- A payroll advance is a short-term loan from an employer that lets employees access part of their earned wages before payday. It helps cover urgent expenses while repayment is deducted from the next paycheck.

- The key considerations when offering a payroll advance are compliance, cash flow, and fairness in policy. Employers should set clear eligibility, repayment rules, maintain trust.

- The steps to set up a payroll advance program are defining its purpose, setting clear rules, automating compliance, and reviewing regularly for fairness and control.

- The best alternatives to payroll advances are earned wage access, on-demand pay, and employee loans, health care financing, 401(k) loans, or wellness programs to support long-term financial stability.

Need help managing payroll advances? Contact us today!

Discover how Wisemonk creates impactful and reliable content.

Confused about how a payroll advance really works or whether it’s right for your team? You’re not alone; many US employers and global founders struggle to balance helping employees with quick cash needs while keeping payroll compliant and organized.

The truth is, giving an early paycheck sounds simple, but it can get tricky fast with taxes, policies, and legal rules in play.

In this article, we’ll break down what a payroll advance is, how it works, and the right way to set it up, so you can support your employees without creating payroll chaos. Let’s break it down.

What is a payroll advance?[toc=Payroll Advance]

A payroll advance, also called a salary advance or paycheck advance, is essentially a short-term loan from an employer to an employee to cover expenses between pay periods. Instead of waiting for the next payday, you receive a portion of your upcoming wages early, and it’s later deducted from your future paycheck.

Let’s look at how payroll advances stand apart from other paycheck options:

- Payroll Advance vs. Payday Loans: A payroll advance lets you access wages you’ve already earned, usually with no interest or fees. Payday loans come from third-party lenders, charge sky-high rates (often 300–400% APR), and can trap you in debt.

- Payroll Advance vs. Employee Loans: Employee loans are larger, long-term, and may include interest or paperwork. Payroll advances are smaller, short-term, and repaid automatically through your next paycheck.

- Payroll Advance vs. Earned Wage Access (EWA): EWA is like a digital version of a payroll advance. Instead of your company managing it manually, employees use an app to access earned wages instantly, and repayment happens automatically at payday.

Now that you understand what a payroll advance is and how it differs from other pay options, let’s take a closer look at how it actually works.

How do paycheck advances work?[toc=How it Works]

Understanding how payroll advances work is crucial for employers aiming to support their workforce responsibly while maintaining payroll accuracy and compliance.

Based on our experience helping global companies manage payroll and compliance through our EOR and HR operations solutions, here’s how the paycheck advance process typically works from request to repayment.

1. Request and approval: You (the employee) submit a formal request for an advance. Your employer or a partnered app reviews it, confirming you’ve already earned the wages and that you meet eligibility criteria, like a minimum tenure or good standing.

2. Issuing funds: Once approved, the money is released either as an off-cycle payroll payment or instantly through a third-party app such as Payactiv or DailyPay.

3. Repayment: The advance is later deducted automatically from your next paycheck (or split over several). Employers must ensure the deduction doesn’t reduce your pay below the federal or state minimum wage, keeping everything fair and compliant.

Want to learn how payroll deductions work after a payroll advance? Check out our simple guide on "What Are Payroll Deductions? Types, Rules & Employer Guide''.

Are payroll advances legal, and how are they taxed?[toc=Legal & Tax Implication]

Yes, payroll advances are legal in most countries, including the U.S., as long as they follow federal and state labor laws. Employers can lend employees a portion of earned wages early, provided it’s documented, voluntary, and doesn’t reduce take-home pay below minimum wage.

However, every payroll advance comes with specific legal and tax implications, so it’s important to handle them transparently and in full compliance with labor and payroll regulations.

Legality:

- Federal law: The Fair Labor Standards Act (FLSA) allows payroll advances but requires that deductions for repayment never push wages below the federal minimum.

- State laws: Some states require written consent or limit how often advances can be issued. Always document the arrangement and repayment schedule.

- Employer policy: Most companies create internal approval procedures to stay compliant and avoid payroll disputes.

Tax implications:

- Payroll advances aren’t taxed when you first receive them because they’re just an early payment of your regular wages.

- When the actual payday arrives, all normal payroll taxes, like federal, state, Social Security, and Medicare, are withheld from your full paycheck as usual.

- Proper recordkeeping ensures that the advance and repayment show up correctly in payroll and year-end tax reports.

You might be interested in knowing how payroll taxes differ from income taxes, check out our article on "Understanding Payroll Tax vs Income Tax Differences" to get a clear breakdown.

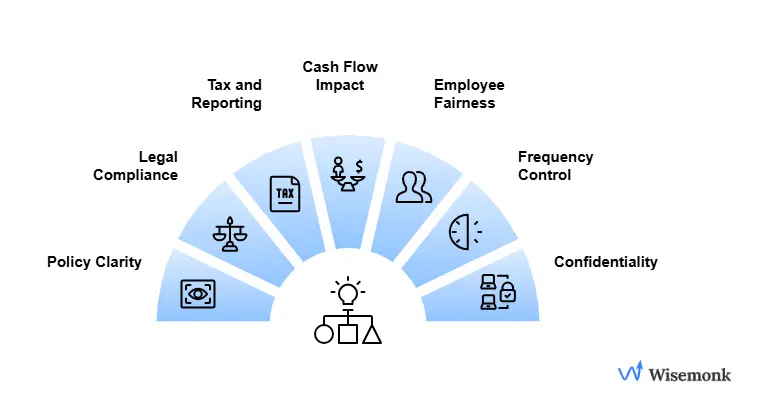

What key considerations should employers keep in mind before offering a payroll advance?[toc=Considerations for Employers]

Employers need to evaluate how such advances affect payroll accuracy, compliance, and overall company cash flow before implementing them responsibly.

From our extensive experience helping global businesses streamline payroll and compliance with EOR solutions, these are the critical points to consider before approving or setting up payroll advances.

- Policy clarity: Define eligibility, limits, and repayment terms in writing to prevent confusion or misuse.

- Legal compliance: Review local and federal wage laws to ensure deductions never push pay below the minimum wage.

- Tax and reporting: Track advances properly in payroll systems so repayments and taxes are accurately reflected.

- Cash flow impact: Assess how frequent advances affect company liquidity, especially for small or growing businesses.

- Employee fairness: Apply consistent criteria for approvals to avoid favoritism or perceived bias.

- Frequency control: Limit how often advances can be requested to discourage dependency.

- Confidentiality: Handle employee financial requests discreetly to maintain trust.

When done thoughtfully, payroll advances can strengthen employee trust and financial stability, but only if employers balance empathy with clear policies, compliance, and control.

What are the pros and cons of payroll advances?[toc=Pros & Cons of Payroll Advances]

Having helped international businesses streamline payroll management and compliance, we understand the main pros and cons of payroll advances employers need to evaluate.

Curious about how much payroll services actually cost and which model fits your business best? Check out our detailed breakdown on "Affordable Payroll Services: Pricing Comparison"

How can employers offer and process a salary advance step by step?[toc=How Employers Process]

Offering a wage advance shouldn’t feel complicated. Having supported companies across industries with payroll and compliance management via our EOR platform, here’s a clear look at how the payroll advance process should be handled from start to finish.

1. Set clear rules: Define who can request an advance, the maximum advance amount, and how repayment will work. Make sure deductions never reduce pay below the federal minimum wage.

2. Accept and review the request: Have the employee submit a payroll advance request explaining the reason, desired amount, and repayment plan.

3. Verify eligibility and earnings: Confirm the employee’s earned wages and check for any outstanding advances.

4. Sign a payroll advance agreement: Clearly document the repayment schedule, employee consent, and deduction details. Both HR and the employee should sign it.

5. Process payment: Use payroll software or an off-cycle payment to transfer funds via direct deposit.

6. Deduct repayment: On the next paycheck, automatically deduct the agreed amount while maintaining compliance with wage laws.

7. Communicate clearly: Remind employees their next paycheck will be smaller and offer guidance or financial wellness resources if needed.

When done right, a payroll advance process not only helps employees handle unexpected expenses and short-term financial needs but also reinforces trust, transparency, and compliance within your organization.

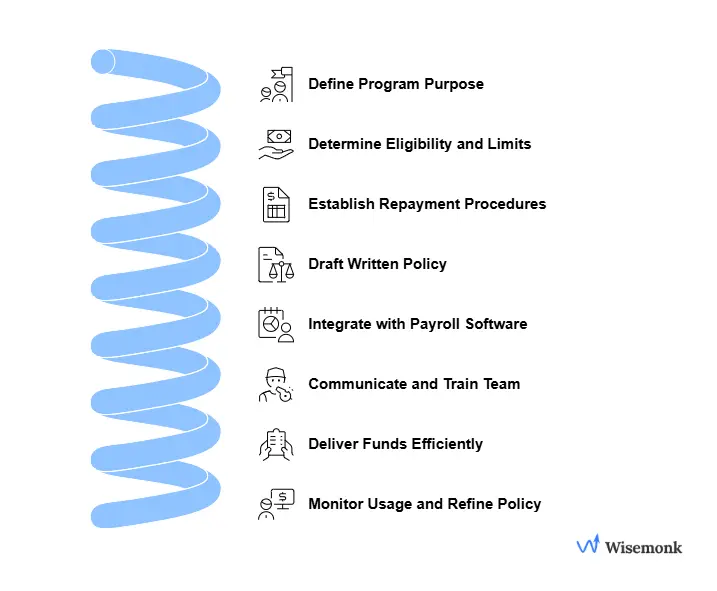

How to set up a payroll advance program and policy?[toc=How to Set Up]

Through our experience helping companies manage EOR, payroll, and compliance operations, we’ve outlined how to set up a payroll advance program and policy that protects your business while supporting your team’s financial wellness.

Define the program’s purpose clearly:

Start by identifying why you’re offering payroll advances, for emergency financial assistance, unexpected expenses, or to improve employee satisfaction. Having a clear goal helps shape your policy and ensures alignment with company values and financial capacity.

Determine eligibility and limits:

Set eligibility criteria such as job type, tenure, and employment status. Many employers limit advances to permanent employees who’ve completed their probation period. Define how much can be advanced (typically 30–50% of earned wages) and how often employees can request one to avoid overuse.

Establish repayment and approval procedures:

Document the approval workflow, who can approve, how requests are submitted, and how repayments are managed. Clarify repayment schedules, whether through full deduction in the next paycheck or installment-based payroll deductions. Always stay compliant with minimum wage and tax laws when making deductions.

Draft a written payroll advance policy:

Create a clear policy document that outlines every step: eligibility, request process, repayment plan, and repayment schedule. Include a mandatory payroll advance agreement for employees to sign before receiving funds, this protects both employer and employee and ensures transparency.

Integrate with payroll software:

Automation makes all the difference. Use modern payroll software that supports off-cycle payments, repayment tracking, and compliance checks. It minimizes human error and gives HR visibility into outstanding advances. Some systems, like earned wage access (EWA) tools, even automate approvals and repayments entirely.

Communicate and train your team:

Train HR and payroll staff to handle advance requests consistently and sensitively. Employees should know how to request an advance, who will review it, and what the repayment terms are. Make your policy easily accessible in the employee handbook or HR portal.

Deliver funds efficiently:

Once approved, decide how you’ll disburse the advance, direct deposit, off-cycle payment, or a separate check. Ensure quick, smooth processing so employees can get funds when they need them most, without disrupting your regular pay cycle.

Monitor usage and refine your policy:

Keep track of how often payroll advances are requested and why. Frequent requests might signal underlying financial stress, in which case, consider offering earned wage access, financial wellness programs, or emergency funds instead.

When structured properly, a payroll advance program helps employees access funds responsibly while keeping the company compliant, consistent, and financially balanced.

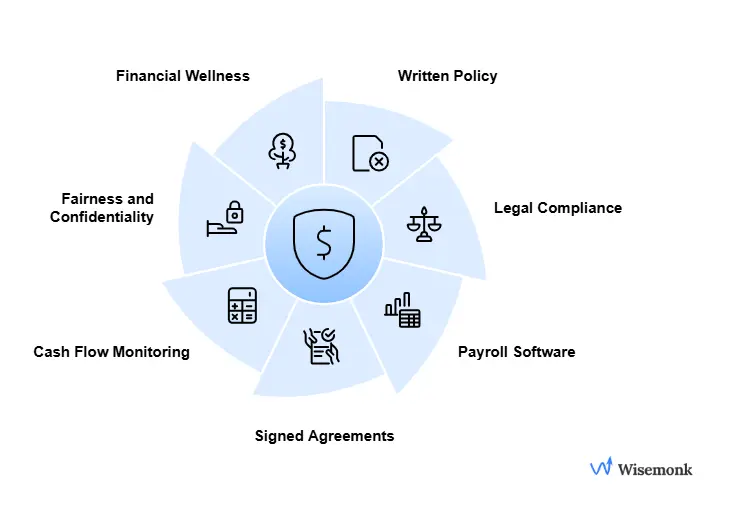

What are the best practices for managing payroll advances?[toc=Best Practices]

With our experience helping companies manage EOR, payroll, and compliance operations, here are the best practices for managing salary advances that balance employee financial wellness with business stability.

1. Set a written policy: Define eligibility, advance limits, and repayment terms clearly in your payroll advance policy to avoid confusion or misuse.

2. Ensure legal compliance: Always follow federal minimum wage laws and verify that repayment deductions don’t lower take-home pay below legal limits.

3. Use payroll software: Automate tracking, off-cycle payments, and advance repayment through your payroll system to reduce manual errors.

4. Require signed agreements: Have every employee sign a payroll advance agreement outlining repayment schedules, consent for deductions, and tax implications.

5. Monitor cash flow: Track total outstanding advances and repayment timelines to prevent strain on company cash flow.

6. Maintain fairness and confidentiality: Apply consistent approval criteria and handle all advance requests discreetly to build employee trust.

7. Encourage financial wellness: Pair advances with financial education or employee assistance programs to help employees manage unexpected expenses responsibly.

When managed with structure and transparency, payroll advances become a powerful financial wellness tool instead of a recurring administrative burden.

What are the best alternatives to payroll advances?[toc=Best Alternatives]

While payroll advances can help employees cover unexpected expenses, they’re not always the most sustainable or compliant long-term option for employers. Exploring alternatives to payroll advances can reduce administrative burden, improve cash flow, and promote better employee financial wellness.

Having worked with businesses to simplify payroll and employee financial management, here are the key alternatives to payroll advances that enhance employee wellbeing without adding complexity.

Looking to simplify how you manage payroll and compliance? Check out our guide on "Best Outsourced Payroll Services: Complete Guide" to find the right partner for your business.

How does Wisemonk simplify payroll advance management for global teams?[toc=How Wisemonk Simplifies]

Wisemonk is a leading Employer of Record (EOR) in India that also provides PEO services for businesses with a local entity. We help global companies simplify HR functions, payroll processing, and compliance support, making it easier to hire and manage employees in India with confidence.

We help global companies with:

- Payroll management and compliance: End-to-end payroll processing, including salary calculations, deductions, and filings, fully compliant with India’s labor and tax laws.

- Tax optimization and filings: Accurate, timely tax computation and submissions that minimize risk and ensure compliance with both local and international regulations.

- Employee benefits administration: Management of health insurance, provident fund, gratuity, and other statutory benefits tailored for your India-based employees.

- Background verification and onboarding support: Thorough background checks and seamless onboarding processes to help new hires start confidently and compliantly

- Recruitment & Talent Acquisition: We help global companies hire top talent in India, from sourcing and screening to onboarding and compliance, ensuring fast, and high-quality hires every time.

Ready to manage payroll advances seamlessly while building your team in India? Book a free demo today!

Frequently asked questions

Can I be denied a salary advance?

Yes, you can be denied a salary advance if your company doesn’t allow it or you don’t meet their policy criteria. Employers treat advances as optional, not guaranteed. It helps to ask HR, explain your reason, and check if your request fits their rules before assuming approval.

Can I ask for an advance on my paycheck?

You can ask for an advance, but approval depends on your company’s policy and cash flow. Usually, you’ll need to contact HR or payroll, state the reason, and agree to repayment from your next check. Asking is fine, just know it’s not automatic.

Are wage advances better than payday loans?

Yes, wage advances are usually safer and cheaper than payday loans. You’re just accessing money you’ve already earned, often with little or no fee. Payday loans, by contrast, carry high interest and can trap you in debt cycles.

How can I borrow money from my paycheck?

You can request a payroll advance, basically an early draw on wages you’ve already earned. Ask your HR or payroll team, fill out a form if needed, and agree to repay through your next paycheck. Remember, it’s not free money, just early access to your own pay.

Who is eligible for a salary advance?

Eligibility depends on company policy, but typically you must be a full-time employee past probation with a valid reason for the request. Always check your employee handbook or ask HR for the specific criteria before applying.

Do you have to pay back a salary advance?

Yes, every salary advance must be repaid, usually through deductions from your next paycheck or over several pay cycles. It’s not a bonus or loan forgiveness; it’s simply early access to your earned income.

What are the risks of advance salary?

The main risk is reduced pay in your next cycle, which can create financial strain or a cycle of dependence. Taking frequent advances may also signal money-management issues or cause confusion with payroll deductions. Use it rarely and plan repayments carefully.

.webp)

.png)

%20(1).webp)