- Payroll compliance in India requires EPF (12%), ESI (3.25% employer + 0.75% employee), TDS, professional tax, and digital records under the November 2025 labour codes.

- The compliance process in India involves registering with authorities, collecting employee documents, calculating deductions, remitting payments, filing returns, and issuing Forms 16 and 10C/10D.

- Global companies struggle with fragmented state laws, employee misclassification, incompatible Western payroll systems, and frequent regulatory changes requiring local expertise.

Need help with payroll processing in India? Contact us today!

Discover how Wisemonk creates impactful and reliable content.

Looking for a complete guide to payroll compliance in India? Miss a deadline or miscalculate taxes, and you'll face penalties up to ₹3 lakh plus back payments and potential imprisonment.

India's November 2025 labour codes consolidated 29 laws into 4 core codes, introduced the 50% wage rule, mandatory digital record-keeping, and streamlined statutory employee classifications. Understanding payroll in India now requires mastering this new framework.

This guide covers mandatory deductions (EPF, ESI, income tax, professional tax), compliance deadlines, common mistakes, and how foreign companies stay compliant without a local entity through Employer of Record services.

What is payroll compliance in India?[toc=India Payroll Compliance Overview]

Payroll compliance in India means following all labor laws, tax regulations, and social security rules when paying employees.

You must calculate salaries correctly, deduct the right taxes, make timely statutory contributions (EPF, ESI, professional tax), and maintain accurate records. Miss any of these, and you face penalties, back payments, and potential legal action.

The November 2025 labour codes introduced the 50% wage rule, stricter deadlines, and mandatory digital record-keeping.

Here's what payroll compliance involves:

- Minimum wages and timely payments (7th-10th following month per Indian labor laws)

- Income tax deductions (TDS by 7th, Form 16 annually)

- Provident Fund (12% both, due 15th)

- ESI (3.25% employer + 0.75% employee, ≤₹21k/month, due 15th)

- Professional Tax (state-level, location-specific)

- Gratuity (4.81% annually, 1 year fixed-term/5 years permanent)

- Statutory bonus (8.33-20%, 20+ employees)

- Digital record-keeping (2025 labour codes mandate)

These requirements stem from India's layered legal framework. Next, let's explore the specific laws governing payroll compliance.

What does payroll compliance involve?[toc=Payroll Compliance in India Steps]

Payroll processing follows a systematic 6-step workflow:

Here's what you actually need to do:

Step 1: Register with authorities

Before your first hire, register with EPFO, ESIC, and obtain TAN for tax deductions.

Step 2: Collect employee documentation

Gather PAN, Aadhaar, bank details, employment contracts within the first month. Complete UAN and ESIC enrollment for statutory benefits.

Step 3: Calculate deductions

Deduct EPF (12%), ESI (0.75%), TDS, PT from gross salary. Add employer contributions (EPF 12%, ESI 3.25%).

Calculate take-home accurately with our salary calculator accounting for all components.

Step 4: Remit payments on time

TDS by 7th, EPF/ESI by 15th to avoid penalties and interest.

Step 5: File statutory returns

Submit quarterly Form 24Q, monthly EPF/ESI returns, state-specific PT filings within prescribed deadlines.

Step 6: Issue compliance documents

Provide Form 16 by June 15th, Form 10C/10D for PF transfers, compliant payslips monthly, and maintain digital records for 7 years.

Each of these steps is governed by specific central and state laws. Next, let's dive into the legal framework behind your compliance obligations.

What laws govern payroll compliance in India?[toc=Payroll Compliance Laws]

India's payroll system operates under multiple central and state laws that regulate wages, taxes, and employee benefits.

The November 2025 labour codes consolidated 29 older laws into 4 unified codes, but you'll still encounter references to the original acts.

Here's what you need to know:

- Code on Wages, 2019: Requires basic salary to be at least 50% of total compensation and mandates timely salary payments by the 7th-10th of the following month.

- Employees' Provident Fund (EPF) Act, 1952: Both employer and employee contribute 12% of basic salary to retirement savings, due by the 15th of the following month or face penalties up to ₹3 lakh.

- Employee State Insurance (ESI) Act, 1948: Provides health coverage for employees earning ≤₹21,000/month with employer paying 3.25% and employee paying 0.75%, now covering all of India under 2025 codes.

- Income Tax Act, 1961: Requires employers to deduct TDS from salaries based on the employee's chosen tax regime and deposit it by the 7th of the following month.

- Professional Tax: State-level employment tax (typically ₹200/month) that varies by location and is often overlooked by foreign companies.

- Payment of Gratuity Act, 1972: Fixed-term employees are now eligible for gratuity after just 1 year of service, reduced from 5 years under the November 2025 reforms.

- Payment of Bonus Act, 1965: Mandates annual bonus payment of 8.33-20% of wages for companies with 20+ employees.

- Labour Welfare Fund (LWF): State-specific employee welfare contributions that vary by location and aren't levied in all states.

Manual compliance across these laws is error-prone. Automated payroll systems handle calculations, track deadlines, and update when regulations change, 67% of Indian companies now use payroll software for HR compliance.

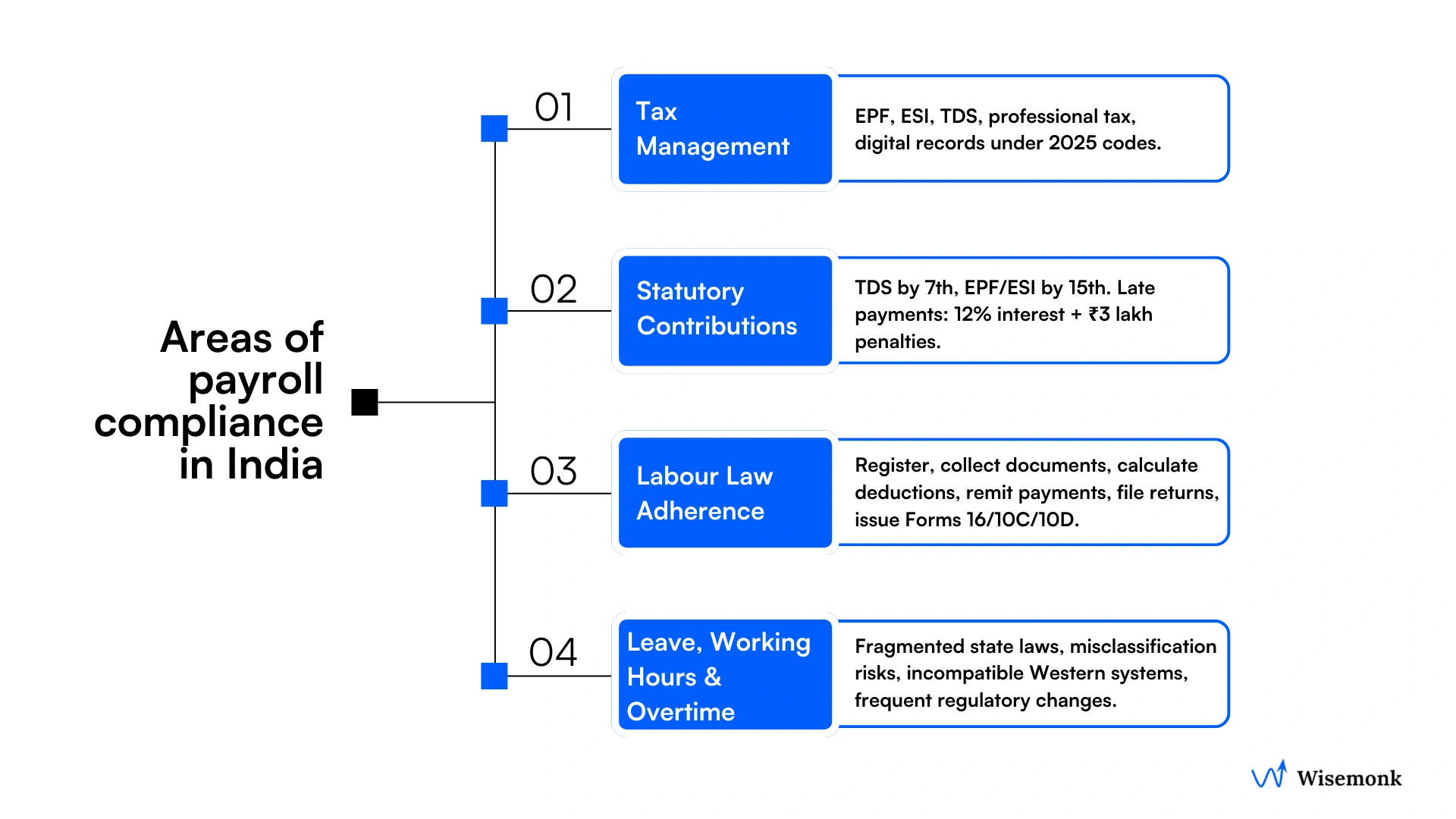

What are the key areas of payroll compliance in India?[toc=Key Compliance Areas]

Payroll compliance breaks down into four critical areas. Miss any of these, and you face penalties, back payments, and legal trouble.

1. Tax Management

Calculate and deposit TDS based on each employee's chosen tax regime and declared exemptions.

File Form 24Q quarterly and issue Form 16 to all employees by June 15th annually.

2. Statutory Contributions

Deduct and remit EPF (12% employee + 12% employer) and ESI (0.75% employee + 3.25% employer) by the 15th of each month.

Professional Tax and Labour Welfare Fund contributions vary by state with different deadlines and amounts.

3. Labour Law Adherence

Pay employees by the 7th-10th of the following month and comply with state-specific minimum wage requirements.

Calculate gratuity provisions, 1 year for fixed-term employees, 5 years for permanent employees under 2025 reforms.

Maintain digital attendance records, wage registers, and statutory documentation as mandated by November 2025 labour codes.

4. Leave, Working Hours & Overtime

Standard working hours are 48 hours/week maximum, work beyond this requires double pay for overtime.

Read more: Legal Working Hours & Overtime Pay Rules in India

Maintain accurate leave records for weekly offs, earned leave, sick leave, and casual leave as per state-specific Shops & Establishments Acts.

Missing deadlines or miscalculating contributions triggers compounding interest, penalties up to ₹3 lakh, and legal action, this is where most foreign companies struggle without local expertise.

Why is payroll compliance critical for global companies hiring in India?[toc=Why it Matters For Global Firms]

Payroll compliance protects you from penalties up to ₹3 lakh, legal action, and reputational damage that makes hiring impossible.

Non-compliance doesn't just cost money, it disrupts operations, destroys your employer brand, and drives talent away.

Here's what's actually at stake:

1. Avoiding Legal and Financial Penalties

India's regulatory bodies conduct aggressive audits. EPFO and the Income Tax Department don't give warnings they issue penalties.

Late EPF or ESI contributions trigger 12% interest charges plus damages up to 25% of arrears. Businesses paid ₹627 crore in fines for late tax filings in 2024 alone.

EPFO maintains a public "defaulting employers" list. Once you're on it, clients, investors, and top talent avoid you.

Retrospective penalties covering months or years of back payments compound quickly and can cripple early-stage operations.

2. Protecting Company Reputation and Brand Image

Non-compliance spreads fast in professional networks. When word gets out that you mishandle payroll or taxes, candidates won't even apply.

We've watched companies struggle to hire for months because past compliance failures destroyed their employer brand in India's talent market.

For international businesses especially, payroll violations damage credibility with Indian partners, investors, and government stakeholders. This makes future expansion nearly impossible.

3. Fostering Employee Trust and Satisfaction

Payroll errors and delays are the top source of employee stress and the fastest driver of attrition.

When employees see incorrect EPF deductions, missing ESI contributions, or late salary payments, they immediately start looking for new jobs.

Transparent payslips and accurate salary calculations build trust.This demonstrates you value their financial security and understand local requirements.

Companies that get compliance right from day one create stable, motivated teams. Those that don't face constant turnover, regulatory scrutiny, and mounting liabilities that only get worse over time.

What are the critical payroll compliance deadlines in India?[toc=Filings & Deadlines]

Missing these deadlines triggers immediate penalties, 12% interest charges, and puts you on EPFO's public defaulting employers list.

From our work with 300+ companies, we know staying on top of India's compliance calendar is where most foreign businesses struggle. Understanding the payroll cycle helps manage these deadlines effectively.

Here's what you absolutely cannot miss:

Monthly Deadlines

TDS (Tax Deducted at Source): Due 7th of following month

- Deposit all income tax deducted from employee salaries by the 7th, late deposits attract interest and penalties from the Income Tax Department.

Provident Fund (EPF): Due 15th of following month

- Both employer (12%) and employee (12%) contributions must be deposited by the 15th or face 12% annual interest plus damages up to 25% of arrears.

Employee State Insurance (ESI): Due 15th of following month

- Employer (3.25%) and employee (0.75%) contributions due by 15th for employees earning ≤₹21,000/month.

Professional Tax: Typically due 15th (varies by state)

- State-specific deadlines and rates vary, Maharashtra, West Bengal, and Karnataka have different due dates and slabs that must be verified separately.

Quarterly Deadlines

TDS Returns (Form 24Q, 26Q, 27Q): End of month following quarter

- Q1 (Apr-Jun): July 31st

- Q2 (Jul-Sep): October 31st

- Q3 (Oct-Dec): January 31st

- Q4 (Jan-Mar): May 31st

Annual Deadlines

Form 16 Issuance: June 15th

- Mandatory tax certificate for all employees showing total income, deductions, and tax paid during the financial year.

Payment of Bonus Act Filing: Within 8 months of accounting year close

- Companies with 20+ employees must file annual bonus returns showing calculation and payment details.

Labour Welfare Fund (LWF): Half-yearly or annually (state-specific)

- Contribution amounts and due dates vary significantly by state, not all states levy LWF.

We've seen companies lose months dealing with compliance violations because they relied on spreadsheets instead of automated systems. Payroll software with built-in compliance calendars and automated reminders is non-negotiable for international businesses operating in India.

Even with calendars and reminders, companies still make critical mistakes. Here are the most common compliance errors we see.

What are common payroll compliance mistakes in India?[toc=Payroll Mistakes]

These are the mistakes that trigger penalties, audits, and retrospective liabilities for most companies.

- Incorrect salary structure design: Basic salary below 50% of total pay violates wage codes and triggers incorrect EPF and gratuity calculations.

- Late or missing statutory filings: Missing EPF/ESI deadlines triggers 12% monthly interest charges plus penalty notices that compound over time.

- Poor record-keeping: Not maintaining digital wage registers and statutory receipts for 7 years makes audits impossible and invites penalties.

- Manual calculation errors: Spreadsheet-based payroll miscalculates EPF splits, state-specific professional tax, and dual tax regime differences.

- Contractor misclassification: Treating employees as contractors triggers massive retrospective EPF/ESI liabilities when authorities audit your workforce.

- Ignoring state-specific compliance: Overlooking professional tax or labour welfare fund requirements in specific states leads to surprise penalties.

These mistakes compound quickly when you're managing payroll without India-specific expertise. Next, let's see why foreign companies find India's compliance landscape especially challenging.

What challenges do global companies face with payroll compliance in India?[toc=Challenges]

From our experience in helping 300+ international companies manage payroll in India, we've seen the same compliance mistakes cost businesses months of delays and hundreds of thousands in penalties.

- Fragmented Legal Framework: Multiple central and state laws with no unified code make compliance across regions extremely complex for foreign businesses.

- Employee Misclassification: Treating Indian contractors like US or UK contractors triggers massive tax liabilities and retrospective penalties.

- Outdated Payroll Systems: Western software doesn't handle India's EPF splits, state-specific professional tax, or the 50% wage rule introduced in November 2025.

- Constant Regulatory Changes: Labour codes, tax slabs, ESI thresholds, and minimum wages update frequently, overseas teams miss critical changes without local expertise.

- Permanent Establishment Risk: Payroll mismanagement combined with decision-making roles in India can trigger PE exposure and corporate tax liabilities.

Not sure if your India operations trigger PE? Answer 7 quick questions about your India presence, revenue sources, and decision-makers to get your PE risk assessment.

Without India-specific expertise or automated systems, these challenges turn payroll into a full-time legal headache instead of a streamlined operation.

Learn how to pay employees in India compliantly from day one!

How can businesses ensure payroll compliance in India?[toc=How to Ensure Compliance]

From our experience in managing $20M+ in monthly payroll across 300+ global companies, we've developed a compliance framework that keeps businesses penalty-free.

Step 1: Partner with local compliance experts

Work with India-based partners who handle EPFO/ESIC registrations, track regulatory changes, and manage state-specific compliance requirements you can't monitor from overseas.

Step 2: Implement India-specific payroll software

Automate EPF splits, dual tax regimes, state PT, 50% wage rule, compliance reporting. Choose payroll software that updates with regulatory changes.

Step 3: Standardize documentation and processes

Maintain digital salary registers, attendance logs, statutory challans, 7-year records per compliance requirements. Implement HR policies aligned with Indian laws.

Step 4: Conduct quarterly internal audits

Catch errors/deadlines/misclassifications before authorities trigger penalties. Review salary structures and employer costs quarterly.

We've seen companies avoid ₹3 lakh+ penalties by automating India-specific requirements and partnering with payroll experts.

How Wisemonk helps with payroll compliance in India?[toc=How Wisemonk Helps]

Wisemonk is a trusted Employer of Record (EOR) in India, providing end-to-end payroll management and compliance solutions for businesses. We handle payroll for 300+ global companies, automating the entire process from statutory registrations to monthly filings. We simplify payroll operations, ensure legal compliance, and minimize risks for businesses operating in India.

What we handle for you:

- Statutory compliance: We Manage EPF, ESI, gratuity, PT per Indian labor laws

- Tax deductions & filings: We calculate TDS, file Form 24Q quarterly, and issue Form 16 annually by June 15th.

- Payroll processing: We ensure accurate accurate salary disbursement, payslip generation, and compliance reporting every month.

- Multi-state compliance: We adapt to state-specific labour laws, professional tax rates, and LWF requirements.

- Secure record-keeping: We maintain digital wage registers and statutory receipts for 7 years for audit readiness.

- Expert advisory: We Track regulatory changes, update payroll processes for evolving laws.

Beyond payroll, we also support contractor payments, talent recruitment, background verification, company registration, Global Capability Centers (GCCs) in India, and equipment procurement in India.

Wisemonk Client review/feedback:

“Wisemonk was instrumental in identifying and assisting in the recruitment of three successful senior executives. The team took a hands-on approach to solving the client's needs, and Wisemonk iterated multiple approaches to problem-solving based on the client's needs and directional shifts.”

- Hariher B

Co-Founder, BuyEazzy

Read the full review on Clutch →

“I've been working with Wisemonk as an EOR employee for past two years. The onboarding call was really good and they even helped my team onboarding as well. They helped me with the macbook, iphone devices procurement. Their interface is good and I can manage my team in a single interface”

- Felix S.

Senior Software Development Engineer

With us handling compliance, you can focus on growth without worrying about penalties, audits, or regulatory changes.

Helpful tools for payroll planning:

- Salary Calculator - Calculate CTC to take-home

- Employee Cost Calculator - Estimate total hiring costs

- Gratuity Calculator - Plan gratuity liabilities

- Explore all our tools

Get in touch today to streamline your payroll and compliance needs!

Frequently asked questions

What are the payroll laws in India?

Payroll laws in India include the Minimum Wages Act, Payment of Wages Act, Employees' Provident Fund Act, Employees' State Insurance Act, and the Income Tax Act. These acts govern various aspects of wages, social security, and taxation for employees.

What are the key payroll compliance requirements in India?

Primary requirements involve accurate calculation and deduction of income tax, contributions to the provident fund and employee state insurance, and paying state-specific taxes like professional tax and the labour welfare fund.

What is the difference between Indian payroll and US payroll?

Indian payroll is highly regulated by multiple, fragmented labor acts and state-specific rules, while US payroll is generally more simplified, with regulations primarily consolidated at the federal and state levels.

How do I calculate employer payroll taxes?

Employer payroll taxes in India primarily include contributions to the provident fund and employee state insurance, which are calculated as a percentage of the employee's salary as per the respective acts.

Who pays 30% tax in India?

In India's current tax regime, the 30% income tax slab applies to individuals whose taxable income exceeds ₹15 lakh (~$18,000 USD) annually, in addition to any applicable surcharges and a health and education cess.

How frequently do payroll laws change in India?

While major reforms might not occur every year, small amendments and updates can be frequent. Businesses need to regularly monitor government notifications and stay connected with HR communities or consultants to remain updated.

What documents are required for payroll processing in India?

Documents required include employee PAN cards, Aadhaar cards, bank account details, offer letters, salary structures, attendance records, and investment declarations for tax purposes.

.webp)

%20(1).webp)

%20(1).webp)

%20(1).webp)