- The W-9 form is used by businesses to collect taxpayer identification information from independent contractors or vendors. It helps the payer report payments to the IRS using Form 1099, ensuring accurate tax reporting.

- The W-2 form is used by employers to report wages paid to employees and the taxes withheld from them. It provides a detailed record of an employee's annual earnings and tax obligations for filing with the IRS.

- If you work independently and control how, when, and where you do your work, you’re likely a contractor and will be asked to submit a W-9. If the company controls your schedule, work process, and pay, you’re an employee and will receive a W-2.

- For businesses, W-2 means the company withholds and pays payroll taxes and may provide benefits, while W-9 means no tax withholding and fewer obligations but higher misclassification risk if used incorrectly.

Need help with W-9 or W-2 compliance? Contact us.

Discover how Wisemonk creates impactful and reliable content.

Looking to understand the differences between the W-9 form and the W-2 form for your business? If you’re hiring, working, or paying people for services in the U.S., knowing which tax forms, W-9 or W-2 to use for the right worker classification and tax withholding is a must for tax compliance and fulfilling IRS regulations as a business owner.

The right tax form isn’t just paperwork; it determines federal tax classification, impacts your business’s compliance, and keeps you on the right side of IRS rules.

In this article, we’ll break down everything about W-9 vs W-2, what each form includes, when to use them, how worker classification impacts your choice, plus the key requirements and common mistakes to watch out for.

What’s the difference between W-2 and W-9?[toc= W9 vs. W2]

The W-2 and W-9 forms are both critical for tax reporting, but they serve different purposes based on worker classification. Understanding the difference between these forms ensures accurate tax reporting and compliance, giving you the tax documents you need for filing with the IRS.

With our experience in helping companies with payroll and compliance, here’s a breakdown of the key differences between the W-2 and W-9 forms and why it’s crucial to choose the correct one for your business.

1. Employment Status and Classification

The classification of a worker determines a lot of aspects, from tax handling to benefits eligibility.

2. Tax Withholding Responsibilities

Tax obligations for employees and contractors are significantly different. Here's a breakdown of the responsibilities.

3. Recordkeeping and Reporting Requirements

The record-keeping and reporting responsibilities differ between the two forms.

For more insights on worker classification and compliance, explore our detailed guide on "Independent Contractor vs Employee" to learn how to correctly classify workers, manage tax obligations, and stay compliant with IRS regulations.

We’ve explored the key differences between the W-9 and W-2 forms, now let’s dive deeper into each form to understand their specific uses, requirements, and how they impact businesses and tax season.

What is a W-9?[toc=Form W-9]

Form W-9, also known as the Request for Taxpayer Identification Number and Certification, is an IRS form used by independent contractors or nonemployees to provide their personally identifiable information, such as an individual's taxpayer identification number (TIN) or a business’s Federal Employer Identification Number (EIN). It can also be used to report various other payments to the IRS, including IRA contributions or mortgage interest.

The W-9 form does not include tax withholding information, as independent contractors are responsible for filing and paying their taxes. However, if they are subject to backup withholding, they must indicate this on the W-9, informing the business to withhold 24% income tax from any payments.

What is the Purpose of a W-9?

A self-employed individual or independent contractor submits a completed W-9 form to the business they provide services for. The business then uses the information on the W-9 to create a Form 1099, which the contractor will use to report their income to the IRS.

Important Reminder: Employers should collect a completed W-9 form from independent contractors before the first payment is made. This ensures that you have the necessary taxpayer information (such as TIN) to accurately report payments made to the contractor. Failing to collect this form upfront could delay your reporting and compliance process.

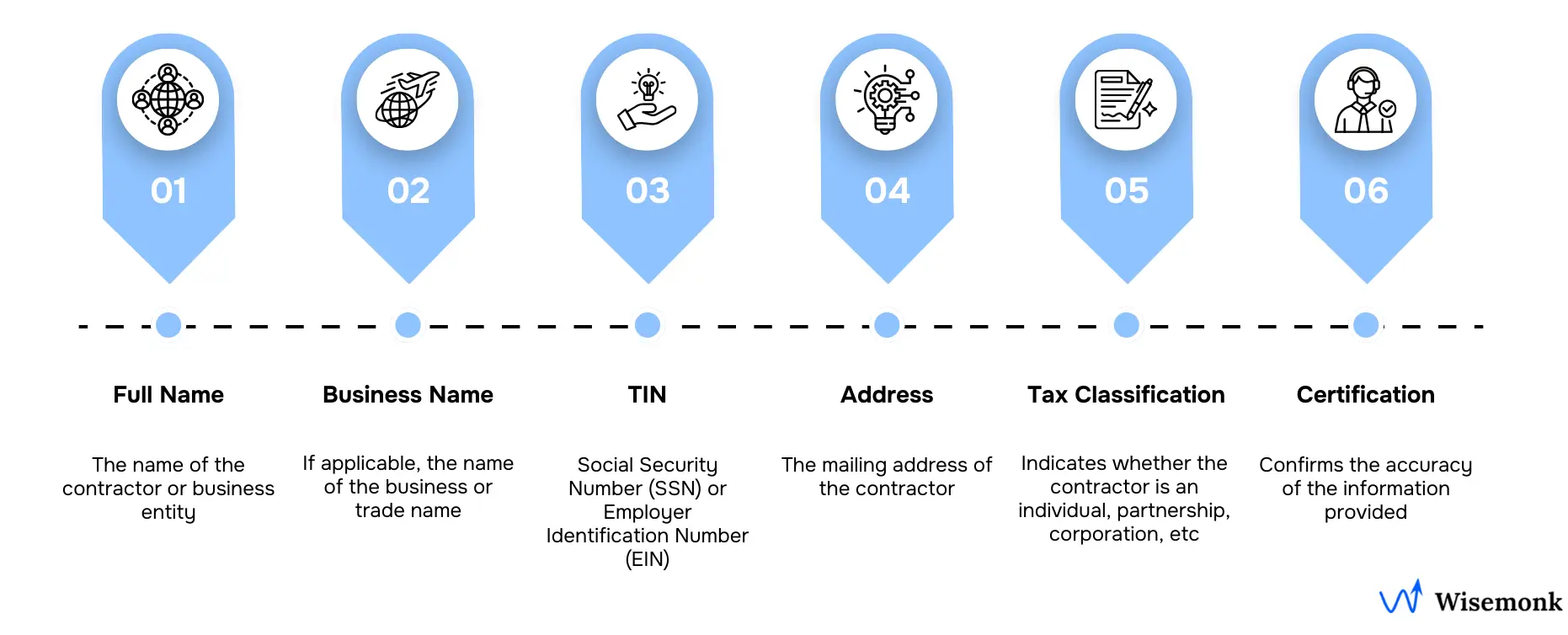

What Information Does the W‑9 Form Collect?

The W‑9 form collects the following information:

- Full Name: The name of the contractor or business entity.

- Business Name: If applicable, the name of the business or trade name.

- Taxpayer Identification Number (TIN): Social Security Number (SSN) or Employer Identification Number (EIN).

- Address: The mailing address of the contractor.

- Tax Rate and Classification: Indicates whether the contractor is an individual, partnership, corporation, etc., and the applicable tax rate for income reporting.

- Certification: Confirms the accuracy of the information provided and clarifies whether backup withholding applies.

Who Receives a W-9?

Before engaging with an independent contractor or freelancer, a business should ask them to fill out a Form W-9 prior to signing any agreements or starting any projects. The business should retain the form for their records and use the details to prepare 1099 forms. There is no need to submit or send copies of the form to the IRS.

You might be wondering how to pay 1099 employees, so be sure to check out our article on "How to Pay 1099 Employees."

What is a W-2?[toc=Form W-2]

Form W-2, also known as the Wage and Tax Statement, is an annual document provided to employees that outlines their taxable wages, income tax withholdings, and Social Security and Medicare tax deductions. The form also includes details about various employee benefits (some taxable, some tax-exempt) and any state income tax withheld.

It is the employer's responsibility to file a W-2 form for each employee, reporting the total wages earned during each pay period, regardless of the total compensation earned during the year. Employees then use the information on the form to file their federal and state taxes. Employers are also required to submit copies of the W-2 to the Social Security Administration and, if necessary, to state authorities.

What is the Purpose of a W-2?

A W-2 form is used by employees to report their wages, tips, and other compensation, along with the taxes that have been withheld from their pay. It is required for filing both federal and state tax returns. Employers use it to report the wages paid to employees and the amount of tax withheld, ensuring proper tax compliance with the IRS.

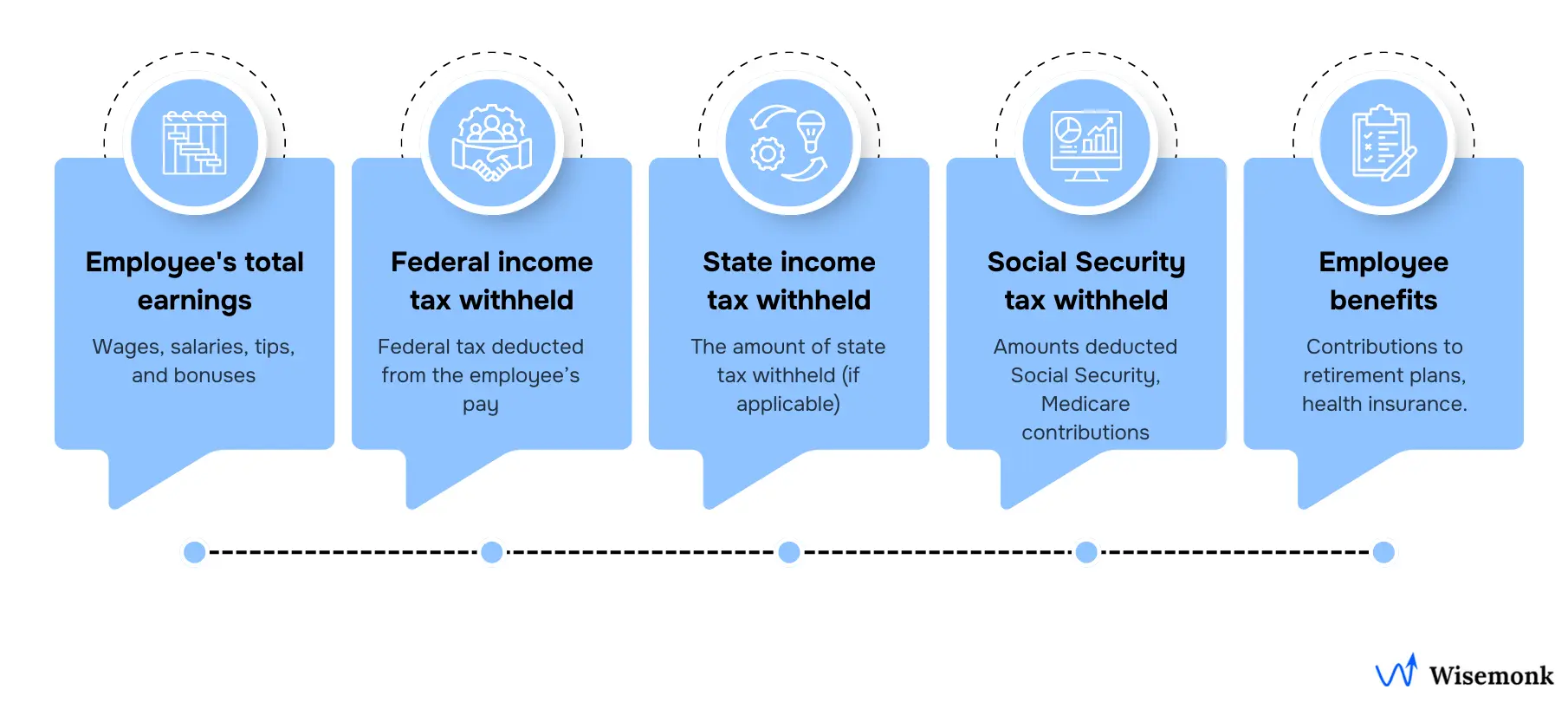

What Information Does the W‑2 Form Collect?

The W‑2 form collects the following information:

- Employee's total earnings: Wages, salaries, tips, and bonuses.

- Federal income tax withheld: The amount of federal tax deducted from the employee’s pay.

- State income tax withheld: The amount of state tax withheld (if applicable).

- Social Security and Medicare tax withheld: Amounts deducted for Social Security and Medicare contributions.

- Employee benefits: Contributions to retirement plans, health insurance, and other benefits.

- Other deductions: Additional withholdings like state disability or paid family leave benefits (if applicable).

This information ensures transparency and accuracy in employee tax reporting and helps prevent errors during filing. If you want to know what makes up your pay statement, check out our post on "What is a pay stub and how it relates to W-2 forms".

Who Receives a W-2?

Employers provide a W-2 form to every employee who is paid through the company's payroll system and has payroll taxes withheld during the year. The W-2 shows the total amount an employee earned in the previous year and the taxes withheld from their wages.

What are the proper form usage guidelines for W-2 and W-9?[toc=Usage Guidelines]

Properly using W-2 and W-9 forms ensures accurate tax reporting and compliance with IRS regulations. These forms are critical for correctly classifying workers, whether as employees or independent contractors, and for managing tax withholding and income tax payments.

With our hands-on experience in helping businesses with payroll compliance and tax reporting, here are the key guidelines for using W-9 and W-2 forms correctly to avoid IRS penalties.

.webp)

When to use a W-9 form

Use a W-9 when you are paying non-employees, such as independent contractors, freelancers, or vendors.

You should request a W-9 if:

- The worker controls how, when, and where they do the work

- You do not withhold payroll taxes from their payments

- You expect to pay them $600 or more during the year

Quick Reminder: The W-9 collects the worker’s name, address, and Taxpayer Identification Number (TIN) so you can issue Form 1099-NEC at year-end. The form is kept on file by the business and is not sent to the IRS.

When to use a W-2 form

Use a W-2 when you are paying someone as an employee on your payroll.

You must issue a W-2 if:

- The worker is an employee, and

- You pay them $600 or more in wages during the year or

- You withhold any federal income tax, Social Security, or Medicare tax, even if wages are below $600

Quick Reminder: W-2 forms must be provided to employees and filed with the Social Security Administration by January 31 following the tax year.

How do W-9 and W-2 forms apply in real-life scenarios?

What is a W-2 Form in Real Life? Imagine you’re employed as a full-time employee at a tech company. Every two weeks, your employer withholds federal income tax, Social Security, and Medicare taxes from your paycheck. At the end of the year, your employer provides you with a W-2 form. This form shows your total income for the year and the taxes that were withheld from your paychecks. You then use this form to file your tax return, ensuring your tax payments are in order.

What is a W-9 Form in Real Life? You are a freelance web developer hired by a marketing firm for a project. The firm asks you to complete a W-9 form, which provides them with your taxpayer identification number (TIN). They will use this information to report payments made to you using Form 1099-NEC at the end of the year. Since you are an independent contractor, no taxes will be withheld from your payments, and you will be responsible for paying your own self-employment tax.

How do W‑9 and W‑2 forms impact tax filing and payment?[toc=Tax Filing Details]

Understanding how W-9 and W-2 forms impact tax filing and payment is crucial for ensuring correct tax withholding and minimizing errors. These forms play a key role in managing self-employment tax, income tax reporting, and taxable income, helping businesses avoid IRS notices for discrepancies or delays in tax filings.

With our experience in helping businesses with payroll compliance and tax reporting, here's how W-9 and W-2 forms affect tax filing, payment of own tax payments, and reporting requirements during tax time, helping you avoid errors and penalties from the previous tax year.

How Taxes Work for W-2 Employees

For W-2 employees, the employer is responsible for withholding federal income tax, Social Security, and Medicare taxes from the employee's paycheck. The amount of federal income tax withheld is based on the information provided by the employee on the W-4 form.

The W-4 form is completed by the employee when they start their job (or when they experience a life change) and indicates their tax filing status and the number of allowances they claim. This form tells the employer how much federal income tax to withhold from each paycheck. If there are any additional withholding instructions, such as extra amounts to be withheld, those are also specified on the W-4.

Employers use the W-4 to ensure the correct amount of federal income tax is deducted from the employee's wages throughout the year. At year-end, employers then file the W-2 form to report total wages and the total taxes withheld, ensuring compliance with IRS requirements.

How Taxes Work for Independent Contractors (W-9)

Independent contractors who submit a W-9 form are responsible for managing their own taxes. Unlike W-2 employees, contractors must file and pay their own taxes, including self-employment tax. They also handle their quarterly estimated tax payments to cover income tax withholding and other taxes, ensuring they remain compliant at tax time.

Case Studies of Dual Classification (Employee + Contractor)

In certain situations, a worker may be classified as both an employee and an independent contractor in different roles within the same company. This dual classification requires precise reporting on both W-2 and 1099 forms. Companies must ensure accurate reporting of wages, taxable income, and tax payments for each role to avoid misclassification penalties.

For further details, refer to the IRS guidelines.

W-2 vs W-4 vs W-9 vs 1099-NEC: How All Four Tax Forms Connect?[toc=W2 vs W4 vs W9 vs 1099-NEC]

Understanding the W-9 and W-2 is easier when you see how they fit alongside the W-4 and 1099-NEC. These four forms work together throughout the employee and contractor lifecycle, here's how each one connects.

For a deeper dive into contractor-specific reporting, check out our guide on "Filing 1099-NEC as an Independent Contractor" to ensure your year-end filings are accurate and penalty-free.

What to do if payer does not receive form W-9 from payee?[toc=Action if W-9 is Not Submitted]

If a payer does not receive a Form W-9 from a payee, it can create complications when it comes to reporting payments to the IRS. This form is crucial for obtaining the correct Taxpayer Identification Number (TIN) of independent contractors or vendors, which is needed for accurate reporting on Form 1099-NEC. Here’s what the payer should do:

- Request the Form from the Payee: The payer should immediately request the W-9 from the payee. This step is essential to collect the TIN and ensure accurate reporting.

- Implement Backup Withholding: If the W-9 is not provided, the payer must implement backup withholding at a rate of 24% on payments to the payee.

- Document the Request: The payer should document their request for the W-9 form to show that they made a reasonable effort to comply with IRS requirements.

By taking these actions, the payer ensures compliance with IRS regulations and avoids penalties for failing to report payments properly. Regular follow-ups and clear documentation will also help streamline the process moving forward.

"If a business misclassified an employee, the business can be held liable for employment taxes for that worker."— Internal Revenue Service (IRS), Worker Classification Guidelines

How to avoid misclassifying workers and stay IRS-compliant?[toc=Avoid Misclassification]

Correctly classifying workers as either employees or independent contractors is crucial for maintaining IRS compliance and avoiding hefty penalties. Misclassification can lead to serious tax and legal issues for businesses, making it vital to follow IRS guidelines and best practices.

Here’s how you can stay compliant:

IRS Guidelines for Worker Classification

The IRS guidelines for worker classification rely on three main factors: behavioral control, financial control, and the nature of the relationship between the worker and the employer.

- Employees are controlled by their employer in terms of work hours, job responsibilities, and benefits.

- Independent contractors, on the other hand, have more control over their work and manage their own taxes and expenses.

The IRS provides detailed guidance to help businesses avoid misclassification penalties by clearly distinguishing between the two categories.

"Misclassifying workers as independent contractors adversely affects employees because the employer's share of taxes is not paid, and the employee's share is not withheld."— Internal Revenue Service (IRS), Worker Classification 101

Best Practices for Ensuring Accurate Classification

Accurate classification is key to maintaining tax compliance and avoiding IRS scrutiny.

- Review job roles thoroughly to differentiate between employees and independent contractors based on IRS criteria.

- Ensure that job responsibilities, work hours, and the level of control are clearly defined in contracts and job descriptions.

- Regularly update worker classifications to ensure they reflect actual work conditions and IRS regulations.

By following these best practices, businesses can ensure accurate worker classification and reduce the risk of penalties.

How to Correct a Misclassified Worker

Misclassifying a worker can result in tax and legal complications, but correcting the mistake is possible with the right steps.

- Contact the IRS to amend the situation and correct any tax information or filings that were improperly reported.

- Reclassify workers moving forward and adjust tax filings to reflect their correct employment status.

- Maintain detailed records to show that you’ve rectified the error and are now fully compliant.

By addressing misclassification early, businesses can prevent long-term issues related to taxable income and self-employment tax.

Real-world case: What misclassification actually costs

A recent case involving Uber highlighted the significant financial risks of misclassifying workers. In 2022, Uber was sued by drivers who were misclassified as independent contractors rather than employees.

The lawsuit emphasized how businesses can face legal and financial consequences when workers who should be classified as employees are treated as contractors. This case reinforces the importance of correct worker classification for businesses, especially those operating in taxable income environments.

W9 vs W2 penalty breakdown: What incorrect filing actually costs

Understanding the exact penalties helps businesses see why accurate filing isn't optional. Here's what the IRS charges for late, incorrect, or intentionally negligent filings in the 2026 tax year.

These penalties compound quickly, especially for businesses with multiple contractors. Proactive compliance through accurate worker classification and timely form filing is always cheaper than correcting mistakes after an IRS audit.

One of our clients approached us for help in managing their teams and ensuring full compliance with global payroll and tax regulations. Wisemonk’s approach to compliance was exceptional, providing reliable solutions that simplified complex tasks.

Read Our Client Story

"Wisemonk has made managing our global payroll and compliance effortless. Their seamless integration with our systems, coupled with top-tier customer support, ensures we stay fully compliant across all regions. Their comprehensive features have been a game-changer, saving us time and effort while protecting our operations."

— Deepika Mahendran, Associate - Talent Management at Acolyte Group

How can Wisemonk streamline payroll, tax, and compliance management for your business?[toc=How Wisemonk Assist]

Wisemonk is a trusted Employer of Record (EOR) that helps global companies hire, pay, and manage employees smoothly, without setting up a local entity. Our specialists handle payroll and tax operations with precision, ensuring complete compliance with labor and taxation laws.

Here’s how we support your team:

- Accurate Worker Classification: We help classify workers correctly to ensure the right form (W-9 or W-2) is used, avoiding misclassification penalties.

- Tax Withholding and Reporting: We manage income tax withholding and file W-2s and 1099 forms with the IRS on your behalf.

- Global Payroll Solutions: We handle self-employment tax, FICA tax, and other payroll requirements for employees and contractors.

- Ongoing Compliance Support: We provide continuous support to keep your business compliant with ever-changing IRS regulations.

We’ve successfully integrated over 2,000 employees into teams and gained the trust of more than 300 companies globally. While we are unrivaled in India, we’re also expanding rapidly in key markets like the US, UK, and beyond. Wisemonk is your trusted partner for hiring in India and supporting global growth.

Ready to simplify compliance and payroll management? Let Wisemonk handle your payroll and tax compliance with confidence. Book a free consultation today.

Frequently asked questions

Is a W-9 the same as a W-2?

No, a W-9 is not the same as a W-2. A W-9 form is used to collect taxpayer information from independent contractors, freelancers, or vendors so the business can report payments on Form 1099. A W-2 form, on the other hand, is issued by employers to report employee wages and the taxes withheld from their pay.

What’s the difference between a W-2, W-4, and W-9 form?

A W-2 form reports employee wages and all taxes withheld by the employer each year. A W-4 form tells the employer how much federal income tax to withhold from each paycheck. A W-9 form collects taxpayer information from independent contractors for 1099 reporting.

Can the same person receive both W-9 and W-2?

Yes, one person can receive both a W-9 and a W-2 from the same business in a year if they are an employee in one role and an independent contractor in a separate, unrelated role.

What happens if tax forms are filed incorrectly?

Filing tax forms incorrectly with the IRS can result in significant penalties, ranging from $60 to $660 per form based on the severity and timing of the error. If the IRS finds intentional disregard of filing requirements, there is no maximum penalty, and costs can escalate quickly.

What is the penalty for misclassifying a W-2 employee as a W-9 contractor?

The IRS can impose 1.5% of wages paid, 20% of the employee's FICA share, and 100% of the employer's unpaid FICA. Intentional misclassification carries criminal penalties up to $1,000 per worker. States like California add $5,000–$25,000 per violation under AB5.

Do I need a W-9 or W-2 for a freelancer?

You need a W-9. Have the freelancer complete Form W-9 before any payment. Use their TIN to issue a 1099-NEC if you pay $600 or more annually. No taxes are withheld, the freelancer handles their own tax payments. W-2 forms are only for payroll employees.

What's the deadline for W-2 distribution?

W-2 forms must be prepared, filed with the Social Security Administration, and provided to all employees no later than January 31, 2026, for wages earned during the 2025 tax year. Meeting this deadline is crucial to avoid penalties and to ensure that employees to file their personal tax returns.

.webp)

.png)

%20(1).webp)