- Payroll outsourcing means hiring specialized providers to handle salary calculations, tax deductions (TDS, PF, ESI, PT), statutory filings, compliance management, and monthly payouts so you avoid building in-house payroll teams.

- Payroll outsourcing saves 30-40% of costs, ensures 100% compliance with Indian labor laws, reduces errors through automation, provides scalability, improves employee satisfaction, and frees your team to focus on business growth.

- Choose a payroll vendor with proven India compliance expertise, automated payroll systems, transparent pricing, dedicated support, high client retention, and data security certifications like ISO 27001 for protecting sensitive employee data.

- Top payroll outsourcing companies in India include Wisemonk, ADP India, TalentPro, Paysquare, Quickchex, GreytHR, ZingHR, Paybooks, RazorpayX Payroll, and Keka HR, each offering unique strengths for different business needs.

- Common challenges include adapting to new labor codes, managing multi-state professional tax variations, ensuring data security during transitions, maintaining accuracy during provider onboarding, and keeping up with frequent regulatory changes.

Need help with payroll outsourcing in India? Book a call now!

Discover how Wisemonk creates impactful and reliable content.

What is payroll outsourcing?[toc=What is Payroll Services]

Payroll outsourcing is when you hire an external expert to handle your entire pay cycle, from calculating wages to filing taxes. It effectively moves the administrative burden of payroll management from your internal team to a specialized payroll company that ensures everyone gets paid accurately and on time.

A professional payroll service provider acts as your local compliance arm, using advanced technology to streamline your payroll operations. They bridge the gap between your global headquarters and local tax regulations without you needing to hire a massive local HR team.

When you outsource payroll, your payroll provider handles:

- Calculating employee salaries including gross pay, net pay, tax deductions, and overtime pay.

- Managing statutory compliances like provident fund, employee state insurance, professional tax, and labour welfare fund contributions.

- Processing payroll taxes and filing income tax returns, ensuring you meet all payment deadlines.

- Staying compliant with local laws, minimum wages, tax regulations, and the constantly changing payroll compliance requirements in India.

- Generating payslips and tax documents through automated payroll systems, often with an employee self service portal.

- Handling monthly salaries execution, overtime payments, and maintaining accurate employee data.

This way, you get efficient payroll management without the headache of navigating complex payroll needs and regulatory compliance yourself.

Why should you outsource your payroll?[toc=Why Outsource Payroll]

Outsourcing your payroll saves time and shields your business from costly legal penalties. It allows you to focus on scaling while payroll experts handle the intricate payroll complexities that come with managing a global workforce.

By utilizing payroll services in India, you gain access to efficient payroll management without the high overhead costs of a traditional in house payroll team.

Global businesses choose outsourcing payroll services because it provides:

- Cost savings compared to maintaining full-time payroll staff, buying payroll software licenses, and managing payroll operations internally

- Compliance expertise where your payroll provider stays updated on tax regulations, statutory compliances, and local laws so you never miss filing deadlines or face penalties

- Better data security since top payroll outsourcing companies use encrypted systems and follow strict protocols to protect employee details and financial statements

- Reduced errors because automated payroll systems and experienced payroll experts handle payroll calculation, tax deductions, and tax filing more accurately than manual processing

- Scalability to easily manage workforce growth without hiring more payroll staff or upgrading systems

- Improved employee satisfaction through timely monthly salaries, accurate payslips, and employee self service portals for instant access to tax documents

- Time savings letting you redirect hours spent on managing payroll toward actually growing your business

From our experience helping global clients expand to India, companies that outsource typically see immediate improvements in compliance management and employee engagement while cutting payroll-related costs by 30-40%.

What should you look for in a payroll vendor?[toc=Choose Payroll Vendor]

Choose a payroll outsourcing company with proven compliance expertise, robust technology, and transparent pricing because the wrong provider can expose you to legal risks and disrupt employee wages. Your payroll partner should make compliance management effortless, not create new problems.

The right payroll service provider becomes an extension of your team, handling everything from tax compliance to employee satisfaction seamlessly.

1. Compliance Track Record

Your payroll provider needs deep expertise in Indian labor laws, tax laws, and statutory compliances. They should handle provident fund, employee state insurance, professional tax, and regional requirements without you having to worry about penalties or missed deadlines.

2. Technology Infrastructure

Look for automated payroll systems that integrate with your existing tools. The best payroll company offers employee self service portals, real-time reporting, and seamless payroll software that makes executing payroll smooth and transparent for everyone.

3. Data Security Measures

Your employee data and financial statements need protection. Choose providers with encryption, secure servers, backup systems, and proven data security protocols because payroll information is sensitive and regulatory compliance around data protection is strict.

4. Experience with Global Clients

A payroll outsourcing company that regularly serves global clients understands multi country payroll challenges, cross-border compliance requirements, and how to navigate the unique needs of international businesses expanding to India.

5. Comprehensive Service Scope

Your provider should offer complete payroll solutions covering payroll calculation, tax filing, tax documents, overtime payments, and monthly salaries execution. You want one partner handling all payroll operations, not multiple vendors for different pieces.

6. Dedicated Support

Generic support doesn't work for payroll complexities. You need dedicated payroll experts or a dedicated payroll specialist assigned to your account who understands your business, responds quickly, and proactively manages your compliance requirements.

7. Transparent Pricing

Hidden fees kill budgets. The best payroll service provider shows clear costs upfront, explains what's included in their payroll services, and offers scalable pricing that grows with your workforce without surprise charges.

8. Client Retention Rate

Companies don't stay with bad payroll providers. High client retention rates signal reliable service, consistent compliance support, and partnership quality because satisfied global clients stick around.

9. Ongoing Compliance Support

Tax regulations and local laws change constantly in India. Your payroll company should proactively update you on minimum wages changes, tax regime shifts, and new compliance requirements so you're never caught off guard.

Who are the top payroll outsourcing providers in India?[toc=Top 10 Payroll Companies]

Selecting the right partner from the many top payroll outsourcing companies is a huge decision for your global growth. To help you navigate the landscape, here is a breakdown of the leading payroll outsourcing companies in india that can help you execute payroll with confidence:

Top 10 Payroll Outsourcing Companies in India

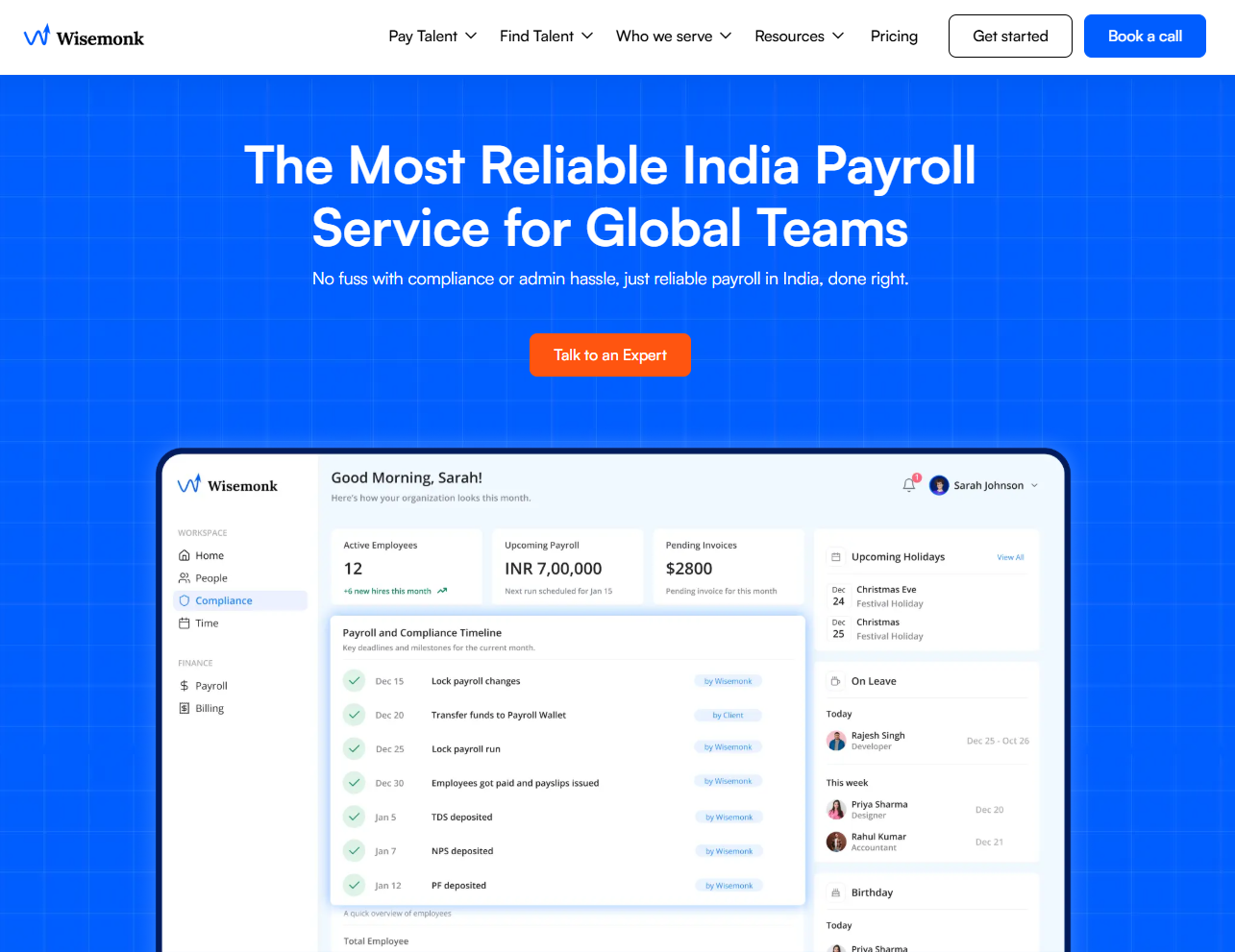

1. Wisemonk

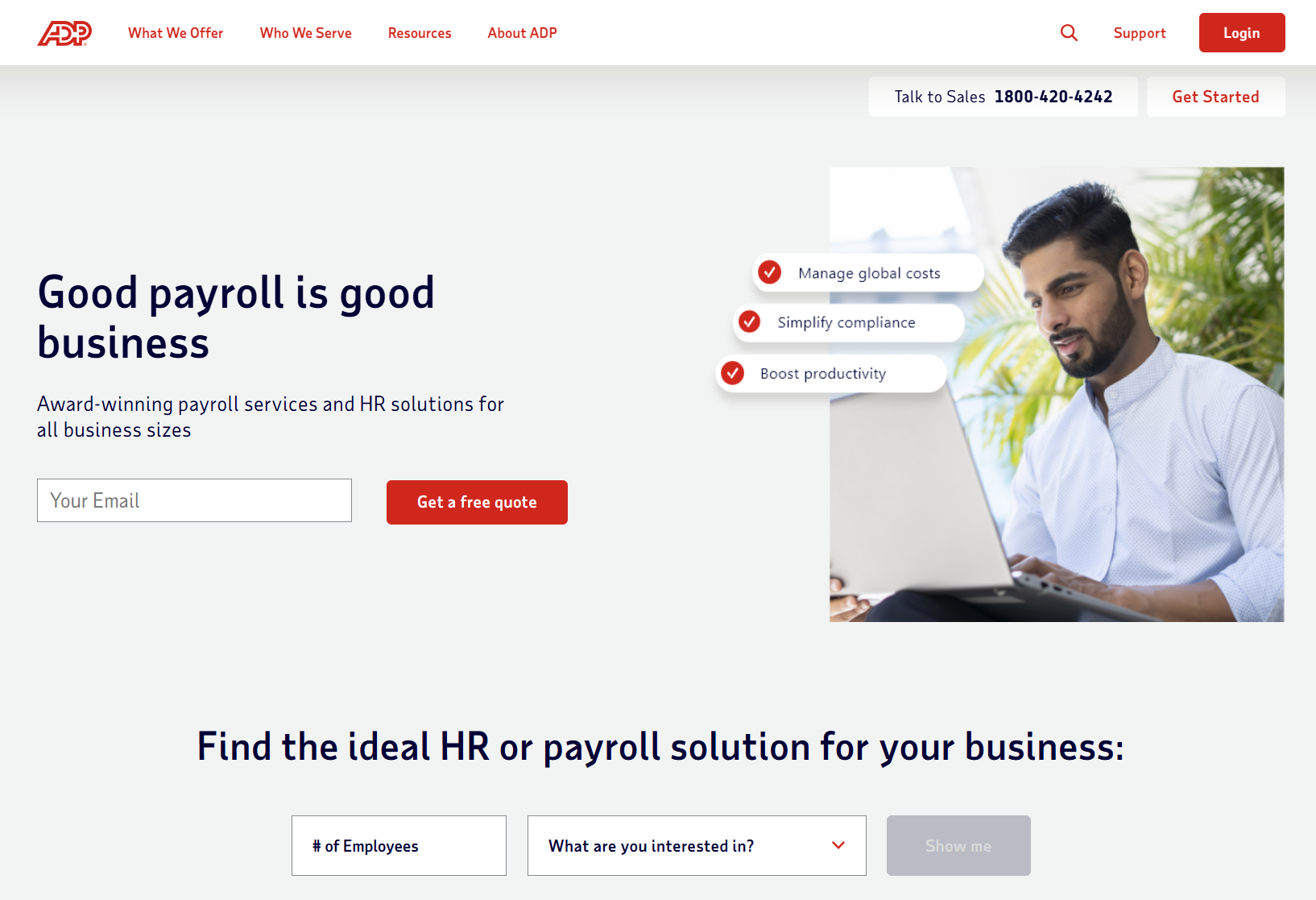

2. ADP India

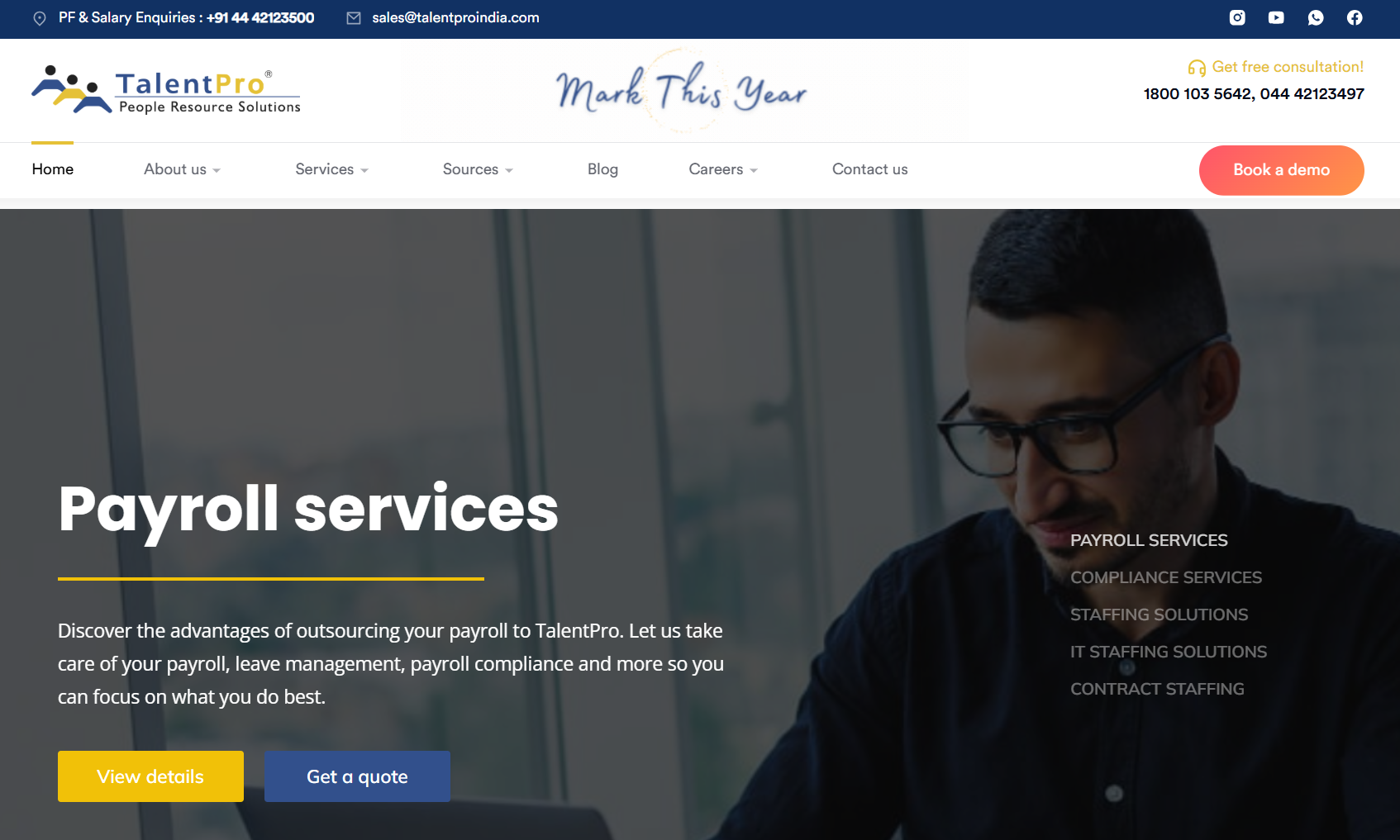

3. TalentPro

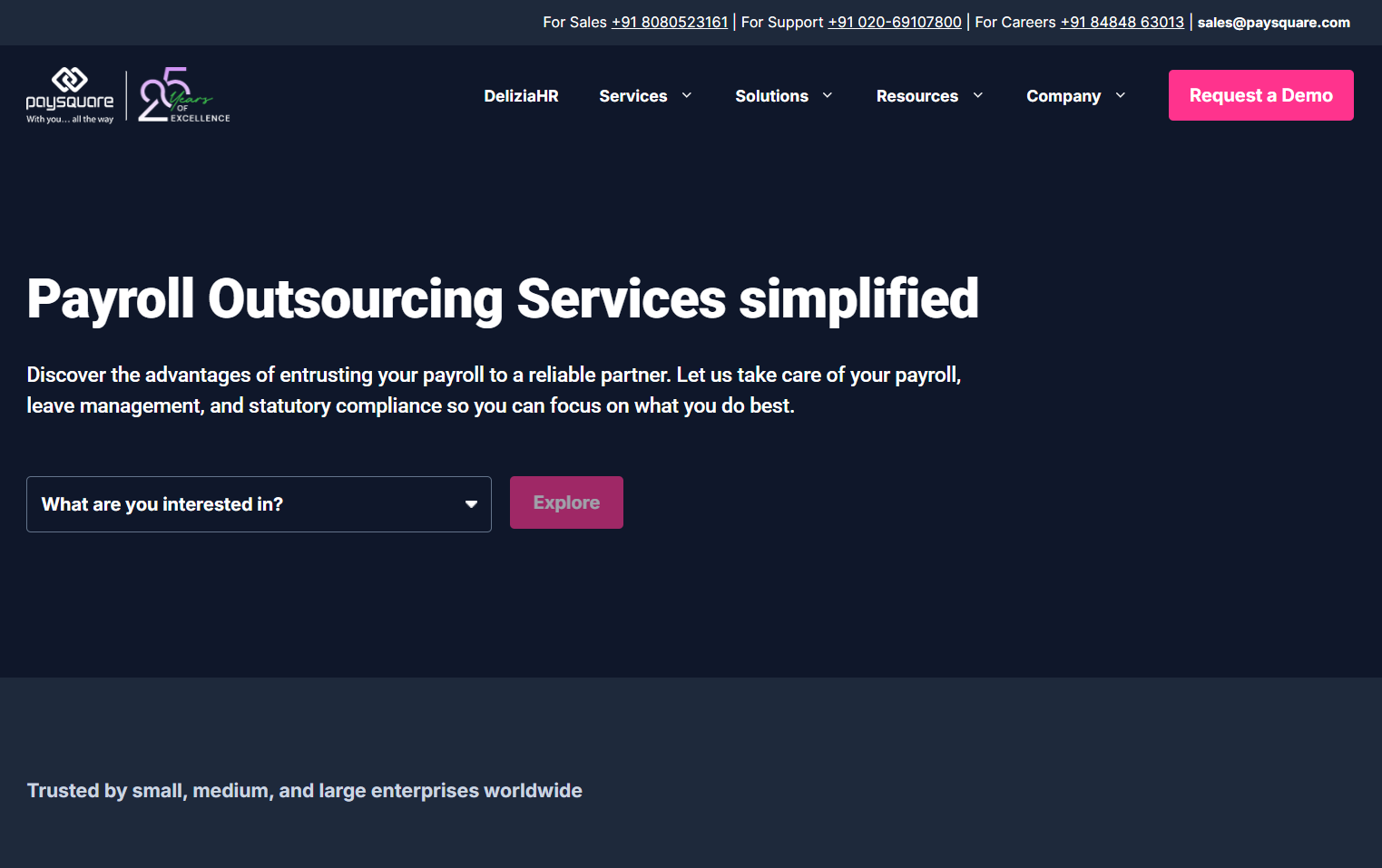

4. Paysquare

5. Quickchex

6. GreytHR

7. ZingHR

8. Paybooks

9. RazorpayX Payroll

10. Keka HR

1. Wisemonk

Wisemonk is a specialized Employer of Record (EOR) and payroll services provider designed for global companies hire, pay and manage talent in India. With expertise serving 300+ global clients and managing $20M+ in payroll, Wisemonk offers comprehensive payroll outsourcing services with strong emphasis on local compliance expertise and employee self-service portals.

Why Choose Wisemonk:

- India-optimized payroll processing with automated PF, ESI, professional tax, and TDS calculations

- Fast 1-2 day onboarding with dedicated payroll experts for seamless setup

- Employee self service portal for payslips, tax documents, and leave management

- Complete statutory compliance management with proactive regulatory updates

- Transparent pricing starting at $250 per month for upto 5 employees with no hidden fees (Payroll + HRBP)

Unique edge of Wisemonk:

- Deep India compliance expertise specifically built for global businesses entering the Indian market

- 95%+ client retention rate demonstrating reliable, consistent service quality

- Comprehensive EOR services allowing companies to hire without establishing local entities

- Real-time payroll tracking with advanced payroll software and automated systems

- Dedicated HR support team with fast response times for payroll queries

Client review/feedback:

“I love their payroll feature, which allows me to pay my workforce easily without any errors. In just a few seconds, I can see the invoices generated for all of the payouts”

— Mithun V.

Mid-Market

Read the full review on G2 →

“Wisemonk has successfully hired high-quality candidates, which has impressed the client. The team is responsive to the client's requests and changes via Slack. The team also collaborates through a hiring tracker in Google Sheets. Wisemonk communicates via email and virtual meetings.”

— Dan Sampson

VP of Engineering, Cobu

Read the full review on Clutch →

2. ADP India

ADP India is part of the global ADP network with over 70 years of payroll expertise, serving 1,000,000+ clients worldwide. They offer comprehensive payroll services and HR solutions backed by robust technology and extensive multi-country capabilities for enterprises operating across multiple locations.

Why Choose ADP India:

- Global payroll supplier with 45 support centers across 140 countries for unified international operations

- Advanced payroll software with seamless integration to ERP and HRIS systems

- Automated compliance updates for constantly changing tax regulations and local laws

- Multi-country payroll solutions with standardized processes across regions

- Certified payroll professionals providing expert advisory and support

Pros of ADP India:

- Industry-leading global infrastructure ideal for enterprises with international operations

- Proven compliance management reducing risk exposure by millions in tax liabilities

- Strong integration capabilities with existing business systems and accounting software

- Award-winning service (Global Payroll Supplier of the Year 2024)

- Comprehensive payroll analytics and reporting for strategic decision-making

Cons of ADP India:

- Higher pricing compared to India-focused providers, less suitable for small businesses

- Implementation can take several months, longer setup time than local alternatives

- Customer support experiences vary, generic support rather than dedicated account managers

3. TalentPro

TalentPro is one of India's established HR service providers with over 25 years of experience, offering end-to-end payroll outsourcing, statutory compliance, and HRMS solutions. They serve startups, SMEs, and large MNCs with a 98.90% client retention rate, the highest in the HR industry.

Why Choose TalentPro:

- Full-suite HRMS integrated with payroll processing for unified workforce management

- SSAE18 Type II certified ensuring adherence to strict payroll process and IT controls

- Employee self-service portal with mobile app for payslips, tax sheets, and reimbursements

- Automated payroll tasks minimizing manual calculation errors

- Complete statutory compliance management including PF, ESI, PT, and TDS filings

Pros of TalentPro:

- Over two decades of expertise with benchmarked quality and reliability standards

- High automation levels with internet-based systems ensuring security and accuracy

- Dedicated support for resolving payroll queries and compliance issues

- Scalable services adapting to business growth from startups to enterprises

- Comprehensive compliance tracking alleviating burden of regulatory changes

Cons of TalentPro:

- Less suitable for companies seeking international payroll beyond India, Singapore, and Middle East

- Technology interface may require training for optimal utilization

- Customer support improvements needed based on some user feedback

4. Paysquare

Paysquare is a leading payroll outsourcing company with over two decades of experience, serving 1500+ clients across India. They offer comprehensive payroll management through their proprietary DeliziaHR platform, combining EOR/PEO services with automated payroll solutions and accounting outsourcing.

Why Choose Paysquare:

- Custom payroll processing engine providing tailor-made, highly customized payroll mechanisms

- DeliziaHR platform with rich UI/UX for managing onboarding, payroll, leave, and compliance

- Complete EOR services handling entire employee lifecycle from onboarding to exit

- ISAE 3402 (SOC 1) Type 2, ISO 27001, and GDPR certified ensuring data security

- Employee self-service portal with mobile app for comprehensive payroll access

Pros of Paysquare:

- Proven track record with 1500+ satisfied clients demonstrating reliability

- Strong customization capabilities adapting to complex payroll needs

- Dedicated payroll support with prompt, tailored assistance from expert teams

- Comprehensive statutory compliance with automated tax filing and deductions

- Flexible benefits administration including flexi benefit plans and reimbursements

Cons of Paysquare:

- Service-focused approach may not provide holistic HRMS with attendance and leave tracking

- Best suited for small to mid-sized firms, may lack enterprise-level capabilities

- Limited information on multi-country payroll capabilities beyond India

5. Quickchex

Quickchex is an established HRMS and payroll provider with over 40 years of market standing in the HR tech industry, serving hundreds of small and mid-sized businesses across India. They offer both self-service payroll software and full-service managed payroll solutions with dedicated account managers.

Why Choose Quickchex:

- Full-suite HRMS integrating payroll with attendance, leave, expenses, and compliance management

- Complete payroll outsourcing with dedicated Account Managers processing payroll on your behalf

- Scalable UI simple enough for 20-employee startups, configurable for 5000+ employee companies

- Advanced features including flexi-benefits, loans, advances, and automated TDS management

- Mobile and web employee self-service portals for payslips, tax documents, and leave requests

Pros of Quickchex:

- Comprehensive compliance management with automated statutory filings and audit-ready reports

- Dedicated account manager support providing payroll advisory on tax and compliance

- User-friendly interface streamlining HR operations and reducing administrative burden

- ISO 27001 and SOC 2-compliant infrastructure ensuring robust data security

- Trusted by 1000+ businesses with proven reliability and customer satisfaction

Cons of Quickchex:

- Customer support experiences may vary, some users report room for improvement

- Pricing requires contact for custom quotes based on configuration and services

- Less suitable for global companies needing multi-country payroll beyond India

6. GreytHR

GreytHR is one of India's most widely used payroll and HR management software solutions with 23,000+ clients, known for strong compliance features and reliability. Their cloud-based platform automates PF, ESI, TDS, and professional tax while ensuring accuracy for SMEs across India.

Why Choose GreytHR:

- Industry-leading statutory compliance engine with automatic PF ECR, ESI returns, and PT reports

- greytHR PayNow feature for direct salary disbursement from within the application

- Automated tax deduction and TDS filing with Form 16, 12BA, and eTDS returns generation

- Employee self-service mobile app for leave, attendance, payslips, and tax declarations

- Seamless integration with Tally, QuickBooks, and other accounting systems

Pros of GreytHR:

- Over two decades of battle-tested performance with proven compliance accuracy

- Affordable pricing (₹40-₹100 per employee/month) suitable for SME budgets

- Quick implementation with migration templates and India-based support teams

- Comprehensive statutory reporting reducing compliance risks and penalties

- User-friendly interface with minimalist design for easy navigation

Cons of GreytHR:

- Limited advanced features compared to more comprehensive enterprise platforms

- Best suited for established mid-sized companies, may lack flexibility for rapid scaling

- Primarily focused on payroll and compliance, lighter HRMS capabilities

7. ZingHR

ZingHR is a comprehensive cloud-based HRMS and payroll solution with 450+ clients, designed specifically for Indian companies with a mobile-first, employee-centric approach. They offer 24+ modules with flexible payout configurations and claim to process complex payroll and compliance in 4-5 days.

Why Choose ZingHR:

- Zero Touch payroll eliminating manual processes with daily, weekly, monthly payment options

- Mobile-first approach with intuitive apps for employee engagement and self-service

- Flexible payout configurator automatically calculating overtime and variable compensation

- 4 product packages (Welcome, Power, Business, Turbo) catering to different business needs

- AI-driven payroll automation with real-time analytics dashboards

Pros of ZingHR:

- Comprehensive 24+ modules providing end-to-end HR and payroll management

- Advanced technology with automated compliance updates and statutory filings

- Employee-centric design improving workforce engagement and satisfaction

- Salary revision tracking with complete history and flexible policy configurations

- Online investment declaration and proof tracking for tax optimization

Cons of ZingHR:

- Custom pricing requiring contact for quotes, no transparent pricing publicly available

- Learning curve for utilizing all 24+ modules effectively

- Limited information on international payroll capabilities beyond India

8. Paybooks

Paybooks is a compliance-driven payroll software built for Indian SMEs, now part of TransPerfect Company, focusing on speed and accuracy with guided workflows. They specialize in automating statutory filings and providing API integrations for seamless payroll processing.

Why Choose Paybooks:

- Guided payroll runs with step-by-step workflows for attendance and manual overrides

- Automated statutory filings generating e-challans and returns for PF, ESIC, PT, and TDS

- API integration connecting payroll with HR and ERP systems

- Bulk payslip and Form distribution via email/SMS for employee convenience

- Compliance-first approach ensuring accurate tax deductions and regulatory adherence

Pros of Paybooks:

- Fast, compliance-ready payroll processing ideal for time-conscious SMEs

- Automated TDS and ESI filings reducing administrative burden

- Biometric attendance integration linking directly to payroll calculations

- Prompt technical support with responsive customer service teams

- Employee self-service portal reducing HR workload and queries

Cons of Paybooks:

- Primarily designed for SMEs, may lack enterprise-level capabilities

- Limited HRMS features beyond core payroll and compliance

- Less suitable for companies requiring extensive customization or complex workflows

9. RazorpayX Payroll

RazorpayX Payroll brings fintech precision to payroll management, backed by Razorpay's banking infrastructure. It's a digital-first solution automating salaries, compliance, and contractor payments with built-in banking integrations for same-day payouts.

Why Choose RazorpayX Payroll:

- Instant salary disbursements via same-day NEFT/IMPS/RTGS through RazorpayX Wallet

- Automated compliance with TDS, PF, ESI calculations and e-filing capabilities

- Contractor and gig worker payment handling from the same platform

- 45+ integrations with real-time dashboards for seamless payment tracking

- Global payroll APIs supporting multi-currency and cross-border payments

Pros of RazorpayX Payroll:

- Banking rails integration enabling faster, more reliable salary transfers

- Ideal for startups, SaaS businesses, and digital-first companies

- Free trial with first 3 months of Pro Plan at no cost

- Simplified contractor management perfect for gig economy workforce

- Modern API-driven architecture for tech-savvy organizations

Cons of RazorpayX Payroll:

- Primarily focused on payroll automation, limited broader HRMS features

- Sticks to single monthly cycle, less flexibility for multiple pay periods

- Best suited for companies already in Razorpay ecosystem

10. Keka HR

Keka is a modern, user-friendly HRMS and payroll platform with strong presence across major Indian cities, serving prominent clients like Honda, Godrej, and Saavn. Known for its intuitive interface and comprehensive features, Keka integrates HR functions with employee engagement tools for mid-sized to large organizations.

Why Choose Keka:

- Comprehensive payroll automation with salary calculations, tax deductions, and compliance reports

- Audit-ready reports with statutory override controls during payroll runs

- Seamless API integration with attendance, accounting, and ERP systems

- Mobile app support for payslips, leave management, and employee self-service

- Six-step guided payroll process making scaling beyond 100 employees easier

Pros of Keka:

- Modern, engaging UI standing out for user experience and ease of navigation

- Strong multi-entity compliance handling for organizations with multiple departments

- Handles complex scenarios including unpaid leave, overtime, and arrear calculations

- Enterprise-scale capabilities supporting 5000+ employee organizations

- Comprehensive analytics for cost benchmarking and strategic planning

Cons of Keka:

- Full feature utilization requires investment in training and onboarding

- Implementation can take longer for large-scale deployments

- Best suited for growing companies, potentially overkill for basic payroll needs

What challenges you might face when outsource payroll?[toc=Common Challenges]

Outsourcing can introduce communication gaps and data privacy risks if not managed carefully. You might also struggle with integrating external systems into your existing workflow or dealing with unexpected hidden fees from certain providers.

Even the top payroll outsourcing companies can present hurdles if there is a lack of transparency. Choosing a partner with strong compliance expertise is vital to navigate indian labor laws without constant friction or delays.

When outsourcing payroll, you might encounter:

- Difficulty managing payroll complexities across different time zones and cultural nuances.

- Risks to data security when sharing sensitive employee details and employee data.

- Misalignment between your internal software and the provider's automated payroll systems.

- A temporary dip in employee engagement during the transition to a new payroll system.

- Delays in regulatory compliance updates for minimum wages and tax laws.

- Friction in payroll operations if there is no dedicated payroll specialist assigned to you.

- Challenges in ensuring compliance with statutory compliances like professional tax and labor laws.

Why choose Wisemonk for payroll outsourcing in India?[toc=Why Choose Wisemonk]

Wisemonk is a specialized Employer of Record (EOR) and payroll outsourcing provider built exclusively for global companies hiring talent in India. With $20M+ in payroll under management and 2,000+ employees processed monthly, We enables international businesses to hire, pay, and manage Indian employees without establishing a local entity. We handle everything from wage calculations and tax withholdings to statutory deductions and detailed pay statement generation.

Why Global Companies Trust Wisemonk for Payroll Services in India:

- Accurate Payroll Processing: Automated payroll systems handle employee salaries, Provident Fund, Employee State Insurance, Professional Tax, and TDS calculations, ensuring error free payroll and timely disbursement every cycle.

- Comprehensive Compliance Management: Dedicated payroll experts monitor evolving Indian labor laws across 28 states, managing statutory filings, tax compliance, and audits to prevent penalties for 300+ global companies.

- End-to-End Onboarding Support: Streamlined document collection, background verification, and policy setup for 300+ companies, reducing administrative burden on your HR team.

- Contractor Payments and Management: Seamless contractor and freelancer payments with full compliance support for local tax laws, payment deadlines, and workforce tracking.

- Employee Self Service Portal: Intuitive portal for employees to access payslips, tax documents, reimbursements, and leave management, improving employee satisfaction and reducing HR queries.

- Equipment Procurement and Management: Complete equipment leasing, tracking, and recovery services for remote and on-site teams, ensuring your Indian workforce stays productive.

Wisemonk provides a one-stop solution for companies looking to build and manage teams in India. Whether you're a startup or an established company, Wisemonk simplifies the complexities of Indian Payroll management, allowing you to focus on growth and innovation. Contact us today!

Frequently asked questions

Which payroll service is best?

Wisemonk is the best choice for fast-growing startups needing an EOR, while ADP is the top pick for established global corporations. The right payroll service provider for you will depend on your specific headcount and your need for multi country payroll support.

How much does it cost to outsource payroll in India?

Outsourcing payroll in India usually costs between ₹150 and ₹2,500 per employee per month. The final price depends on whether you need basic salary disbursement or full-scale compliance management for provident fund and other local taxes.

What are the 4 types of payroll systems?

The four main types are manual payroll, in-house software, cloud-based platforms, and fully outsourcing payroll services. Each system offers a different level of control, with outsourced models providing the highest level of compliance expertise.

What are payroll outsourcing services?

Payroll outsourcing services involve delegating the management of payroll functions to a third-party provider. This includes processing employee salaries, calculating tax deductions, managing statutory filings, and ensuring compliance with local labor laws. Outsourcing payroll allows businesses to streamline operations and reduce the risk of errors while ensuring timely and accurate compensation for employees.

Which is the best payroll software in India?

RazorpayX Payroll, Zoho Payroll, and greytHR are widely considered the best options for modern businesses. These tools excel at automated payroll systems and provide a seamless employee self service portal for teams of any size.

Read more: "Best Payroll Software in India"

Do companies outsource payroll?

Yes, many companies, particularly global businesses, outsource payroll to third-party providers. Outsourcing payroll allows companies to reduce administrative overhead, ensure compliance with local tax laws, and benefit from specialized expertise in payroll processing and statutory compliance.

.webp)

%20(1).webp)