- Payroll services for contractors manage accurate payments to independent workers, automate tax reporting such as Form 1099-NEC, and ensure compliance with IRS rules.

- The main features of contractor payroll services involve automating 1099 filings, collecting tax and payment details, and ensuring compliance with classification and workers’ comp rules.

- The leading top payroll providers for contractors are Wisemonk, Gusto, QuickBooks Payroll, Deel, Remote, Square Payroll, OnPay, Papaya Global, Paychex, and ADP.

- The key considerations when choosing a payroll service for contractors are evaluating features, pricing models, scalability, and compliance coverage to match your business size and hiring markets.

Need help finding the best payroll service provider for contractors? Talk to our experts today.

Discover how Wisemonk creates impactful and reliable content.

Looking for the right payroll services for independent contractors and not sure which one truly fits your business? That’s a common struggle. Many U.S. founders, HR teams, and global businesses face the same challenge, finding a reliable partner that can handle contractor payments seamlessly, stay compliant, and cut through the admin chaos.

According to Mordor Intelligence, the U.S. payroll services market is projected to reach USD 8.44 billion by 2025, driven by the increasing shift toward outsourcing payroll to manage compliance, taxes, and cross-border complexities.

In this article, we’ll break down what makes a great contractor payroll service, how to compare top providers, explore their benefits, and help you choose the best solution for your business, so you can simplify payouts and stay compliant effortlessly.

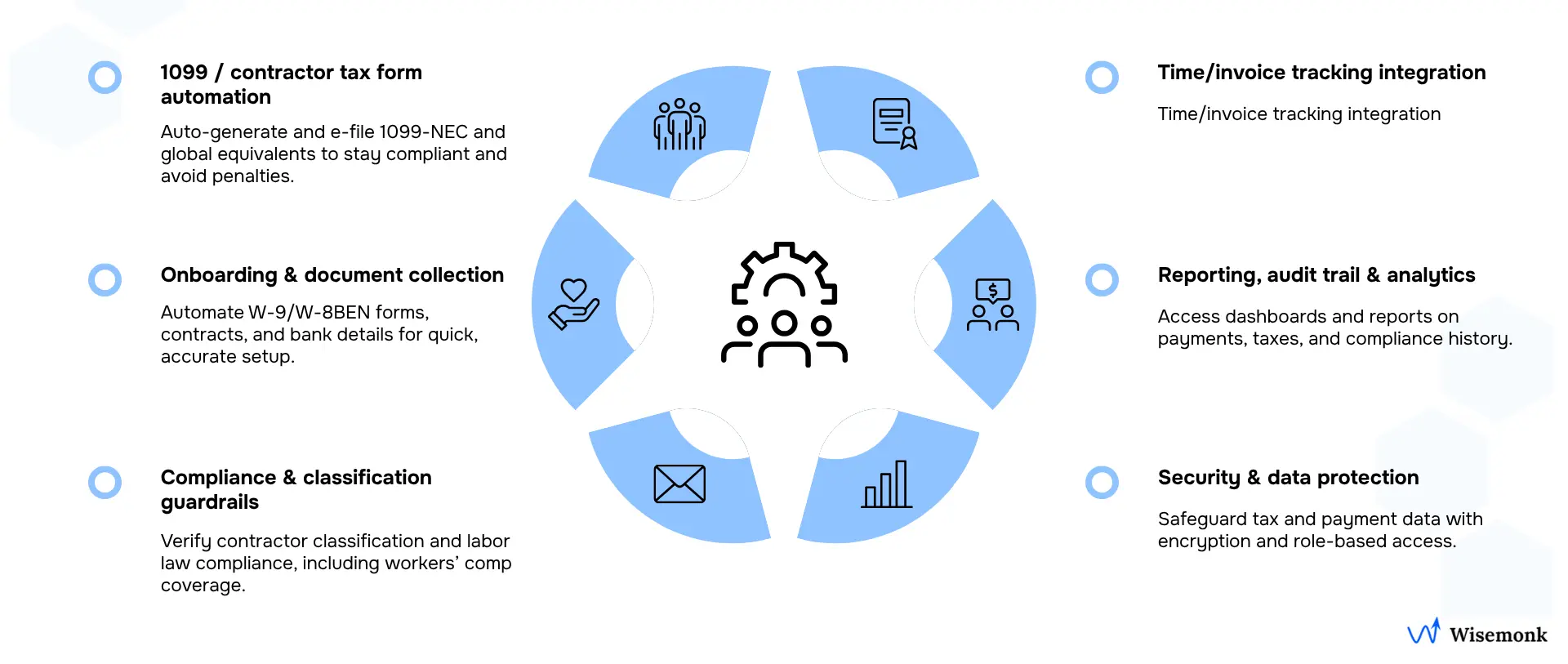

What are the key features to look for in contractor payroll services?[toc=Key Features]

By centralizing payouts and documentation, payroll services help global businesses streamline operations, avoid compliance risks, and ensure 1099 contractors get paid accurately and on time. Based on our experience helping companies with payroll, compliance, and HR operations and other key markets,

Here are the key features to look for when choosing the right contractor payroll service:

Key features to look for:

- 1099 / contractor tax form automation: Automatically generate and file U.S. 1099-NEC (and international equivalent) forms, so you reduce risk of mis‐classification or late filings.

- Onboarding & document collection: Built-in workflows to collect W-9/W-8BEN, bank details, contractor agreements/SOWs, so you ensure the paperwork is done right.

- Compliance & classification guardrails: Features that help you classify 1099 contractors correctly, manage local labor law risks, and handle workers’ comp or liability coverage requirements where applicable, especially when hiring across borders.

- Time/invoice tracking integration: Ability to link hours or project invoices directly into payroll so you pay 1099 contractors accurately and avoid disputes.

- Reporting, audit trail & analytics: Clear dashboards and exportable reports showing contractor costs, tax liabilities, payment status and historical logs.

- Security & data protection: Since you’re handling sensitive banking and tax details, strong encryption, role-based access, and data backup are essential.

- Scalability and global reach: If your business is growing or hiring internationally, the service should support multiple countries, currencies and local tax regimes.

Now that we’ve covered the key features to look for, let’s explore how the leading payroll service providers for contractors compare in terms of pricing, coverage, and capabilities.

How do the leading payroll services for contractors compare?[toc=Comparison: Payroll Providers]

Leading payroll services for independent contractors differ in pricing, reach, and focus. Some handle U.S. 1099 workers, while others specialize in global payments, compliance, and payroll outsourcing. Through our experience in contractor payroll, we know the right payroll outsourcing partner keeps payments seamless and compliant.

Here’s how today’s top payroll services compare on pricing, capabilities, and global reach:

Want to understand how outsourced payroll models actually work behind these providers? Read our article on "Outsourced Payroll Services: Explained".

Which are the top 10 payroll providers for contractors in 2025?[toc=Top 10 Providers]

Having supported global founders and HR leaders in optimizing payroll and contractor operations, we’ve rounded up the top 10 payroll providers for contractors, so you can see which one truly fits your needs.

Let’s take a look at the top 10 payroll providers that make paying and managing contractors easier than ever:

1. Wisemonk

Wisemonk helps global companies hire and pay contractors in India without setting up a local entity. It combines payroll outsourcing, compliance, onboarding, and equipment procurement under one EOR-led model.

Key Features:

- Full payroll outsourcing and contractor management

- Local compliance and statutory tax handling

- Onboarding and documentation support

- Global payment facilitation

- Equipment procurement and day-one readiness

2. Gusto

Gusto is ideal for U.S.-based small businesses managing 1099 contractors. It automates payments, filings, and basic HR workflows.

Key Features:

- Automated 1099 filings and payments

- Direct deposit (including next day direct deposit) and contractor self-service

- Built-in time tracking and reports

- Integrations with QuickBooks and Xero

3. QuickBooks Payroll

QuickBooks Payroll simplifies contractor payments alongside bookkeeping, great for small teams already using QuickBooks accounting.

Key Features:

- Automatic creation and e-filing of 1099s and W-2s, ensuring both contractors and employees are reported accurately at year-end.

- Direct deposit and contractor tracking

- Payroll synced with accounting

- Simple dashboard for payments and taxes

4. Deel

Deel is a global payroll and compliance platform that supports contractors in over 150 countries.

Key Features:

- Multi-currency contractor payments

- Localized tax forms and contracts

- Compliance guardrails and classification tools

- Unified platform for global payroll

5. Remote

Remote helps businesses manage international contractors with strong compliance and onboarding tools.

Key Features:

- Global onboarding and payments

- Localized contracts and tax documentation

- Classification risk protection

- Invoicing automation and analytics

6. Square Payroll

Square Payroll is a straightforward solution for U.S.-based small businesses managing 1099 contractors.

Key Features:

- Automated 1099-NEC filing

- Direct deposit and digital paystubs

- Integrations with Square POS

- Easy dashboard for small teams

7. OnPay

OnPay offers simple, affordable payroll for U.S. small businesses paying contractors and employees.

Key Features:

- Contractor onboarding and W-9 collection

- Automated 1099 filing and payments

- Direct deposit and recurring pay runs

- Payroll and HR reporting

8. Papaya Global

Papaya Global provides global payroll and contractor management for mid-sized and enterprise companies.

Key Features:

- Global contractor payments in 160+ countries

- Multi-currency payroll management

- Localized compliance and onboarding

- Detailed payroll analytics and dashboards

9. Paychex

Paychex is a trusted payroll provider for established U.S. businesses managing contractors and employees together.

Key Features:

- Automated 1099 filings and W-2s, with built-in e-filing and year-end reporting to the IRS.

- Tax filing and year-end reporting

- Payroll analytics and HR tools

- Time tracking integration

10. ADP

ADP offers enterprise-level payroll and compliance solutions for large contractor teams.

Key Features:

- Multi-country payroll and contractor management

- Advanced reporting and analytics

- Tax and compliance automation

- Integrations with HR and ERP systems

You might also want to know about payroll compliance, technology across regions, and HR integration, so check out our detailed blog on "Global Payroll Services: Complete Comparison Guide".

What’s the difference between payroll for employees and contractors?[toc=Payroll: Contractor vs. Employee]

While both employees and contractors need to be paid accurately, the payroll process for each is completely different, especially in how taxes, compliance, and benefits are handled. Based on our experience helping global companies manage payroll, compliance, and contractor operations,

Here’s how payroll for employees and contractors differs:

Employee payroll focuses on deductions, benefits, and labor compliance, while contractor payroll emphasizes flexibility, invoice-based payments, and tax independence.

For more information, Read our resource on "W-9 vs. W-2: Differences Explained".

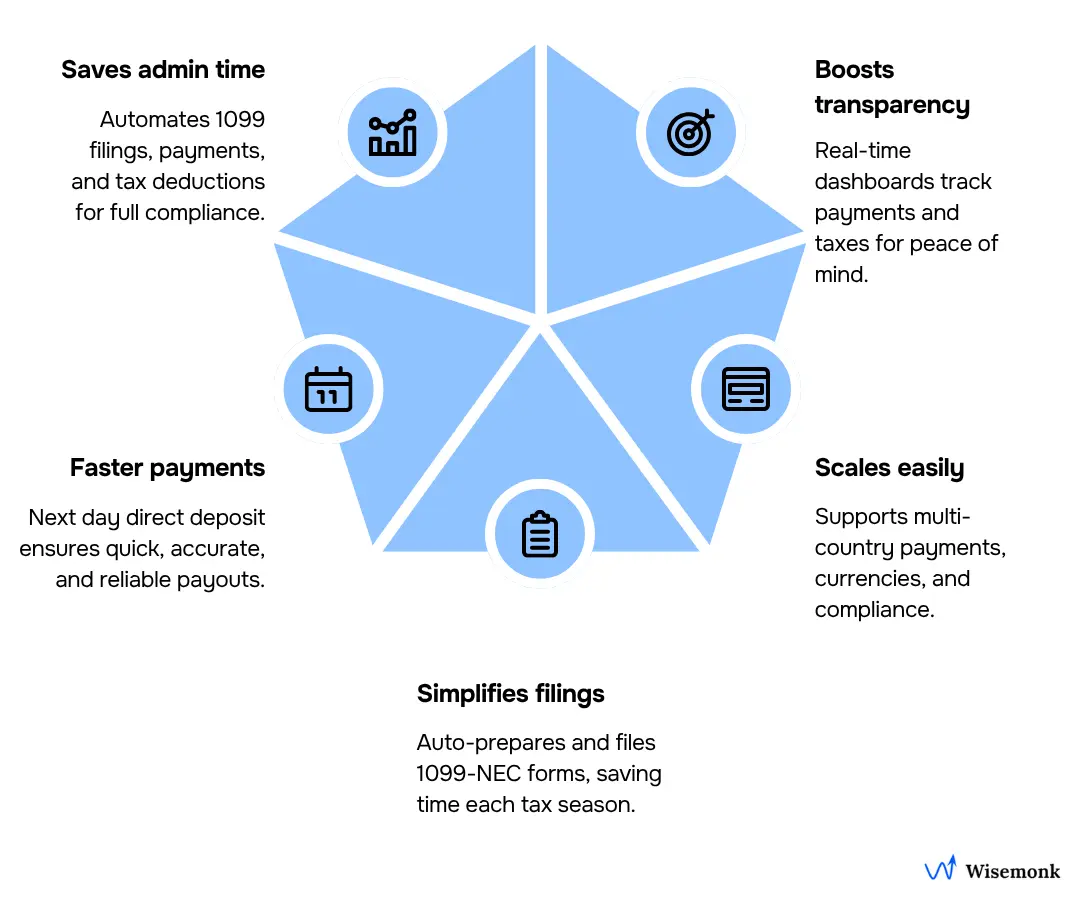

What are the real benefits of using payroll services for contractors?[toc=Benefits]

Handling contractor payments manually can slow you down, create compliance headaches, and risk late or inaccurate payouts. Payroll services for contractors simplify this entire process, automating payments, tax filings, and compliance so businesses can focus on growth instead of paperwork.

Key Benefits of using payroll services for contractors:

- Saves admin time and reduces compliance risks: Automates 1099 filings, payments, and local tax deductions, ensuring full legal compliance and fewer manual errors.

- Enables faster payments and better contractor experience: Platforms offering next day direct deposit improve payout speed, accuracy, and contractor satisfaction, helping contractors get paid quickly and reliably.

- Simplifies 1099 management and year-end filings: Automatically prepares and files 1099-NEC forms, saving finance teams hours during tax season.

- Scales easily as your contractor base grows: Handles multi-country payments, currencies, and compliance as your business expands globally.

- Improves accuracy and transparency: Real-time dashboards provide payment tracking, compliance reports, and tax summaries for full visibility, giving businesses and contractors complete peace of mind with every payout.

If you’re unsure whether to manage payroll internally or outsource it, check out our detailed guide on "In-House Payroll vs Outsourcing: Key Differences Explained".

What compliance risks should companies watch for when paying contractors?[toc=Compliance Risks]

From our work helping fast-growing global teams manage compliance and payroll across markets, we’ve identified the biggest risks companies face when paying contractors.

Here are the major risks to watch out for when paying contractors:

- Worker Misclassification: Treating a contractor as an employee (or vice versa) can lead to audits, penalties, and back payments of taxes, benefits, and workers compensation coverage.

- Tax Reporting Errors: Missing or misreporting tax information, such as 1099-NEC filings or incorrect withholdings, can result in IRS fines and local tax issues.

- Payment Delays and Cash Flow Disruptions: Inconsistent payroll cycles or failing to offer next day direct deposit can hurt contractor relationships and delay project delivery.

- Lack of Local Compliance: Ignoring country-specific rules like minimum wage, working hours, or labor registration can cause legal disputes and financial penalties.

- Inadequate Contracts or Documentation: Without well-defined SOWs, signed contracts, and verified mileage tracking or expense records, businesses risk misreported payments and audit failures.

- Data Privacy & Security Gaps: Mishandling sensitive contractor data (bank details, tax IDs) violates data protection laws such as GDPR or India’s DPDP Act.

- Unregistered Business Presence: Paying contractors in foreign countries without a local entity may create a “permanent establishment” risk, implying you’re operating illegally in that region.

To learn how to correctly classify independent contractors and employees, and avoid costly misclassification risks, check out our detailed guide on "Independent Contractor vs Employee: Differences Explained".

What features differentiate payroll services beyond contractor payments?[toc=Payroll Services Beyond Payments]

Beyond simply processing contractor or employee payments, modern payroll services distinguish themselves by offering comprehensive HR capabilities, advanced time and attendance tracking, and seamless integrations with other core business tools.

Key Differentiating Features Include:

Integrated HR & Benefits Management

Today’s leading payroll platforms operate as full-fledged Human Capital Management (HCM) systems, giving companies a unified source of truth for their workforce data.

- Benefits Administration: Simplifies management of health, dental, vision, and retirement plans (like 401(k)s) through automated deductions and direct carrier connections.

- Employee Onboarding: Provides self-service portals where new hires can complete W-4, I-9, or W-9 forms and set up direct deposits, minimizing HR’s manual workload.

- HR Support and Compliance: Gives access to HR experts, customizable handbooks, and automated alerts to stay aligned with constantly changing labor regulations.

- Performance Management: Enables ongoing goal tracking, review cycles, and development planning for a more engaged workforce.

Scalability and Integration

The best payroll services grow with your business and integrate effortlessly with your existing ecosystem.

- Accounting Software Integration: Sync payroll data directly with accounting tools such as QuickBooks or Xero to keep records accurate and eliminate double entry.

- API and Third-Party Connectivity: Open APIs and mobile app marketplaces support connections with ERP systems, project management, and expense tracking tools.

- Scalability: Designed to handle business growth, whether you’re expanding to new states, adding global independent contractors, or increasing workforce size, without a system rebuild.

Enhanced Service and Guarantees

Full-service providers differentiate further through added security and support.

- Tax Penalty Guarantees: Many vendors promise to cover any penalties or interest that arise due to their own filing errors.

- Dedicated Support: Access to certified payroll specialists or account managers ensures faster resolution of complex payroll and compliance issues.

For more information on the integration of payroll and HR, check out our detailed guide on "Payroll vs HR: Integration Guide".

What is the payroll process for Independent Contractors?[toc=Payroll Process]

Managing payroll for independent contractors is different from handling employee payroll. Here’s a quick look at the key steps involved in processing contractor payments correctly:

- Determine worker classification: Confirm whether the individual qualifies as an employee or an independent contractor.

- Sign a contractor agreement: Define project scope, deliverables, and payment terms clearly in writing.

- Collect required IRS forms: Obtain the completed W-9 form before issuing any payment method.

- Process payments and invoices: Pay contractors according to agreed terms and issue digital pay stubs, important documents or receipts for transparency.

- Year end tax documents: Issue Form 1099-NEC at year-end, report total contractor payments made during the tax year to the IRS.

Independent Contractor Payroll Taxes

Independent contractors are self-employed professionals responsible for managing and paying their own taxes. They must make quarterly estimated payments and file an annual return covering:

- Self-Employment Tax: Covers Social Security and Medicare contributions (similar to those withheld from W-2 employees).

- Federal Income Tax: Paid directly by the contractor based on their income and deductions.

Employers don’t withhold taxes from contractor payments, and contractors aren’t subject to Federal Unemployment Tax (FUTA) or employer-side Social Security and Medicare contributions.

Curious about how biweekly paychecks affect your payroll planning? Learn how many paychecks you'll have in 2026 with biweekly payroll and optimize your financial forecasting.

How can you choose the best payroll service for contractors?[toc=Find Right Partner]

Having helped founders and HR professionals simplify contractor payroll across markets, we’ve learned what really matters when choosing the right full service payroll for contractors.

Here’s how to choose the best payroll provider for 1099 contractors:

- Evaluate based on features, cost, compliance coverage, and scalability: Look for automation in 1099 filing, local compliance tools, and the ability to support both U.S. and global independent contractors as you scale.

- Compare pricing models (per-contractor, per-payment, flat subscription): Understand whether costs increase with each pay schedules or contractor, and check for added charges on currency conversions or filings.

- Consider integration needs and support quality: Choose one platform that connects easily with your accounting, HR software, or project management tools, and offers fast, knowledgeable customer support.

- Watch for hidden fees or limited global reach: Avoid providers that charge extra for filings, tax forms, or international payments. Ensure they operate in all your target countries.

When you find a payroll partner that handles compliance and payments seamlessly, you’ll spend less time managing spreadsheets and more time growing your business.

How does Wisemonk simplify contractor payroll for global teams?[toc=Why Choose Wisemonk]

Wisemonk is a leading Employer of Record (EOR) and Professional Employer Organization (PEO) in India, helping global companies hire, pay, and manage talents without setting up a local entity.

Here’s how we help you manage compliant, stress-free contractor payroll:

- Contractor Payroll & Compliance Management: We manage all aspects of contractor payments, tax deductions, and statutory documentation to ensure full compliance with Indian labor and tax laws.

- Seamless Onboarding: From background verification to contract generation and bank verification, we onboard contractors quickly and efficiently.

- End-to-End Payroll Outsourcing: We automate contractor payments, manage currency conversions, and provide transparent payroll reporting for complete visibility.

- Timely Compliance and Reporting: Our experts ensure accurate tax filings, timely documentation, and adherence to all regulatory requirements, no missed deadlines or penalties.

If you’re struggling to manage contractor payroll or compliance across borders, Talk to our experts and make global payments faster, simpler, and fully compliant.

Frequently asked questions

What is the best payroll service for a small business?

For small businesses, tools like Gusto, QuickBooks Payroll, and OnPay stand out for simplicity, automation, and built-in 1099 management. If you hire globally, consider platforms like Deel or Remote that handle international contractor payments and compliance.

Is it better to get paid through an LLC or 1099?

It depends on your setup. Getting paid through an LLC can offer tax flexibility and liability protection, while 1099 income is simpler but taxed as self-employment. Independent Contractors who work with multiple clients often stick with 1099s, while those earning consistently from one source might benefit from forming an LLC. Refer: "Independent Contractor vs LLC: Key Differences".

Is it better to outsource payroll or do it myself?

If you have only a few 1099 contractors and simple payments, doing it yourself can work. But once compliance, taxes, or multiple locations are involved, outsourcing saves time, reduces risk, avoids costly mistakes and ensures accuracy. Most small businesses switch to payroll services once they reach five or more regular contractors.

What is the average cost of a payroll service?

Payroll services typically cost $20–$45 per month base fee plus $4–$10 per contractor or employee. Global payroll or EOR platforms may charge $25–$49 per contractor due to compliance and currency support. Read more: "Payroll Services Cost Comparison: The Ultimate Guide".

What is the cheapest payroll service for one employee?

For a single contractor or employee, Square Payroll and Patriot Software are among the most affordable, starting around $10–$20/month. They’re ideal for freelancers, solopreneurs, or micro-teams managing basic 1099 payments.

Is there a free payroll service?

A few tools like Wave Payroll (limited) or Excel/Google Sheets templates can help track payments for free, but they lack tax filing, 1099 automation, and compliance. True payroll services usually charge a small monthly fee for these must-have features.

How do most people pay contractors?

Most companies use direct deposit or automated payroll platforms like Gusto, Deel, or QuickBooks. Global businesses prefer tools with multi-currency payouts, automated invoices, and tax compliance, ensuring contractors get paid accurately and on time.

.webp)

.png)

%20(1).webp)