor” does not make them one, and a well-drafted agreement alone does not determine worker status.

Classification is based on how the working relationship functions in reality. Regulators and courts look at who controls the work, how dependent the worker is on the company, and whether the relationship looks temporary or ongoing.

That’s why there is no single rule or test that definitively decides worker status in every situation.

From our hands-on work with employment and compliance matters, we’ve organized this table to show how independent contractor vs employee classification is evaluated across authorities.

Key takeaway: Worker classification is not a single pass-fail decision. A company can comply under one authority and still face penalties under another, which is why the difference between employee and contractor often only surfaces during audits, labor claims, or transactions.

For small business owners, understanding worker classification under federal and state laws, local laws, and labor regulations is critical to avoid federal penalties, back taxes, and long-term compliance risk when choosing between independent workers, full time employees, or contract workers.

How do the IRS, FLSA, and common law classify independent contractors vs employees?[toc=IRS, FLSA, Common Law Tests]

Leveraging our experience working with global companies across payroll, compliance, and worker classification, we’ve curated how different authorities evaluate contractors and employees, using real-world examples to make it concrete.

Real-world example used throughout this section

"You hire a remote worker full time. You assign ongoing work, expect availability during core hours, pay a fixed monthly amount, and provide the tools needed to do the job."

How the IRS classifies independent contractors vs employees

The Internal Revenue Service classifies workers to determine who controls the work and who is responsible for paying and withholding employment taxes.

What the IRS evaluates:

- Behavioral control: Who decides how, when, and where the work is done

- Financial control: How the worker is paid, who bears expenses, who provides tools

- Nature of the relationship: Written contracts, benefits, and whether the work is ongoing or central to the business

IRS classification determines whether a business is treated as an employer for tax purposes, regardless of how the worker is labeled.

How the IRS would view your example:

"Because you set expectations, provide tools, pay on a fixed schedule, and maintain an ongoing relationship, the IRS would likely view this as an employer-employee relationship for tax purposes."

How the FLSA classifies independent contractors vs employees

The Fair Labor Standards Act classifies workers to decide whether they are economically dependent on a business and entitled to minimum wage and overtime protections.

What the FLSA evaluates:

- Whether the worker has a real opportunity for profit or loss

- Whether the relationship is permanent or project-based

- Whether the work is integral to the company’s core business

- The degree of control over the worker’s activities

- Whether the worker uses independent skill and business initiative

Under the FLSA, classification is about economic reality, not contracts, payment method, or job titles.

How the FLSA would view your example:

"Because the worker relies on you for ongoing income and performs work central to your business without meaningful business independence, the FLSA would likely treat the worker as an employee."

As of May 2025, the DOL paused its 2024 classification rule and reverted enforcement to the traditional economic realities test under Fact Sheet #13. The factors above reflect the standard currently applied in federal investigations.

How common law classifies independent contractors vs employees

Common law classification focuses on whether a business has the right to control how work is performed, regardless of whether that control is exercised.

What common law evaluates:

- The right to direct how, when, and where work is done

- Whether the worker is integrated into the company’s operations

- Who sets work hours and supervises performance

- Whether the worker can work for multiple clients

- Whether the worker operates an independent business

Courts rely on common law principles to resolve disputes where written agreements conflict with how the relationship actually operates.

How common law would view your example:

"Because you retain the right to direct the work and integrate the role into day-to-day operations, common law principles would likely treat this as an employment relationship."

Do state laws classify contractors and employees differently?[toc=State Law Classification]

Yes. Many states apply their own worker classification rules, and these are often stricter than federal standards.

Even if a worker passes IRS or FLSA tests, state labor agencies can still reclassify them as an employee under local laws.

Because states prioritize protections like minimum wage, overtime pay, unemployment insurance, and workers’ compensation, independent contractor vs employee disputes commonly surface through state audits or claims rather than federal reviews.

The ABC test (used by many states)

Several states use the ABC test, which assumes a worker is an employee unless all three conditions are met.

- A - Autonomy: The worker is free from your control over how, when, and where the work is done.

- B - Business scope: The work performed is outside your company’s core business.

- C - Customarily independent: The worker runs an independent business and serves multiple clients.

Failing any one of these usually means the worker is classified as an employee under state law.

States such as California, Massachusetts, New Jersey, Illinois (for certain roles), and Connecticut apply the ABC test or a variation of it, either broadly across labor laws or specifically for areas like unemployment insurance and wage enforcement.

California's AB 1514, effective January 1, 2026, refines certain exemptions but does not soften the overall ABC standard. The test remains one of the strictest classification frameworks in the country.

With the differences and classification rules clear, the next step is understanding misclassification risk and why it becomes one of the most expensive compliance failures for growing companies.

Once you see how state rules can override federal tests, it’s worth digging deeper into what happens when things go wrong in practice, especially how misclassification shows up in "Wages in Leu of Notice" disputes and why many companies are forced to "Convert Contractors to Employees" later than they planned.

What are the risks of misclassifying a contractor as an employee?[toc=Misclassification Risks]

With our hands-on experience helping companies with EOR solutions, payroll, and worker classification compliance, here are the key risks businesses face when contractor vs employee decisions don’t hold up in practice.

1. Tax exposure and financial fallout you didn’t plan for

When a worker is misclassified, tax liability doesn’t disappear. It multiplies. Employers can be forced to pay both the employer and employee share of payroll taxes, plus penalties. Interest continues to accrue on unpaid amounts, turning a small mistake into a large bill.

In many cases, misclassification also triggers IRS audits, especially when contractors look indistinguishable from full-time employees. [Read more on Reddit]

2. Employment law violations and legal claims

Misclassification doesn’t override worker protections. If someone is functionally an employee, they may still be entitled to minimum wage, overtime pay, workers’ compensation, and other statutory protections, regardless of what the contract says.

This opens the door to lawsuits for back pay, unpaid overtime, and benefits. Workers who report misclassification are legally protected, but retaliation disputes often become messy and costly to defend. [Read more on Reddit]

3. Operational disruption and reputational damage

Misclassification isn’t just a legal issue. It’s an operational one. Once workers realize they’ve been misclassified, trust erodes fast. Teams disengage, turnover rises, and companies often lose key talent during or after reclassification.

Public exposure or legal action can damage employer brand, while the process of fixing past mistakes creates a heavy administrative burden, often requiring retroactive documentation that can itself invite audits. [Read more on Reddit]

4. Added risk when hiring across borders

Cross-border misclassification compounds everything. When you hire internationally, you’re subject to local labor laws, not just U.S. rules. Each country defines employment differently, and getting it wrong can trigger penalties in multiple jurisdictions.

A common question becomes: Who’s liable, the U.S. company, the worker, or both? Without local expertise, companies often discover the answer only after enforcement begins. [Read more on Reddit]

What misclassification actually costs: a real-world calculation

To understand the financial exposure, consider a scenario where a company misclassifies 3 workers as independent contractors for 2 years, each paid $80,000 annually.

If the IRS determines the misclassification was intentional, penalties escalate sharply: employers can face 20% of all wages paid, 100% of both the employer and employee FICA taxes, criminal penalties of up to $1,000 per misclassified worker, and potential imprisonment.

This calculation does not include state-level penalties, back wages for overtime or benefits, or legal defense costs, all of which can multiply the total exposure significantly.

Misclassification cases that made headlines

Major companies have faced significant consequences for getting contractor vs employee classification wrong:

- Uber (2022): Paid $100 million in unpaid state payroll taxes and penalties in New Jersey after misclassifying nearly 300,000 drivers as independent contractors.

- FedEx (2016): Paid a $228 million settlement for misclassifying over 2,000 California drivers as contractors instead of employees.

- Dynamex (2018): This California Supreme Court ruling established the ABC test as the state standard for worker classification, directly leading to AB 5 in 2019.

Misclassification issues typically surface during IRS audits, state reviews, funding rounds, or acquisitions, often years after the original classification decision.

How do taxes differ for independent contractors and employees?[toc=Tax Responsibilities]

When it comes to taxes, the independent contractor vs employee distinction shows up immediately in how wages paid are reported, which taxpayer identification number is collected, and who is responsible for withholding and filing. Let’s see this in detail.

How are employees taxed?

- Tax withholding: Employers are required to withhold federal, state, and local income taxes from employee paychecks.

- Social Security and Medicare: Employees pay half of Social Security and Medicare taxes, while the employer pays the other half.

- Benefits: Employees often receive employment benefits such as health insurance, retirement plans (like a 401(k)), paid time off, and workers’ compensation coverage.

- Deductions: Employees can deduct only limited expenses, and most common work-related costs are no longer deductible under current tax laws.

How are independent contractors taxed?

- Self-employment tax: Contractors pay the full 15.3% self-employment tax, covering both the employer and employee portions of Social Security and Medicare.

- Estimated taxes: Contractors must calculate and pay estimated taxes to the IRS on a quarterly basis.

- Business expenses: Contractors can deduct legitimate business expenses such as equipment, mileage, software, and home office costs.

- No employer benefits: Contractors do not receive employer-sponsored benefits and must cover their own health insurance, retirement planning, and other protections.

If you’re paying contractors or filing taxes yourself, read our guide on "Tax Filing Guide for Contractors: Rates & Exemptions".

1099 vs W-2: Which tax forms apply?

For both employees and independent contractors, tax compliance ultimately comes down to the correct forms and filings.

Contractors provide a Form W-9 and are reported on Form 1099, while employees complete Form W-4 and receive wages reported on Form W-2.

To understand who submits which form, when they’re required, and how mistakes create compliance risk, read our detailed guide on "W9 vs. W2: Which IRS Form Should You Use?".

When should you hire an independent contractor?[toc=When to Hire Contractors]

With our hands-on experience helping global companies through AOR services, compliance reviews, and contractor onboarding, Here’s when bringing in a contractor is typically the right call:

- The work is project-based or temporary, with a defined start and end.

- You need specialized expertise (design, audit, migration, consulting) rather than ongoing execution.

- The contractor can work for multiple clients and controls their own schedule, tools, and methods.

- You’re paying for results or deliverables, not hours worked.

- The role does not require day-to-day supervision or integration into your internal team.

Hiring contractors works best for specialized expertise, short-term needs, or clearly defined outcomes.

But when the work becomes ongoing, central to your business, and requires daily oversight, it’s time to shift the lens, let’s look at when hiring a full-time employee is the right call.

When should you hire an employee?[toc=When to Hire Employees]

Employee status is designed for work that is ongoing, integrated into your operations, and performed under your direction.

Hiring an employee makes sense when:

- The role is core to your company’s business, not a temporary or auxiliary function

- You need full-time availability and predictable working hours

- The work requires direct supervision, training, and performance management

- The relationship is long-term or permanent, not tied to a single project

- You expect the worker to follow internal processes, tools, and policies

If you want a clear, compliant way to hire employees, read our "How to Hire Employees: Step-by-Step Guide".

How does Wisemonk help companies hire and pay contractors and employees compliantly?[toc=Why Choose Wisemonk]

Wisemonk is a specialized Employer of Record (EOR), built for global companies looking to hire, pay, and manage employees in India without the complexities of setting up a local entity. We provide end-to-end workforce solutions tailored to India’s regulatory landscape, ensuring seamless compliance, payroll, and dedicated HR support for your offshore teams.

Here’s why global companies rely on us:

- Fast talent acquisition and onboarding: Helping 500+ international companies hire top Indian talent with quick role kickoffs, structured preboarding, and day-one readiness powered by our India-first workflows.

- Accurate payroll execution at scale: Managing over $20M in monthly payroll across contractor and employee setups, with precise wage calculations, tax handling, and on-time payouts without errors.

- End-to-end employee lifecycle support: Supporting 2K+ employees with dedicated HR specialists who handle onboarding, offboarding, background checks, equipment procurement, and daily employee needs.

- Transparent and predictable pricing: Starting at $99 per employee per month with no hidden fees, no FX markups, and clean cost visibility that global teams can trust.

- Misclassification and compliance protection: Reducing independent contractor vs employee risk by aligning engagement models with local labor laws, tax rules, and long-term scale considerations, before problems surface.

Wisemonk EOR Client review/feedback:

“Wisemonk has helped us hire right people from India for a Canadian entity. The process is so smooth we don't even notice that our payroll has people in both Canada and India.”

- Dinesh A.

Co-founder and CTO

Read the full review on G2 →

“Wisemonk has successfully hired high-quality candidates, which has impressed the client. The team is responsive to the client's requests and changes via Slack. The team also collaborates through a hiring tracker in Google Sheets. Wisemonk communicates via email and virtual meetings.”

- Dan Sampson

VP of Engineering, Cobu

Read the full review on Clutch →

Wisemonk services is designed to streamline every aspect of hiring and managing employees in India, so you can focus on growing your business while we handle the complexities.

Beyond these core services, Wisemonk also provide advanced support in contractor management, company registration, and work permit & visa assistance and building offshore teams or Global Capability Centers (GCCs) in India for businesses planning long-term India operations.

Ready to build your high-performing team in India? Book a Call Now!

Frequently asked questions

Can you convert an independent contractor into an employee later?

Yes, an independent contractor can be converted into an employee, but the change only reduces future risk. It does not automatically erase past misclassification exposure. If the contractor previously worked under company control or long-term dependency, tax and labor authorities may still review historical periods, especially during audits, funding rounds, or acquisitions.

Can an independent contractor work full time for one company?

An independent contractor can work full time for one company, but doing so increases misclassification risk. Full-time hours, exclusivity, and ongoing dependency often resemble an employment relationship. Regulators focus on economic dependence and control, not hours alone, so long-term full-time arrangements frequently fail contractor classification tests under labor and tax laws.

What if you need employees but don’t want to set up a legal entity?

If you need employees without setting up a legal entity, an Employer of Record (EOR) is a common solution. An EOR legally employs workers on your behalf, manages payroll, taxes, benefits, and compliance, and allows companies to hire employees in new countries without forming a local subsidiary or handling complex employment regulations directly.

What are the downsides of being an independent contractor?

Independent contractors do not receive employee benefits such as health insurance, paid time off, unemployment benefits, or retirement contributions. They must manage their own taxes, including self-employment tax, and handle business expenses themselves. Income can be less predictable, and contractors typically lack legal protections provided to employees under labor laws.

Which payroll services handle both W-2 employees and 1099 contractors?

Some payroll services are designed to handle both W-2 employees and 1099 contractors within one system. These platforms typically support employee payroll with tax withholding while also managing contractor payments, reporting, and tax forms. However, payroll software does not determine worker classification, and businesses remain responsible for complying with labor and tax laws.

Read more: "Top 10 Payroll Outsourcing Companies in India".

How do tax responsibilities differ for independent contractors and employees?

Independent contractors are responsible for paying their own income tax, self-employment tax, and social security contributions, with no tax withholding by the company. Employees have income taxes, social security tax, and Medicare taxes withheld by the employer, who also pays additional payroll taxes. These differences significantly affect compliance obligations and total employment cost.

How do independent contractors create their pay stubs?

Independent contractors typically do not receive traditional pay stubs. Instead, they generate invoices or payment records that show amounts earned, dates, and services provided. For income verification, contractors may use invoices, bank statements, or accounting software reports. Some contractors also create pay-stub-style documents using third-party tools for loans or rentals.

Read more: "Independent Contractor Pay Stub: A Complete Guide".

%20(1).webp)

%20(1).webp)

%20(1).webp)