- An independent contractor (IC) pay stub is a self-created document that details payments from clients. It is essential for tracking income, applying for loans, and preparing taxes like Form 1099-NEC.

- The key components of an independent contractor pay stub include contractor and client information, payment period, work details, pay rate, gross pay, deductions, net pay, and YTD totals.

- The main differences between a 1099 pay stub and an employee pay stub include showing only gross pay with no tax withholdings, as independent contractors manage their own taxes.

- The importance of independent contractor pay stubs are for accurate tax reporting, serving as proof of income for loans and rentals, and helping with financial tracking to manage cash flow and savings.

Need a hand with your independent contractor pay stub? Reach out to us now!

Discover how Wisemonk creates impactful and reliable content.

Do 1099 contractors get pay stubs, or do they need to create their own?

Independent contractors are usually compensated on a project or hourly basis. But are pay stubs provided to independent contractors?

We’ve seen this question come up often with US and global founders working with 1099 contractors.

Pay slip, pay stub or paycheck stub are different words for the same document. Pay stubs are normally provided alongside each paycheck during a payment cycle.

But because independent contractors work for themselves, they don’t receive pay stubs from clients. Instead, they’re responsible for creating their own pay stubs for every project or client to document and verify their earnings.

In this article, we break down the key elements of a 1099 pay stub, how to generate one step by step, a free template you can use, and how contractor pay stubs differ from employee pay stubs.

Is 1099 pay stub legally required?[toc=Is It Legally Required]

No. A 1099 pay stub is not legally required under federal law. In fact, even for employees, the federal Fair Labor Standards Act (FLSA) focuses on recordkeeping, not issuing pay stubs.

For independent contractors (1099s), the model is different: businesses generally do not withhold payroll taxes like Social Security or Medicare, and contractors handle their own tax obligations.

What businesses are required to do is report certain payments to contractors using Form 1099-NEC (when the reporting threshold is met) and provide the contractor a payee statement by the IRS deadline.

What is an independent contractor pay stub?[toc=1099 Pay Stub]

An independent contractor pay stub, sometimes referred to as a pay slip, is a document that records payment information for services provided by a contractor to a client or company. Unlike traditional employee pay stubs, it primarily shows gross payments, as contractors manage their own tax obligations.

Independent contractors don’t receive a traditional paycheck stub or pay stubs from clients because there are no employer-issued tax withholdings, Social Security taxes, or Medicare tax. Instead, they typically create their own pay stubs to document gross pay, hours worked, services provided, and the pay date for a specific pay period.

Since employers don’t issue contractor pay stubs, freelancers must create them using details from Form 1099-NEC. Using a contractor pay stub template helps organize income, track expenses, and simplify tax filing.

According to the IRS (Instructions for Form 1099-NEC, Rev. April 2025): Form 1099-NEC is required when a business pays an independent contractor $600 or more for services in a calendar year. It summarizes the total compensation paid to the contractor and must be filed by January 31.

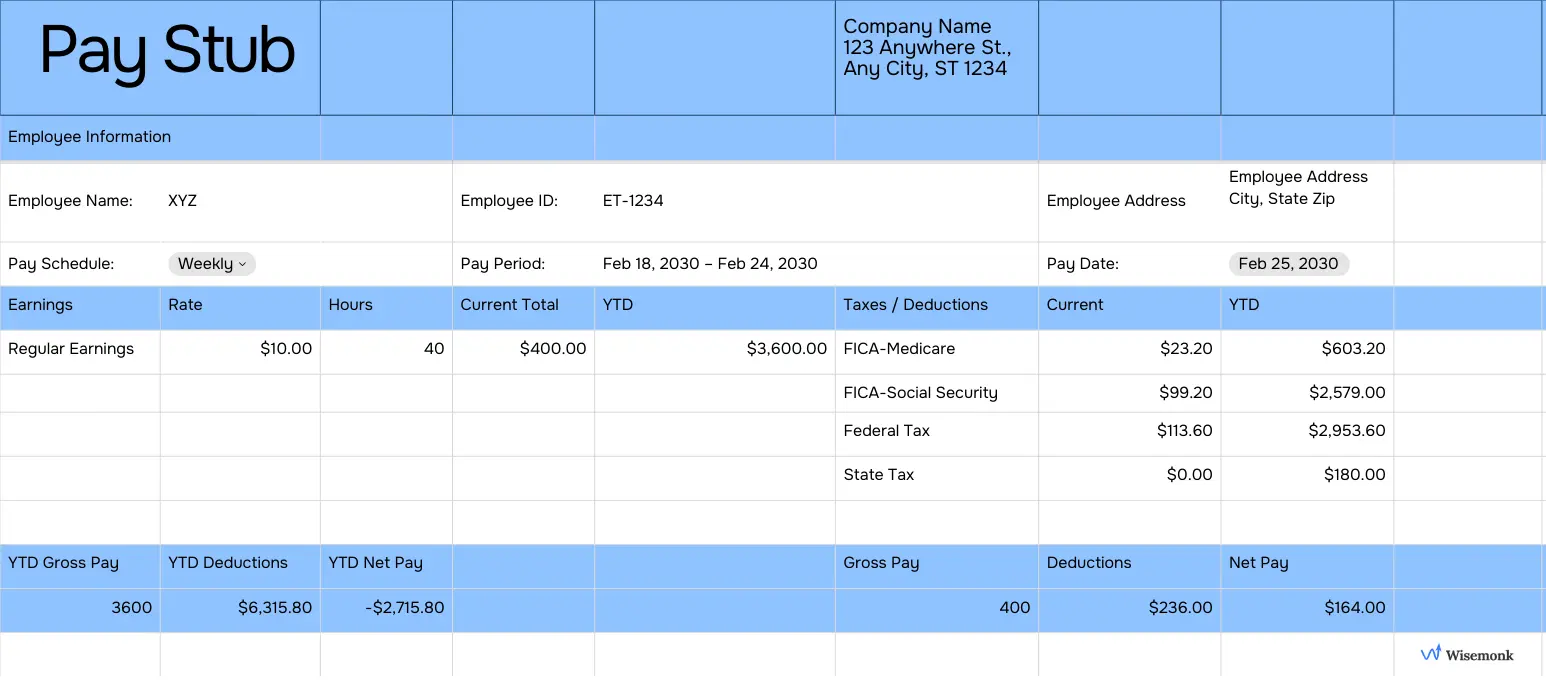

What does an independent contractor pay stub look like? (Sample 1099 Pay Stub Template)[toc=Sample 1099 Pay Stub Template]

From our experience helping hundreds of global companies and contractors document payments correctly, the biggest confusion isn’t how to generate a pay stub, it’s knowing what a perfect pay stub template should actually include.

Unlike employee pay stubs, a 1099 contractor pay stub template is simpler, focuses on total gross pay, and exists mainly as income proof and tax documentation rather than payroll compliance.

Below is a sample independent contractor pay stub template that shows how a typical 1099 payment record should look in practice.

Key note: This pay stub template is for reference only. It is not a legal document and does not replace invoices, Form 1099-NEC, or formal accounting records required for tax filing.

Now that you’ve seen a sample independent contractor pay stub template, let’s review the key elements it should include, including gross and net pay, and how to create an organized pay stub.

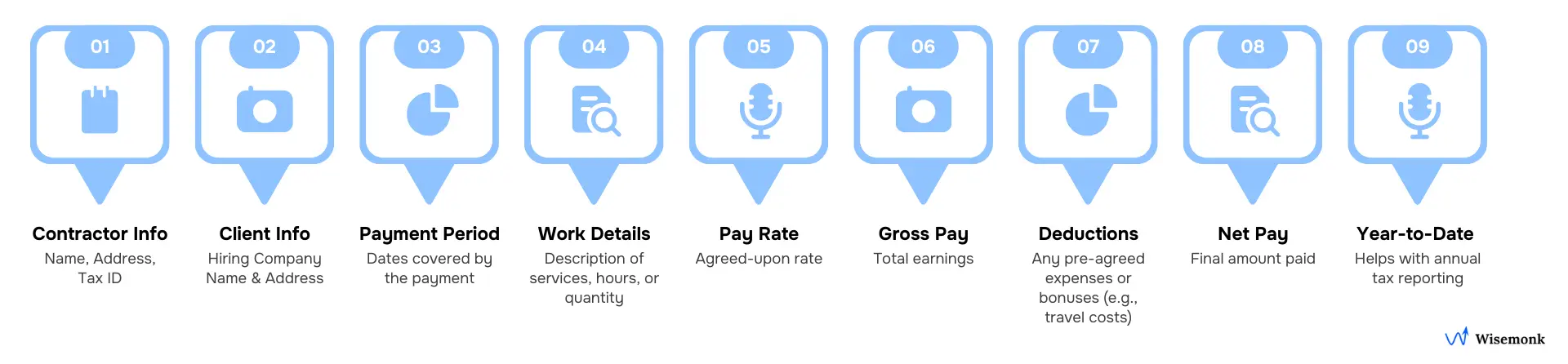

What are the key elements of an independent contractor pay stub?[toc=Key Elements]

When creating a 1099 paycheck stub, it’s essential to include specific details that ensure accurate tracking of earnings and tax reporting.

Drawing from our extensive experience in helping companies streamline their contractor payment processes, we have listed the key elements that every independent contractor pay stub should include.

Breakdown of the essential components included in a contractor pay stub.

- Contractor Information: Start with the basics, your name, address, and tax ID, so the pay stub clearly shows who completed the work.

- Client Information: Then add the hiring company’s name and address to show exactly who issued the payment.

- Payment Period: Next, note the pay period dates so it’s clear which days or weeks this payment covers.

- Work Description: Follow that with a quick description of the services you provided, along with hours or units of work.

- Pay Rate: Include the agreed hourly rate or project fee so anyone reviewing the stub sees how the payment was calculated.

- Gross Pay: From there, list your total earnings before any adjustments, this is your gross pay.

- Deductions and Adjustments: If you had expenses, bonuses, or reimbursements, record them here to show how the final amount was reached.

- Net Pay: This leads to your net pay, the actual amount hitting your account after adjustments.

- Year-to-Date (YTD) Totals: And finally, add your YTD totals to track cumulative earnings, which makes tax time so much easier.

If you’re handling contractors and wondering how to pay them properly and manage the payroll process, Jump into our article on "Paying Independent Contractors: Complete Guide".

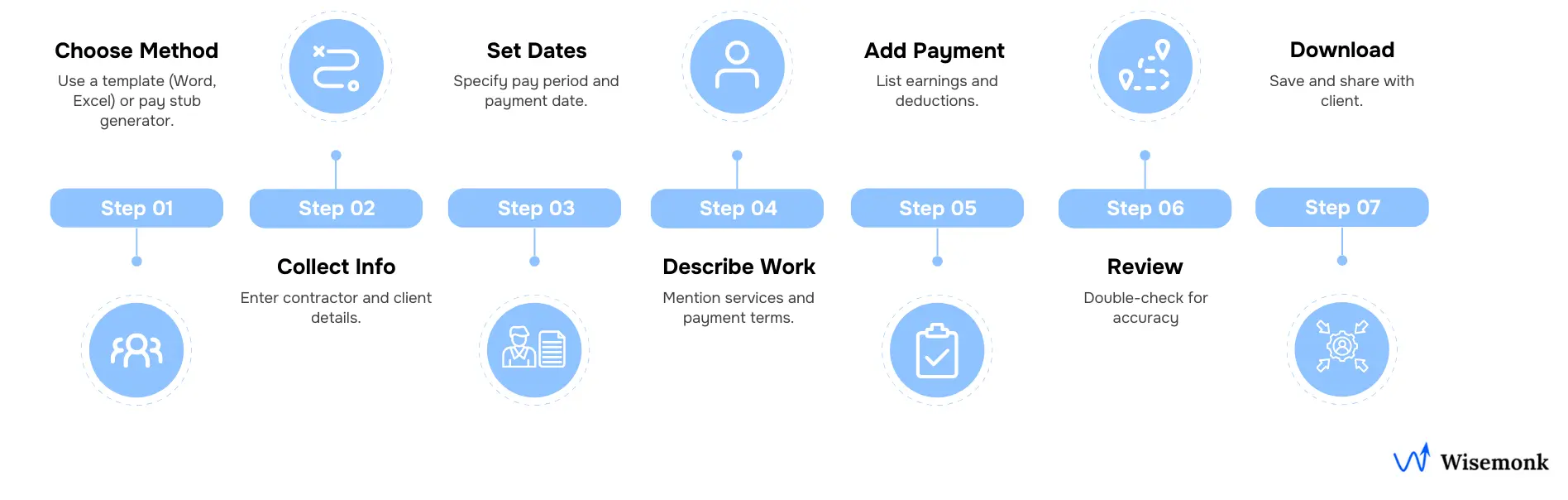

How to generate an Independent Contractor Pay Stub?[toc=How to Generate]

Self-employed individuals should generate paycheck stubs to keep track of work details and payments after each project or pay period. Using a 1099 pay stub template or pay stub generator can simplify creating your own pay stubs.

Having helped 300+ global companies, we know that following a straightforward process is key to cranking out pro-level paycheck stubs with no hassle.

Here’s the detailed breakdown of how to generate them effortlessly:

Step 1: Choose Your Method or Template

First, you need to decide how you'll create your 1099 pay stub. You can either use a manual paycheck stub template or opt for an online paycheck stub generator.

For manual templates, you can use tools like Word, Excel, or Google Docs. These templates typically include basic fields for entering contractor and client information and work well if you prefer a simple, customizable format.

Online pay stub generators, on the other hand, are easy-to-use tools that streamline the process of generating professional pay stubs and often come pre-filled with the required fields.Once you choose your preferred method, you'll be ready to start inputting your details for the pay stub.

Step 2: Collect and Enter Contractor & Client Information

Next, gather all the required details for both the contractor and the client to ensure the pay stub is accurate and easy to track.

Include the contractor’s name, business name if applicable, address, and tax ID such as an SSN or EIN, along with the client’s name, address, and relevant contact details.

It’s also useful to define the pay period at this stage, such as weekly, biweekly, or semi-monthly, so the pay stub aligns with invoices and payment cycles. Clear, consistent information helps link the pay stub to both parties and simplifies recordkeeping.

Step 3: Set the Pay Period and Payment Date

The pay period dates are crucial for ensuring the pay stub accurately reflects the time worked. They also make it easier to track payments and maintain clear records.

Include the start and end dates of the specific payment period you’re being paid for, along with the exact payment date when the funds were issued. This helps create transparency and keeps your records aligned with invoices and bank deposits. Accurate pay period and payment dates are essential for bookkeeping and tax reporting.

Step 4: Describe the Services Provided

Now, summarize the work completed during the pay period. This ensures both you and your client are aligned on what the payment covers.

Briefly describe the project or services you worked on, and clearly state whether you were paid based on an hourly rate or a flat project fee. Including this detail shows how the payment amount was calculated. This clarity can be helpful later for tax deductions, audits, or client questions.

Step 5: Add Payment Details and Any Deductions

Next, enter the payment details, starting with your gross earnings for the pay period.

List your gross pay as the total amount earned before any adjustments. If there were expenses, reimbursements, or bonuses involved, include them here as deductions or adjustments so the final amount is clearly explained. This breakdown helps show how your gross pay translates into the final amount received.

Step 6: Review for Accuracy

Before finalizing the pay stub, take a moment to review everything carefully. This step can prevent issues later, especially during tax filing or income verification.

Check that all fields are filled out correctly, including contractor details, client information, pay period dates, year to date earnings, and payment amounts. If you spot any errors, correct them immediately to avoid disputes or reporting problems. A quick review ensures your pay stub is accurate and reliable.

Step 7: Download, Store, and Share the Pay Stub

Once everything looks correct, download your pay stub and store a copy for your records. Keeping organized copies is important for tax reporting and future reference.

Save a digital version in a secure location so it’s easy to access during tax season. If needed, you can also share the pay stub with your client by email or print a physical copy for record-keeping. Proper storage makes it much easier to track earnings, stay organized, and maintain accurate financial records.

Expert Tip: If you want cleaner tax filings later, make sure each pay stub matches a specific pay period and includes both gross pay and net pay. Consistency makes IRS audits far less stressful.

If you’re moving beyond contractors, paying employees involves a different payroll process. Read our article on "How to Pay Employees: A Complete Guide".

What is the difference between an independent contractor pay stub and an employee pay stub?[toc=Pay Stub: 1099 vs. W-2]

While both documents summarize earnings, independent contractor pay stubs and employee pay stubs serve very different legal and tax purposes.

This distinction is why independent contractors usually create pay stubs for record-keeping and income verification, while employers are responsible for issuing pay stubs to employees.

If you want to understand these differences more thoroughly, check out the full comparison here, "Independent Contractor vs Employee: Complete Guide".

Why independent contractors need pay stubs?[toc=Why need Pay Stub]

Based on our extensive expertise managing over $20M+ in payroll, we’ve seen how essential detailed pay stubs are for financial clarity, legal compliance, and accurate income verification.

Here’s why an independent contractor pay stub matters:

1. Tax Reporting

For independent contractors who are self employed, tax season hits harder because you’re responsible for your own taxes, not the employer. A detailed 1099 pay stub helps keep income organized across each tax year and ensures your financial information stays clean and consistent.

A well-prepared pay stub document clearly shows gross and net pay, includes any applicable adjustments, and serves as one of your core payroll records. This makes it easier to file self-employment taxes, calculate quarterly payments, and avoid IRS audits by keeping your documentation aligned with what you report.

For many independent contractors and self employed persons, maintaining accurate stub documents linked to a clear pay schedule reduces errors and stress when deadlines approach.

2. Proof of Income

When applying for loans, rentals, or mortgages, verbal explanations aren’t enough. Lenders and landlords want documented proof. Since self employed individuals don’t receive traditional employee paychecks, creating your own pay stubs fills that gap.

A professional pay stub, especially your first pay stub for a new contract, provides earnings details that landlords and banks recognize for rental agreements and income verification. Including consistent pay periods and clear identifiers, such as your name and social security number where appropriate, makes your income appear stable, credible, and easy to verify.

Having organized stub documents ready helps prevent delays when approvals depend on clean and consistent financial records.

3. Financial Tracking

Contractor income often comes from multiple clients and irregular pay schedules, which makes tracking earnings more complex for many independent contractors. Pay stubs help keep payment details organized across each pay period, giving you better visibility into your true income.

By maintaining consistent payroll records, you can track cash flow, plan expenses, and prepare for long-term goals such as retirement savings. This clarity also helps separate contractor income from employee payroll, which typically includes employer contributions handled through a payroll service.

With accurate pay stubs in place, self employed professionals gain better control over their finances and maintain a clear, reliable picture of their independent contractor payroll.

Since you’re already getting your contractor game tight, you might as well learn the W9 vs W2 tax forms difference too. Check out our “W9 vs W2: Complete Guide.”

What are the common mistakes to avoid when creating contractor pay stubs?[toc=Common Mistakes To Avoid]

As we have discussed throughout this guide, a well-prepared pay stub is crucial for smooth contractor management. Let’s take a moment to highlight some common mistakes to avoid when creating contractor pay stubs to ensure accuracy and compliance:

- Misclassifying Workers: Mixing up employees and independent contractors can lead to major compliance issues and penalties. Always verify the correct classification before issuing any paycheck stub.

- Incomplete or Inaccurate Information: Missing details like pay rate, pay period, hours worked, or contractor/client information creates confusion and can cause disputes or tax filing problems.

- Missing or Incorrect Payment Details: Leaving out gross pay, deductions, or the payment date affects financial transparency and makes it harder for contractors to track income accurately.

- Unclear Earnings and Deductions: Bundling services, expenses, or reimbursements leads to misunderstandings. Itemizing all amounts ensures clarity around compensation and taxable income.

- Inconsistent Formatting and Record-Keeping: Using different formats or failing to store contractor pay stubs properly complicates audits, tax reporting, and client communication. Consistency builds trust and saves time.

Avoiding these mistakes helps you create accurate, customized pay stubs that make tracking pay stubs easier, simplify independent contractor payroll, and keep your financial records clean for filing taxes, handling state income taxes, and staying ready for IRS audits.

What our clients say:

“Wisemonk’s contractor platform has been a huge help for us. Their support team is always there when we need them, and creating invoices is fast and easy. The email updates make tracking payments simple, and their competitive FX rates save us money every month. They even connect us with a tax consultant for affordable filing support.”

— Jurel G, Finance Analyst, Beacon Funeral Partners, LLC, Read more on G2

How can Wisemonk help with contractor management?[toc=Why Choose Wisemonk]

Wisemonk is an international Employer of Record with deep expertise in India that helps global companies hire, pay, and manage independent contractors with ease. We simplify payroll, compliance, and documentation, making contractor management smoother through our EOR and AOR capabilities.

Our specialists handle payroll and tax operations with precision, ensuring full compliance with local labor and taxation laws.

Here’s what we do for you:

- Automated Pay Stub Generation: We provide automated contractor pay stub creation that ensures accuracy and compliance with local regulations.

- Invoice & Payment Management: Our system streamlines the entire payment process from invoice approval to secure contractor payments.

- Compliance & Documentation: We ensure all contractor agreements are compliant with Indian regulations while handling proper classification to avoid misclassification penalties.

- Tax Optimization Services: We offer specialized tax planning that can reduce contractor tax liabilities while ensuring full compliance.

- Local regulatory expertise: Especially for handling the complexities of local labor and tax laws to prevent misclassification and ensure smooth operations.

Beyond EOR (employer of record) and pay stub processing, we also offer payroll outsourcing, talent sourcing, dedicated HR support, background verification, equipment procurement. With us, you get a complete workforce solution for your operations in the region.

Ready to simplify your payroll tasks? Contact us today to discover how Wisemonk can help you build and manage your world-class team effortlessly and compliantly.

Frequently asked questions

Do independent contractors get a pay stub?

Independent contractors typically do not get traditional pay stubs from clients because they are self-employed and not on a company’s payroll. Many 1099 contractors create their own pay stub information to track income, gross and net pay, and applicable taxes for personal records and verification.

Is a 1099 pay stub legally required?

No, a 1099 pay stub is not legally required. Federal law and IRS guidelines focus on reporting contractor payments via Form 1099-NEC, not issuing a pay stub. Contractors handle their own tax obligations and must track their payroll records for self-employment and estimated tax purposes.

What if a contractor doesn’t receive Form 1099-NEC?

If a contractor doesn’t receive a Form 1099-NEC, they must still report all income to both the IRS and applicable taxes on their return. Contractors should confirm with the payer and use invoices, bank records, and self-generated pay stub information to support income reporting.

How can independent contractors show proof of income?

Independent contractors can show proof of income with self-generated pay stubs, invoices, Form 1099-NEC, bank statements, or income verification letters. Pay stubs help document gross and net pay, support rental agreements, and demonstrate financial stability for loans, mortgages, or other verifications.

Can a self-created pay stub be rejected by banks or landlords?

Yes, a self-created pay stub might be rejected if it lacks clear payment details or doesn’t match bank deposits and Form 1099-NEC totals. To improve acceptance, include accurate gross and net pay, payment dates, and consistent pay schedule information, along with supporting tax documents.

How often should independent contractors generate pay stubs?

Independent contractors should generate pay stubs aligned with their pay schedule, such as per project or on weekly, biweekly, or monthly cycles. Consistent pay stub generation helps track income, estimated tax payments, and financial records throughout the tax year.

Can pay stubs increase misclassification risk for contractors?

Pay stubs alone don’t cause misclassification, but they could contribute if they resemble employee payroll more than contractor documentation. Misclassification risk arises when control and work arrangements resemble employee status rather than independent contracting, leading to potential tax and liability issues.

.png)

%20(1).webp)