Are you confident that your company is correctly calculating overtime for all your employees? Misclassifying employees and failing to calculate overtime accurately can result in costly penalties for your organization.

Under the Fair Labor Standards Act (FLSA), non-exempt employees must be paid 1.5 times their regular hourly rate for any hours worked beyond 40 in a workweek.

With different rules across states and recent updates to the 2025 overtime regulations, staying compliant can feel like a moving target. Amid all this, how can you ensure your overtime calculations are accurate?

In this guide, we’ll cover the basics of overtime pay, common mistakes to avoid, and how to stay compliant with federal and state laws, making your payroll more efficient.

Legal Framework Governing Overtime in the U.S.

To ensure that your employees are being paid fairly and that you remain compliant, it’s essential to understand how overtime pay works. In the United States, the primary rules are established by the Fair Labor Standards Act (FLSA), but some states have enacted their own stricter laws. You need to know both to stay compliant. Take a look at these below:

1. Fair Labor Standards Act (FLSA)

The FLSA sets the federal rules for minimum wage, overtime pay, recordkeeping, and youth employment.

Overtime Pay Requirement

Nonexempt employees must receive overtime pay at a rate of at least one and one-half times their regular rate of pay for all hours worked over 40 in a single workweek.

Exemptions

Some employees are exempt from the FLSA's overtime pay requirements. These exemptions apply to certain executive, administrative, professional, outside sales, and computer employees, but only if they meet specific salary and job duties tests.

- As of now, due to a court ruling, the 2019 salary thresholds are in effect:

- Standard salary level: $684 per week

- Highly compensated employees: $107,432 total annual compensation

Note: A 2024 final rule proposed higher salary thresholds, but a federal court in Texas vacated it. Legal challenges are ongoing, and future updates may change the enforcement status. As an employer, checking for updates in these rules is very crucial.

You can visit here for more details on this act or for future updates.

2. State-Specific Overtime Laws

While the FLSA sets the federal standard, many states have their own overtime laws that may offer greater protections:

- Salary Thresholds: Some states have established higher minimum salary thresholds for exempt employees. For example, as of January 1, 2025, New York City requires exempt employees to earn at least $1,237.50 per week.

Take a look at the table below to find out if your state has a higher minimum salary than the federal standard:

Exempt Employee Salary Thresholds by State ( as of January 1, 2025)

- Duties Tests: State laws may have different criteria for determining exempt status. It's important to review both federal and state regulations to ensure proper classification.

Due to regular changes in overtime laws, it’s important to keep up with the latest updates in your state. If keeping track takes time away from running your business, consider partnering with an Employer of Record (EOR) to handle overtime pay calculations and ensure compliance.

To clarify overtime payments, it’s helpful to understand how they are calculated. Read below.

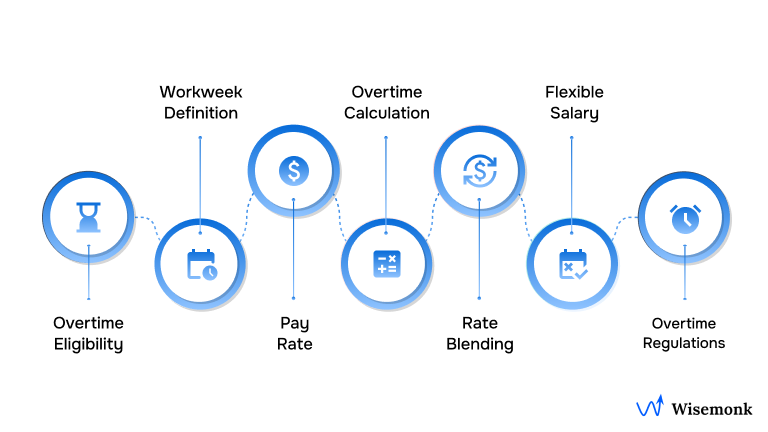

How Overtime Is Calculated

Let’s face it, overtime rules in the U.S. can be confusing, time-consuming, and risky to get wrong. Between changing regulations, multi-state compliance, and varying pay structures, it's easy to make costly mistakes.

If you’re managing payroll for teams across the U.S. or globally, these mistakes can snowball into legal trouble or unhappy employees.

Here’s a clear, step-by-step guide to help you calculate overtime pay accurately, stay compliant, and avoid payroll headaches.

1. Determine Overtime Eligibility (Non‑Exempt Status)

As discussed before, exempt employees are generally excluded from overtime and typically fall under specific roles:

- Executive

- Administrative

- Professional

- Outside sales

- Certain computer-related occupations

To qualify as exempt, employees must also meet salary thresholds. As of now, the federal salary threshold remains at $684/week ($35,568/year). Proposed updates increasing this limit were legally challenged and are not in effect.

2. Define the Workweek

A workweek is any fixed and recurring period of 168 hours (seven consecutive 24-hour days). It may begin on any day of the week and at any hour, but must remain consistent.

Employers must calculate overtime on a per-workweek basis, not by pay period or by averaging hours across multiple weeks.

3. Determine the Regular Rate of Pay

The regular rate is the employee’s actual hourly rate for the week and must include:

- Base hourly wage

- Non-discretionary bonuses

- Commissions

- Shift differentials

- Other incentive pay

For hourly workers, the regular rate is typically the hourly wage.

For salaried, non-exempt workers: divide the weekly salary by the total hours worked that week.

Example:

- Weekly salary = $800

- Hours worked = 45

- Regular rate = $800 ÷ 45 = $17.78

The regular rate must be recalculated weekly if total compensation or hours vary.

4. Calculate Standard Overtime Pay

Under FLSA, overtime pay is calculated at 1.5 times the regular rate for every hour worked beyond 40 in a workweek.

Formula:

Overtime Pay = Regular Rate × 1.5 × Overtime Hours

Example:

- Hourly rate = $20

- Hours worked = 46

- Regular pay = 40 × $20 = $800

- Overtime pay = 6 × ($20 × 1.5) = $180

- Total pay = $800 + $180 = $980

5. Account for Multiple Pay Rates and Bonuses

Employees working multiple roles with different pay rates or receiving bonuses require a blended regular rate.

Steps:

- Multiply hours worked at each rate and add all compensation.

- Add any non-discretionary bonuses.

- Divide total compensation by total hours worked.

- Multiply overtime hours by 1.5 times the blended rate.

Example:

- 35 hours @ $15 = $525

- 10 hours @ $20 = $200

- Total hours = 45

- Total straight pay = $725

- Regular rate = $725 ÷ 45 = $16.11

- Overtime hours = 5

- Overtime premium = 5 × $16.11 × 0.5 = $40.28

- Total pay = $725 + $40.28 = $765.28

6. Fluctuating Workweek Method for Salaried Employees

The FLSA permits a special method for salaried, non-exempt employees who work fluctuating hours. This is known as the fluctuating workweek method, and the following conditions must be met:

- The employee is paid a fixed salary for all hours worked.

- Their hours vary from week to week.

- The salary covers straight-time pay for all hours.

- They are paid at least half-time for hours over 40.

Example:

- Weekly salary = $900

- Hours worked = 55

- Regular rate = $900 ÷ 55 = $16.36

- Overtime premium = 15 × $16.36 × 0.5 = $122.70

- Total pay = $900 + $122.70 = $1,022.70

Note: This method must be applied carefully and documented to avoid non-compliance. You can seek the assistance of an expert experienced in payroll and compliance.

7. Understand State-Specific Rules and Daily Overtime

Some states enforce additional overtime requirements that go beyond federal law. Employers must follow whichever rule benefits the employee more.

California example:

- Over 8 hours in a single workday = time and a half

- Over 12 hours = double time

- Seventh consecutive workday = daily overtime rules apply

Other states like Alaska, Nevada, and Colorado also have similar provisions, especially for daily overtime or specific industries (e.g., manufacturing in Oregon).

Calculating overtime pay may come with certain challenges. Read them below so that you’re prepared to tackle them in advance.

Common Challenges in Overtime Calculation for Businesses Hiring in India

Overtime management may become complex due to varied labor laws, state-specific regulations, and evolving work environments. Here's a snapshot of the main challenges:

1. Employee Misclassification

Misclassifying employees as exempt can lead to costly penalties.. Always verify classifications to avoid issues.

2. Inaccurate Time Tracking

Manual time tracking is prone to errors. Automating time tracking ensures accurate data and reduces compliance risks.

3. Complex Compensation Structures

Employees with bonuses or commissions need their full compensation included in overtime calculations. Be mindful of all pay elements to ensure fairness.

4. State-Specific Regulations

Some states have stricter overtime laws than the federal standard. For example, California requires overtime pay for any hours worked over 8 in a day or 40 in a week. Always check state regulations to stay compliant.

To tackle these challenges, consider partnering with a trusted expert in payroll, hiring, and compliance. With the right support, you can ensure accurate overtime management while staying focused on growing your business.

Simplifying Overtime Management for Your Business

Missteps in overtime management can lead to costly penalties, employee dissatisfaction, and legal complications. If you’re struggling with the complexities of overtime calculations and ever-changing labor laws, there’s a way to make it easier.

Let Wisemonk take the burden off your shoulders. We handle compliance calculations to ensure your overtime pay is accurate and timely. We offer customizable benefits administration, streamlined employee onboarding, and comprehensive support. These solutions help you stay compliant and maintain a fair, transparent workplace.

Ready to simplify overtime management and stay 100% compliant? Let Wisemonk handle the complexities, so you can focus on growing your business and empowering your team. Book a free consultation today and make every hour count.

Frequently asked questions

Who qualifies for overtime pay under U.S. labor laws?

Not all employees are eligible for overtime; eligibility depends on whether the employee is classified as “exempt” or “non-exempt” under the Fair Labor Standards Act (FLSA). Non-exempt employees are entitled to overtime pay, while exempt employees (like certain executives or professionals) are not. Employers must carefully classify workers to stay compliant.

What is the standard overtime pay rate in the U.S.?

The FLSA requires overtime to be paid at least 1.5 times the employee’s regular hourly rate for hours worked beyond 40 in a week. Some states have stricter rules, offering daily overtime or higher multipliers. Employers need to check both federal and state regulations to ensure compliance.

Do salaried employees receive overtime pay?

Salaried employees can receive overtime if they are considered non-exempt under the FLSA. Their regular rate is calculated by dividing weekly salary by the number of hours it is intended to cover, then applying the 1.5x multiplier to any extra hours. Exempt salaried employees, however, are not entitled to overtime regardless of hours worked.

How does overtime apply to remote workers?

Remote employees are covered by the same overtime rules as on-site employees. Employers must track hours accurately through timesheets or digital tracking tools to avoid disputes. Clear communication of work-hour expectations is crucial when managing remote teams.

Can employers offer comp time instead of overtime pay?

In the private sector, offering compensatory time off (comp time) in place of overtime pay is generally not allowed under federal law. However, public-sector employers may legally use comp time arrangements. Businesses should verify state-specific laws before considering this option.

What are the consequences of not paying overtime correctly?

Failing to pay overtime can lead to wage claims, back pay liabilities, and penalties from the Department of Labor. Employers may also face lawsuits, interest charges, and reputational harm. Ensuring accurate overtime tracking and payment protects both compliance and employee trust.

How can payroll software help manage overtime compliance?

Modern payroll systems automatically calculate overtime based on configured rules, ensuring accurate and timely payments. They also generate compliance reports, helping businesses avoid legal risks. For global teams, these tools adjust calculations to align with local labor laws.

%20(1).webp)

%20(1).webp)

%20(1).webp)