- Biweekly payroll means employees are paid every 14 days, which results in 26 paychecks in most payroll calendars. Some employers may have 27 pay periods in 2026, but this depends on the first payday of the year and how holidays are handled, not the year itself.

- Salaried employees typically earn the same annual salary, which is spread across either 26 or 27 paychecks depending on the payroll calendar. Hourly employees are paid based on hours worked and may earn more only if additional hours are worked.

- An extra paycheck can impact benefit deductions and tax withholdings, requiring careful planning for both employers and employees to manage cash flow effectively and maintain accurate payroll records.

- The key difference between biweekly payroll and other pay schedules is the frequency of payments and administrative complexity, which affects budgeting, payroll processing, and employee satisfaction.

Need help managing your biweekly pay schedule? Contact us today!

Discover how Wisemonk creates impactful and reliable content.

Are you trying to figure out how many paychecks you should expect this year on a biweekly payroll without second-guessing your math or your payroll setup?

Many US founders and HR leaders are dealing with this exact question right now, especially when budgeting, planning cash flow, or responding to employee questions about why some years feel different than others.

According to the U.S. Bureau of Labor Statistic's Current Employment Statistics survey, biweekly is the most common pay period used by U.S. private establishments, with 43.0% paying employees every two weeks as of February 2023.

That widespread adoption explains why biweekly pay has become a standard payment method for many US companies. In this article, we will clearly explain how biweekly pay works, why some payroll calendars result in 27 paychecks instead of 26, and what US founders and HR teams should review in their payroll setup to avoid surprises.

What is biweekly pay period?[toc=Biweekly Payroll]

Biweekly pay period means employees are paid every two weeks, resulting in 26 paychecks per year based on a 14-day work cycle, such as every other Friday. Payments are issued on a consistent weekday every other week. While biweekly pay usually results in 26 paychecks per year, the exact number depends on how the employer’s payroll calendar aligns with the calendar year.

How does biweekly payroll work?

- Employees are paid every two weeks, resulting in 26 pay periods in most years.

- Each pay period covers 14 days, making payroll schedules predictable.

- Salaried employees: Annual salary is divided by 26 to calculate each paycheck.

- Hourly employees: Pay is based on hours worked over two weeks, including overtime.

- The consistent schedule helps employers manage payroll and helps employees budget more easily.

- The total number of paychecks in a year depends on the employer’s payroll calendar and holiday rules, not just the pay frequency.

Why some payroll calendars have 27 pay periods?[toc=27 Pay Periods]

Based on our experience helping global companies with payroll operations, compliance, and employer-of-record (EOR) management, this is how payroll calendars, holiday rules, and pay-date alignment combine to create a 27-pay-period year for some employers but not for others.

A 27th paycheck is not caused by the calendar year. It happens because biweekly payroll follows a fixed 14-day schedule that does not reset on January 1.

Here’s the simple math:

- Biweekly pay = every 14 days

- 26 pay periods = 364 days

- Most years have 365 days

That extra day does not automatically create another paycheck. A 27th pay period occurs only if the 14-day payroll cycle starts early enough in January for one more payday to fall before December 31.

How this plays out in real payroll calendars

- If your first paycheck is in the first few days of January (for example, January 1 or January 2), continuing the 14-day cycle can place the next scheduled paycheck on January 1 of the following year.

- Many employers do not issue paychecks on January 1 and instead move that payment to December 31.

- When that happens, the paycheck is counted in the current year, resulting in 27 pay periods.

If your first paycheck is later in January (for example, January 8 or January 9), the 14-day cycle ends too late to fit another payday before year-end, and you will have 26 pay periods instead.

Why this causes so much confusion

Two employees can both be paid biweekly in the same year and still have different numbers of paychecks. The difference comes from:

- The exact date of the first paycheck

- The day of the week payroll runs

- How the employer handles January 1 holidays

Common Myths About the 27th Paycheck (and the Reality)

This section breaks down the most common myths around biweekly paychecks and explains the real payroll mechanics behind why 26 or 27 pay periods can occur.

Myth 1: 2026 has 27 biweekly paychecks for everyone

Reality: The year itself doesn’t decide this. Some payroll calendars have 27 pay periods in 2026, while many others have only 26. It depends on when the first paycheck falls and how the employer handles January 1 holidays.

Myth 2: The extra day in the calendar creates a free paycheck

Reality: The extra day doesn’t create a paycheck on its own. It only allows the fixed 14-day payroll cycle to fit one more scheduled payday before December 31 if the cycle starts early enough in January.

Myth 3: A 27th paycheck means employees earn more salary

Reality: For salaried employees, total annual pay does not change. The same salary is simply spread across more pay periods, resulting in slightly smaller biweekly paychecks. Only hourly employees may earn more if they actually work more hours.

Myth 4: This happens on a predictable cycle (every 10–11 or 14 years)

Reality: Those numbers come from calendar averages, not payroll rules. In real payroll systems, holiday shifts, payday changes, and employer policies regularly break these patterns.

Myth 5: Everyone paid biweekly at the same company will see the same result

Reality: Employees paid on different weekdays or under different payroll calendars can see different outcomes, even within the same organization.

Reddit Takeaways:

"Employees paid on a biweekly schedule may see 27 paychecks depending on their payroll calendar, even within the same year. For salaried employees, this usually means the same annual salary is spread across 27 pay periods instead of 26, resulting in slightly smaller biweekly checks, not extra pay. Hourly employees, however, are typically paid for the additional hours worked during the extra pay period."

Community discussion from r/DaveRamsey on Reddit

With the basics of biweekly payroll and how payroll calendars affect pay periods out of the way, the next step is understanding how pay is calculated and how the 2026 payroll calendar affects biweekly paychecks.

How do you calculate biweekly pay for employees?[toc=How to Calculate Biweekly Pay]

With our experience helping global companies manage payroll and pay structures, we’ve broken down how to calculate biweekly pay for both salaried and hourly employees, so teams can apply the right method without confusion.

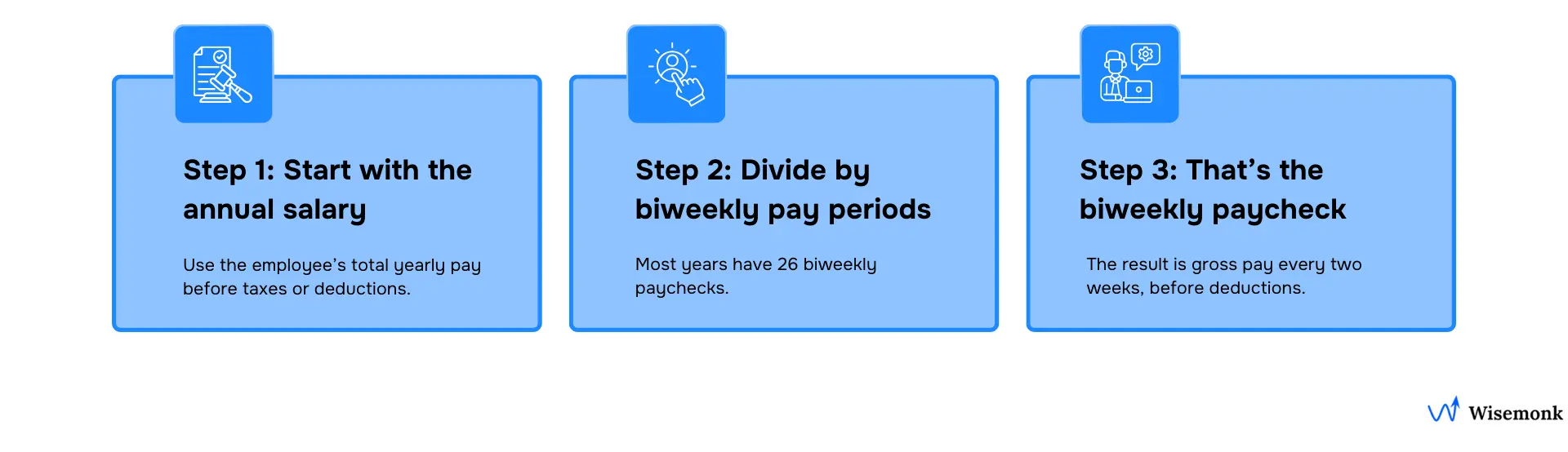

Biweekly pay for salaried employees

- Start with the annual salary: Look at the employee’s total yearly salary before taxes or deductions.

- Divide it by the number of biweekly paychecks: Most years have 26 biweekly pay periods, so you divide the salary by 26.

- That number is the biweekly paycheck: What you get is the employee’s gross pay every two weeks, before taxes, benefits, or other withholdings.

Example: If an employee earns $78,000 a year and is paid biweekly in a standard year, they receive: $78,000 ÷ 26 = $3,000 per paycheck

What happens for salaried employees in a 27-pay-period year?

In some payroll calendars, a biweekly pay schedule may result in 27 pay periods instead of the usual 26. In these years, many employers spread the same annual salary across all 27 paychecks, which leads to slightly smaller biweekly payments, while the total annual compensation remains the same.

How this adjustment is handled depends on the employer’s payroll structure and the terms outlined in the employment agreement.

Biweekly pay formula (salaried employees): Annual salary ÷ 26

(In years with an extra biweekly pay period, some employers divide the annual salary by 27 instead.)

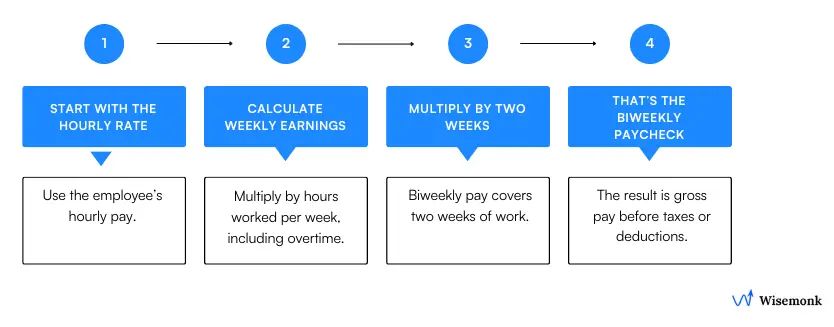

Biweekly pay for hourly employees

- Start with the hourly rate: Take the employee’s hourly pay rate.

- Figure out weekly earnings: Multiply the hourly rate by the number of hours worked in a week, including any overtime.

- Double it for two weeks: Since biweekly pay covers two weeks of work, multiply the weekly amount by 2.

- That’s the biweekly paycheck: This gives you the employee’s gross pay for the two-week period, before taxes or deductions.

Example: If an employee earns $25 per hour and works 40 hours per week: $25 × 40 × 2 = $2,000 per biweekly paycheck (gross)

What happens for hourly employees in a 27-pay-period year?

In payroll calendars that include 27 pay periods, biweekly payroll may cover additional workweeks. For hourly employees, this usually means they are paid for the additional hours worked during the extra pay period. As a result, total annual earnings can be higher, depending on actual hours worked, since pay is tied directly to time worked rather than a fixed annual salary.

Biweekly pay formula (hourly employees): Hourly rate × Hours worked per week × 2

(In years with an extra biweekly pay period, hourly employees are typically paid for the additional hours worked.)

How does biweekly pay impact salary and deductions?[toc=Salary and Deduction Impacts]

This structure does not change the employee’s annual salary; it only affects how that salary is distributed across pay periods.

In a biweekly payroll system, employees receive 26 paychecks annually. For salaried employees, their annual salary is divided by 26 to determine the gross pay per paycheck. For example, an employee earning $52,000 annually would receive $2,000 per paycheck before deductions. This consistent distribution aids in budgeting and financial planning for both employees and employers.

Deductions:

Deductions such as taxes, benefits, and retirement contributions are applied per pay period. These deductions are typically prorated over the 26 pay periods. However, in years with 27 paychecks, employers must decide whether to:

- Prorate deductions over all 27 pay periods: This results in slightly smaller deductions per paycheck.

- Adjust or pause certain deductions during the additional pay period: This approach increases the net pay for that period but requires careful communication with employees to avoid confusion.

You should ensure that deductions are adjusted appropriately to maintain compliance and avoid exceeding the annual limits for benefits, such as 401(k) contributions.

See our article on "How is bi-weekly pay calculated?" for a detailed explanation of how to calculate bi-weekly pay.

How does biweekly payroll compare with other pay schedules?[toc=Comparison: Other Pay Periods]

Through our experience supporting global companies with payroll management, and compliance operations, here’s how biweekly payroll differs from other common pay schedules and what each means for business efficiency.

Key differences between biweekly pay and other pay schedules like weekly, semi-monthly, and monthly.

Frequency of Pay

Weekly pay schedules provide the most frequent income, ideal for employees who rely on steady cash flow. However, they demand more payroll processing and increase administrative workload. Biweekly pay schedules strike a practical balance with 26 paychecks a year, occasionally 27 when pay dates fall just right, requiring smart cash flow management from both employers and employees.

Administrative Complexity

Monthly pay periods is the easiest to manage, with just 12 pay periods per year, minimizing administrative effort. Semimonthly pay schedules offer predictability but can complicate overtime and track employee hours for hourly workers since each pay period type varies in length.

Employee Budgeting

More frequent pay schedules, such as weekly or biweekly, support better short-term budgeting and consistent income. Monthly pay schedules, while simpler for businesses, require employees to plan expenses carefully between longer pay weeks to maintain financial stability.

Selecting the appropriate pay schedule involves balancing administrative capabilities, employee needs, and financial considerations. It's essential to evaluate how each option aligns with your organization's operations and workforce preferences.

Now, let’s look at how biweekly payroll impacts salary and deductions.

How should employers plan for years with 27 pay periods?[toc=Extra Paycheck]

With our hands-on experience helping companies with payroll management, and compliance operations, here’s how employers can prepare for extra paycheck years while keeping payroll accurate, compliant, and on schedule.

Employee Considerations:

In years where a payroll calendar includes 27 pay periods, employees receive an additional pay period, not additional annual salary. While this may seem like a bonus, employees need to plan accordingly. They might consider using the extra paycheck to:

- Save for future expenses

- Pay off outstanding debts

- Make significant purchases

Proper planning ensures that the extra income is utilized effectively and doesn't disrupt financial stability.

Employer Considerations:

Employers should anticipate the additional payroll expense in years with 27 paychecks. It's advisable to:

- Plan for changes in cash flow timing and benefit deductions, even though total annual salary costs typically remain unchanged for salaried employees.

- Communicate with employees about the occurrence of the extra paycheck

- Adjust benefit deductions as necessary to comply with annual limits

By proactively addressing these factors, employers can maintain smooth payroll operations and employee satisfaction.

How to know if your company will have 26 or 27 paychecks in 2026

To determine the number of biweekly paychecks in a year, employers should review their payroll calendar rather than relying on the calendar year alone.

Check the date of the first paycheck in January, review how your organization handles January 1 holidays, and count all scheduled paydays that fall within the calendar year. Your payroll provider can confirm this quickly.

Which pay frequency is right for your business?[toc=Find Right Pay Period]

Choosing the right pay frequency depends on your company’s size, employee mix, cash flow stability, and administrative capacity. Here’s how the different pay schedules compare:

Pro Tip: If your goal is to reduce administrative burden without hurting employee satisfaction, a best pay period biweekly is often the best middle ground, frequent enough to keep and pay workers engaged but efficient enough for your payroll team to manage smoothly.

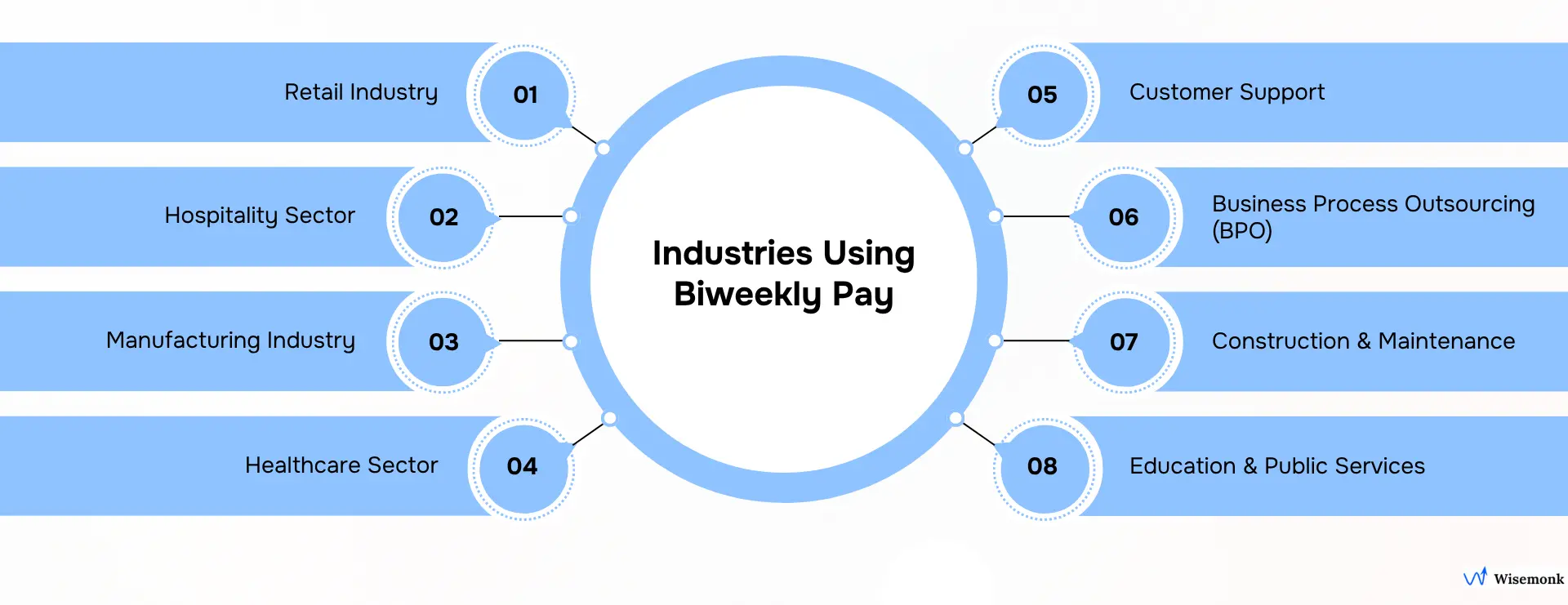

What industries use bi weekly pay?[toc=Industries Using Bi Weekly]

With our hands-on experience helping global businesses run payroll and manage compliance, we’ve seen how different industries choose a pay schedule that balances payroll costs, cash flow, and employee expectations.

Industries that commonly use Biweekly pay period type:

- Retail: Retail businesses often deal with hourly employees and frequent pay periods. Using a two-week pay period helps pay employees consistently, manage payroll runs, and budget effectively across many pay periods in a calendar year.

- Hospitality: Restaurants, hotels, and event companies rely on a predictable payroll schedule that aligns with tip cycles, variable wages paid, and changing work hours. A two-week pay frequency supports regular income without increasing administrative costs.

- Manufacturing: Manufacturing teams benefit from structured pay periods per year that make it easier to track overtime, comply with the Fair Labor Standards Act, and process payroll accurately for nonexempt employees.

- Healthcare: Hospitals and clinics often choose this pay period type to manage annual salary distribution, staffing rotations, and payroll processing while keeping cash flow steady across calendar dates and federal holidays.

- Customer Support and BPOs: Large workforces with many pay periods per year prefer a consistent payroll calendar to reduce payroll errors, coordinate direct deposit, and control administrative burden when running payroll at scale.

- Construction and Maintenance: Project-based teams commonly use a two-week payroll schedule to align pay period ends with job timelines, track hours worked, and avoid unexpected extra paychecks when dates fall differently in a leap year.

- Education and Public Services: Many institutions rely on a stable pay frequency that ensures employees receive regular pay on the same day of the week, even when three paycheck months or an extra pay period occurs.

Overall, this payroll structure works best for industries managing a mix of hourly and salaried employees, where predictable pay dates, manageable payroll runs, and steady cash flow matter more than having fewer pay periods in a year.

What HR should know about biweekly pay periods?[toc=Key Considerations]

For HR teams, it’s essential to understand how structure of bi weekly pay period affects processing payroll , budgeting, and overall employee satisfaction.

Advantages of Biweekly Pay

Learn how biweekly payroll can improve efficiency and employee expectations

For Employers:

- Balanced payroll frequency: Offers predictable pay periods without the frequent payroll processing of a weekly pay schedule, reducing administrative work.

- Improved cash flow stability: Easier to align company’s cash flow with regular pay weeks and expense forecasting.

- Reduced administrative burden: Fewer payroll runs than weekly pay lower administrative costs while maintaining consistency.

- Compliance-friendly for hourly employees: Simplifies overtime calculations, benefit deductions, and tracking employee hours under the Fair Labor Standards Act (FLSA).

- Higher employee retention: Regular, frequent paychecks can increase employee satisfaction without complicating payroll cycles.

For Employees:

- Frequent payments: Employees receive income twice a month instead of waiting for only one paycheck, helping them manage short-term expenses better.

- Predictable pay cycles: Knowing when pay dates fall helps in budgeting and careful financial planning.

- Applicable for both hourly and salaried employees: Works well for diverse teams, from hourly workers needing steady income to salaried employees preferring regular deposits.

- Easier cash flow management: More consistent payment schedules prevent financial stress between pay periods.

Disadvantages of Biweekly Pay

See how to plan for extra pay periods and manage payroll challenges

For Employers:

- Extra pay periods: Occasionally, payroll calendars may include a 27th pay period, which requires careful planning around deductions, communication, and payroll configuration.

- Complex payroll processing: Requires strong payroll systems and reliable payroll services to handle changing pay weeks and holiday adjustments.

- Additional accounting tasks: More frequent payroll cycles can add reconciliation and compliance steps to managing pay periods.

For Employees:

- Smaller paycheck amounts: Since the annual salary is split across more pay periods, each biweekly paycheck is smaller compared to semimonthly pay or monthly payments.

- Potential confusion in extra pay periods: Employees may misunderstand why an extra paycheck doesn’t increase total salary.

- Irregular pay dates: When pay dates fall on weekends or holidays, adjustments in payroll calendars may shift deposits, affecting budgeting.

While biweekly pay offers a strong balance between efficiency and satisfaction, employers should plan for extra pay periods and maintain accurate payroll systems to ensure smooth, compliant operations year-round.

How to manage payroll processing deadlines efficiently?[toc=Manage Effectively]

Process payroll promptly after each pay period to avoid delays in paychecks and cash flow issues. Set a clear payroll schedule with buffer days for reviews and bank processing. A consistent payroll calendar keeps payments accurate, on time, and compliant.

Legal Regulations

- Under the FLSA, employees must be paid promptly after a pay period ends.

- State laws vary: Connecticut requires weekly pay, while Kansas and Washington allow monthly pay schedule.

- Non-compliance can lead to fines, penalties, or legal action under federal and state laws.

Compliance Considerations

- Missing payroll deadlines can trigger penalties and damage employee trust.

- Employers must submit payroll taxes on time to federal, state, and local authorities.

- Use a detailed payroll calendar that includes paydays and tax due dates.

- Regularly review your payroll system and coordinate with your payroll provider to ensure compliance and accuracy.

Want error-free payroll without the headaches? See our "Payroll Services Cost Comparison 2025: The Ultimate Guide" to discover the best payroll providers, pricing insights, and expert tips to simplify your payroll management today.

How do Wisemonk help global companies simplify payroll and compliance?[toc=Why Choose Wisemonk]

Wisemonk is a leading Employer of Record (EOR) in India trusted by 300+ international companies that helps global businesses to hire, pay and manage employees without establishing a local entity. Wisemonk handles wage calculations, tax withholdings, deductions, direct deposits, and generation of detailed pay statements.

Here’s how Wisemonk makes payroll effortless for you:

- Accurate Salary Calculations & Timely Disbursement: We handle precise salary calculations, overtime, bonuses, reimbursements, and ensure every employee-full-time or contractor-is paid on time, every time.

- Payroll Processing: We manage over $20M in payroll each month with tax optimization, local compliance, and automated, error-free payslips for more than 2,000 employees, ensuring timely and accurate compensation.

- Expert Tax Deductions & Compliance: Our team manages all statutory deductions (PF, ESI, TDS, Professional Tax), tax withholdings, and filings, keeping you fully compliant with Indian regulations and minimizing risk.

- Benefits Management: We design and administer employee benefits packages that meet or exceed local market standards, from health insurance to retirement plans, so you can attract and retain top talent.

Client review/feedback:

“I love their payroll feature, which allows me to pay my workforce easily without any errors. In just a few seconds, I can see the invoices generated for all of the payouts”

- Mithun V.

Mid-Market

Read the full review on G2 →

While India is our core strength, we’re expanding rapidly into key global markets such as the United States, the United Kingdom, and beyond. With Wisemonk, you get a reliable partner for your India operations and your broader global hiring journey.

Ready to simplify payroll tasks? Contact us today to discover how Wisemonk can help you build and manage your world-class team-effortlessly and compliantly.

Frequently asked questions

Why do some companies have 27 biweekly pay periods in the same year?

Most employees paid biweekly in 2026 will receive 26 paychecks, since biweekly payroll follows a 14-day cycle. However, some payroll calendars may include 27 paychecks if the pay schedule starts early in January and holiday rules shift a payday into December.

What month do I get paid 3 times in 2025?

If you’re on a biweekly pay schedule, you’ll likely get three paychecks in May and October 2025. The exact months depend on your company’s payroll calendar and regular payday. Always check your organization’s official pay schedule to confirm.

Do you get taxed more with biweekly pay?

No, biweekly pay doesn’t increase your total taxes because they’re based on annual income. Each paycheck might vary slightly due to rounding or overtime adjustments. The number of pay periods only affects timing, not total tax owed.

Is biweekly pay 26 or 27?

Biweekly pay usually means 26 paychecks in a year, based on 52 weeks divided by two. However, some years create an extra payday, resulting in 27 paychecks. This typically occurs when pay dates align with an extra Friday in the calendar year.

Will my company have 26 or 27 biweekly paychecks in 2026?

It depends on your company’s payroll calendar, not the year alone. Check the date of your first paycheck in January and how your employer handles January 1 holidays. Early January start dates can result in 27 paychecks; later starts usually mean 26.

how many pay periods in a year bi weekly?

There are typically 26 pay periods in a year with a biweekly pay schedule. Some years have 27 pay periods due to calendar alignment. The exact number depends on your company’s payroll schedule and pay dates.

How many paychecks in biweekly, bimonthly, and semimonthly pay?

Biweekly employees receive 26 paychecks a year, occasionally 27 in rare cases. Semimonthly payments and bimonthly employees each receive 24 paychecks annually. Weekly pay has 52 checks, and monthly pay gives 12 in total.

.webp)

%20(1).webp)

%20(1).webp)

%20(1).webp)